Global Bio/Pharma Industry Outlook Provided at Virtual DCAT Week

The bio/pharma industry faces challenges in growth as the world seeks to recover from the COVID-19 pandemic. Per an IQVIA analysis, drug sales in most of the world increased in 2020, but growth rates were below historical norms and unit volumes were flat or declined in many regions. What is the near-term outlook?

Healthcare systems worldwide will face a long recovery from COVID-19, which will impact sales of pharmaceuticals. That was the message from Graham Lewis, Vice President of Global Pharma Strategy at IQVIA, who was the featured speaker at the Pharma Industry Outlook program at Virtual DCAT Week, which was held July 12–16, 2021. DCAT Week is the premier global event for companies engaged in the bio/pharmaceutical manufacturing value chain and is organized by the Drug, Chemical & Associated Technologies Association (DCAT), a global business development association.

|

|

Graham Lewis |

The emergence of new variants has provoked second and third waves of the pandemic in virtually all geographies, and although vaccination rates have surged in developed countries, it is currently not enough to prevent further outbreaks. The understandable desire to restore economic activity will provoke further risks as vaccination rates are so diverse and threaten the emergence of further variants and spikes in infection. The widely anticipated “new normal” will not emerge until 2023 for the global economy, said Lewis.The objective is not to eliminate the virus but to reduce the burden of hospitalization and deaths to levels associated with other viral infections, notably influenza.

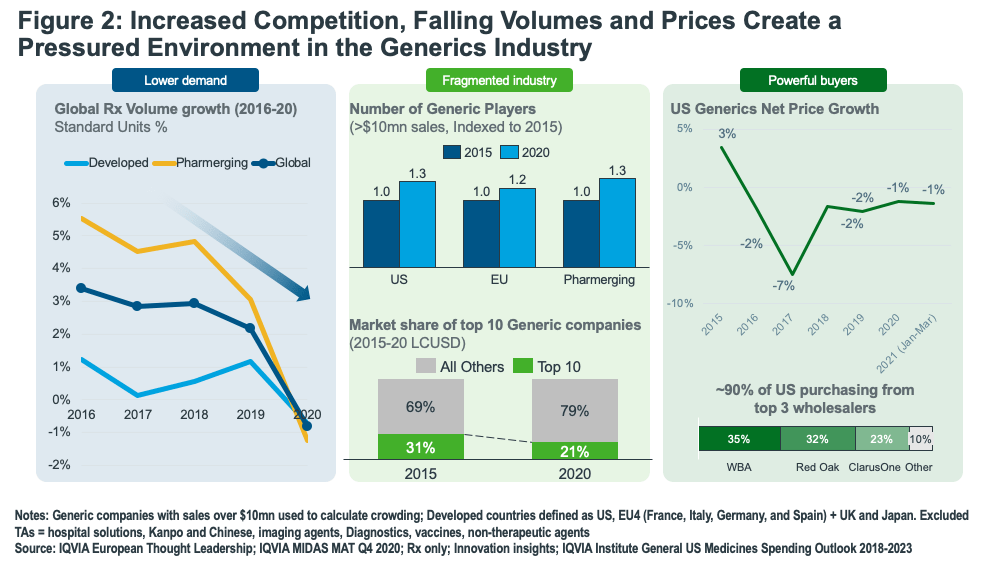

Even in developed countries, Lewis says it will take healthcare systems until 2023 or later to work through the backlog of patient visits and treatments while managing the huge impact on national healthcare spending resulting from treating COVID patients and running national vaccination programs. Lewis noted that in the US, patient diagnostic visits in 2020 were 19% below what would have been expected while in the UK, 4.7 million people are on waiting lists to see physicians. Addressing the backlog will be made more difficult because many healthcare professionals are expected to leave because of the strains on healthcare systems, he added.

Slowdown in global bio/pharmaceutical growth

Drug sales in most of the world increased in 2020, but growth rates were below historical norms and unit volumes were flat or declined in many regions. Globally, pharmaceutical sales (based on ex-manufacturer prices) grew 5% in 2020, but that was below a recent trend of 6% and unit volumes were flat.

Delving into the data, on a value basis, only countries in the Western hemisphere—the US and Latin America—managed to maintain historic pharma growth trends at ex-manufacturer prices during 2020, with the US experiencing 6% growth (a percentage gain of 1% compared to the 2018-2019 period) and Latin America showing growth on a value basis of 13% (a percentage gain of 2% compared to the 2018-2019 period). Europe (Italy, France, Germany, Spain, and the UK) also saw a 5% gain in 2020 on a value basis (but a percentage decline of 1% compared to the 2018-2019 period). Pharma sales in Japan and China each declined 2% in 2020, respectively representing percentage declines of 2% and 12% on value basis compared to the 2018-2019 period.

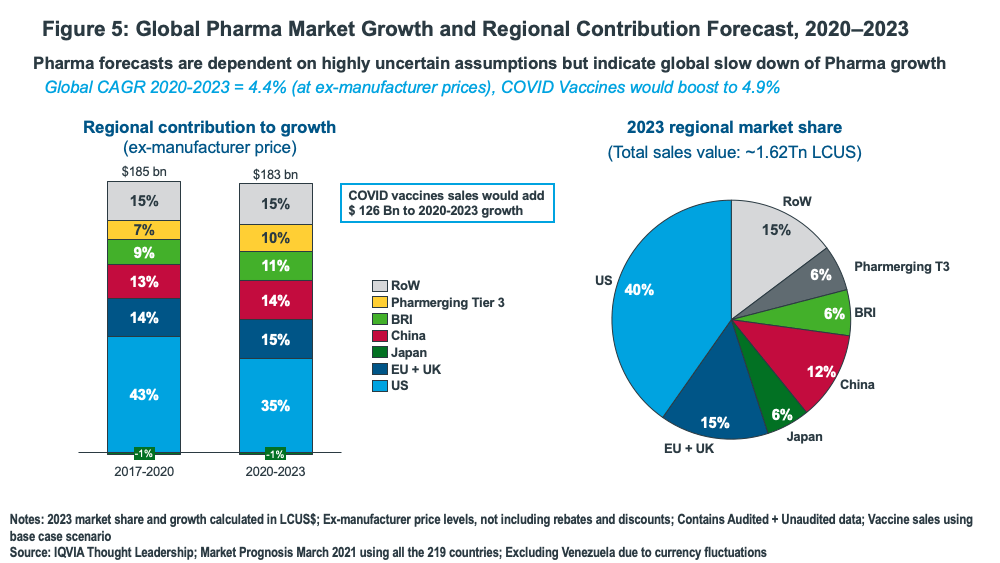

Looking ahead, excluding COVID-19 vaccines, IQVIA is forecasting global pharmaceutical growth through 2023 at a compound annual growth rate (CAGR) of 4.4% at ex-manufacturer prices; including vaccines, the CAGR is projected to be 4.9%. However, both levels are still below the pre-pandemic global growth rate. Two markets will be key to future success: the US and China, which will collectively account for more than 50% of global pharma sales in 2023.

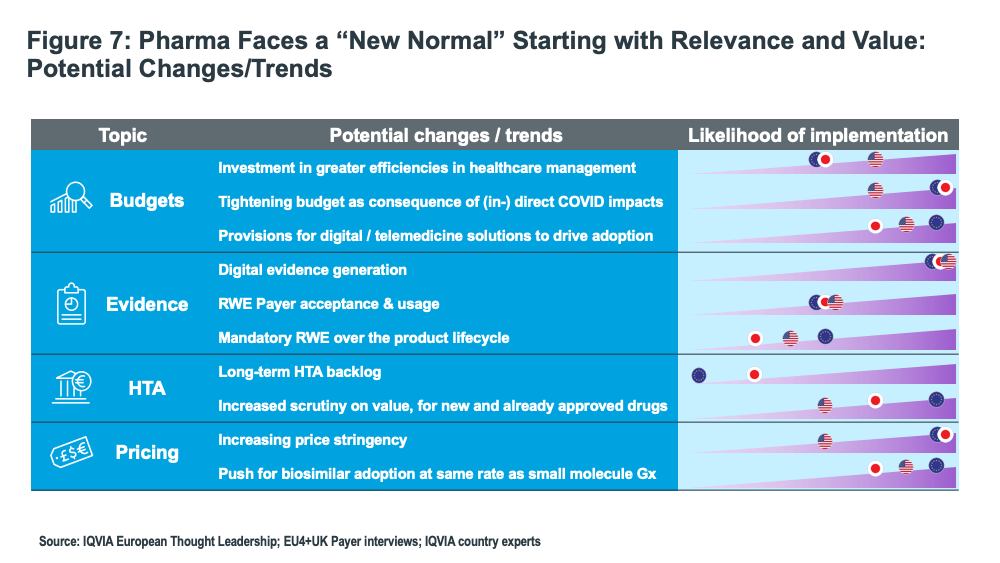

Multiple factors have factored into slowing growth. In terms of new products, although the COVID pandemic did not impact the number of launches of new active substances (NAS) in 2020, sales were markedly below pre-pandemic levels (see Figure 1). In looking at the number of NAS launched from January–October 2020 compared to the average number of NAS launches from January–October 2015–2019, NAS launches were up in the US, the EU countries, the UK, and Japan in 2020. While new products were available and launched in 2020, the challenges imposed by the pandemic made conventional means of sales and promotion difficult, explained Lewis, and sales of NAS, as measured by average monthly sales after six months versus pre-COVID timelines (2020 vs average of 2015-2019) were muted (see Figure 1).

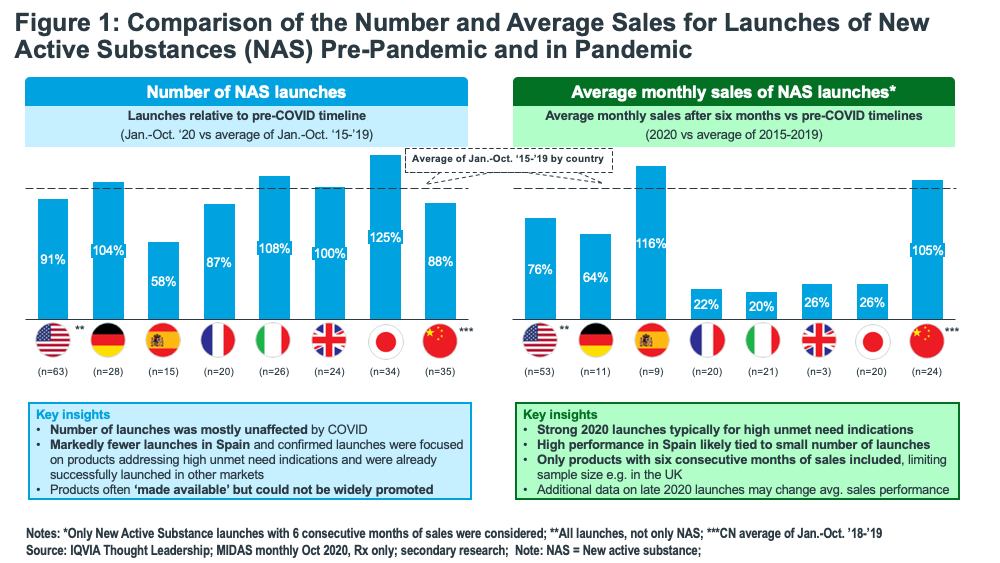

The generic segment is particularly challenged, said Lewis. Generic utilization has increased in most major markets, and the high rate of penetration will limit further growth, except in Europe. Further, branded generic sales are declining as countries clamp down on spending. A complicating factor is that competition has intensified as the number of companies participating in the generics sector has grown despite the slowdown in sales growth; traditional market leaders have been losing market share (see Figure 2).

Difficulties reaching prescribers

Slow adoption of new medicines has challenged the performance of innovator companies. According to Lewis, many products were launched in 2020 because of the perceived medical need, but they were not widely promoted due to the broader healthcare crisis of the pandemic. Further, patient visits to healthcare professionals were down significantly, which, combined with a huge decline in face-to-face (F2F) interaction between pharma sales reps and prescribers, has slowed awareness and acceptance of new medications. Telehealth has compensated for some of the reduced patient–provider interaction, but not enough to offset the slower adoption.

Volume growth is not expected to surge as backlogs are reduced partly because many potential medicated patients have been “lost.” (see Figure 3). However, innovative medicines may benefit as patients in illness areas, such as cancer and cardiovascular, may have deteriorated during the pandemic and require more effective therapies.

The challenge of accessing prescribers is forcing a fundamental change in the pharma industry’s business model. The industry is moving to a multi-channel engagement model: there will be more direct engagement with healthcare providers, but it will be remote and potentially “24/7.” Lewis noted that both spending on promotion and the number of sales reps fell in 2020 as remote interactions increased.

Strategic realignment for Pharma

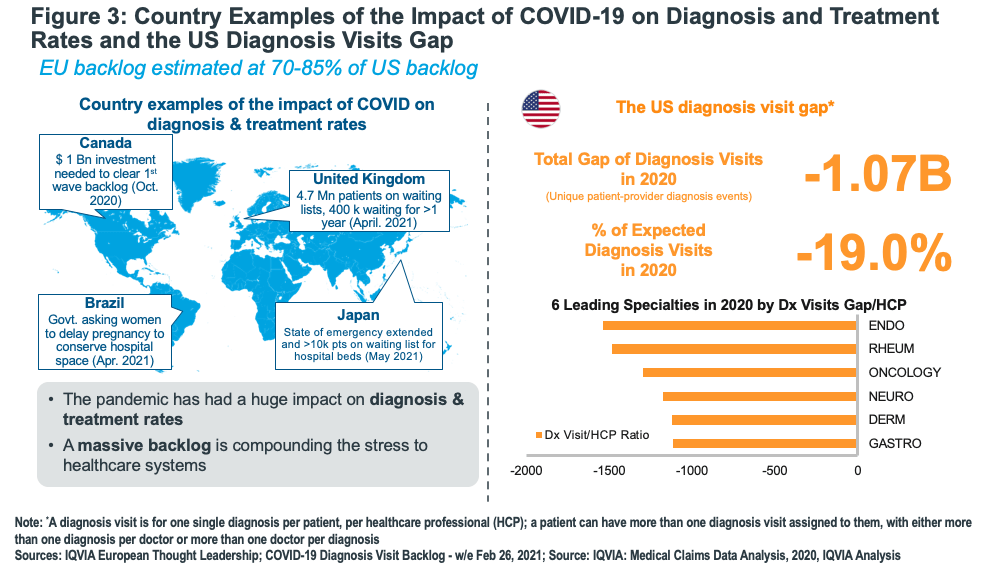

The industry has made significant progress in moving toward “precision medicine,” thereby producing effective outcomes for patients and better value for healthcare systems. This has driven significant growth in oncology, autoimmune disorders, and a growing number of rare diseases. However, the pandemic is provoking discussion regarding future investment as governments and healthcare systems reflect on future priorities. The first priority is to manage budgets more efficiently.

Uptake of biosimilars will gain momentum, especially in the US, and, in fact, the penetration of new biosimilars in the US is tracking at the same rate as in Europe, so much faster than in the past. An important need that has emerged during the pandemic is that simpler forms of delivery are highly desirable, and this may well drive the emergence of “improved” biosimilars, so called “biobetters.”

At the same time, the remarkable speed in developing vaccines for COVID-19 suggests new pathways for infectious disease prevention in the future, a need strongly advocated by the World Health Organization for many years.

Additionally, the impact of the pandemic has refocused attention on central nervous system (CNS) diseases, and it is likely that this area will become a greater focus for R&D in the future.

Finally, IQVIA’s Lewis referred to the surge in medicines developed for rare diseases and wondered whether the strategic focus on these often intractable diseases would shift to numerically much larger challenges in medicine as healthcare systems begin to unravel the challenges and lessons learned from the pandemic.

China opportunity

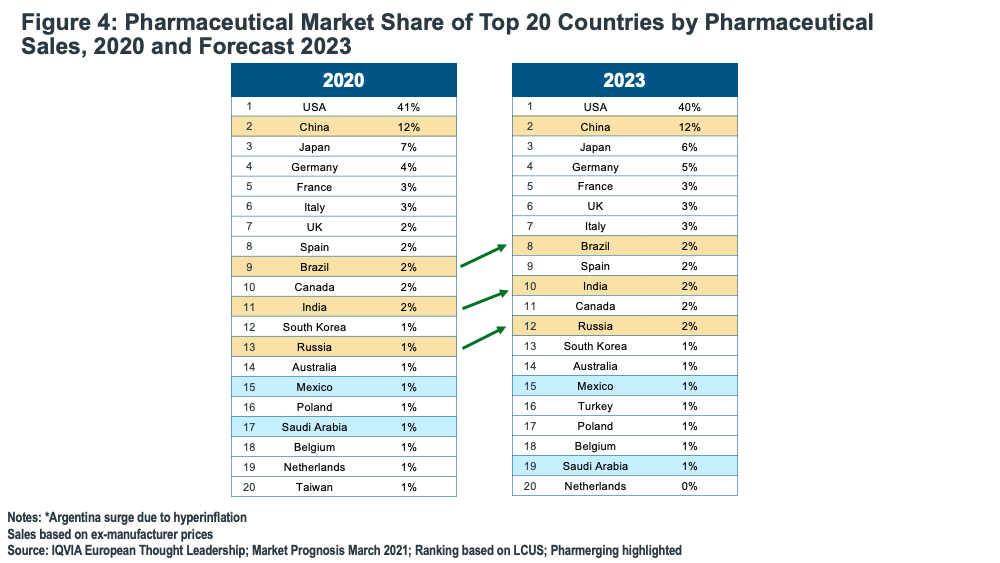

Lewis noted that the so-called “Pharmerging countries,” (i.e., the most promising emerging markets countries) will have the most rapid growth rates and will be among the largest pharmaceutical markets in coming years. Pharma sales in China will grow at an annual rate of over 7% for the next several years while Brazil, India, and Russia will move up the league tables, so almost all BRIC countries (Brazil, Russia, India, China) will be in the Top 10 by 2023 (see Figure 4). This includes India joining the Top 10 for the first time.

IQVIA projects absolute growth of $183 billion (excluding vaccines based on ex-manufacturer prices) on a global basis from 2020 to 2023, with the US contributing 35% of that growth, down from the 40% it contributed in the prior three-year period (2017-2020). China, the EU and UK (combined), and Brazil, Russia, and India (combined) are expected to increase their respective contribution to global pharma growth (see Figure 5).

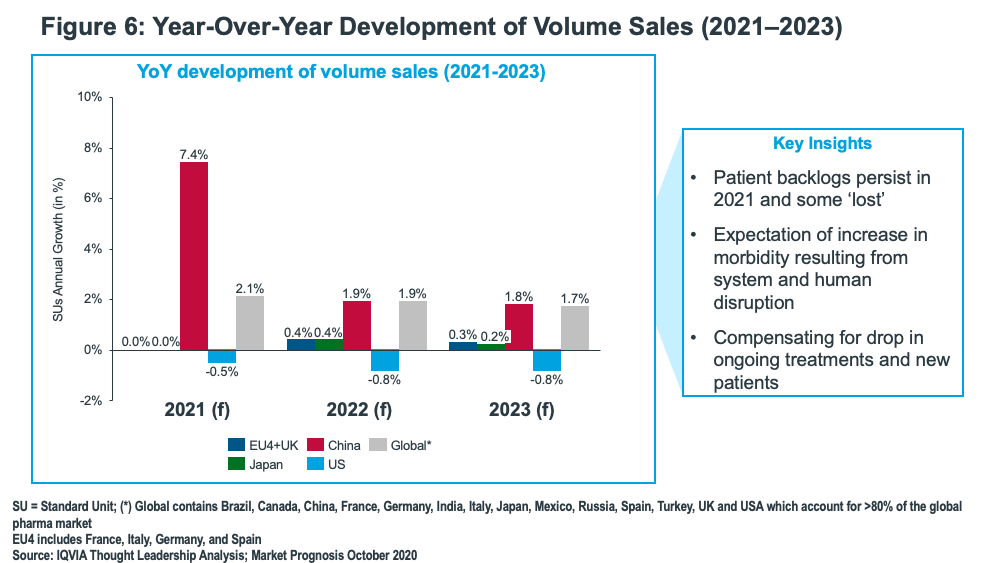

Volume growth, however, is projected to fall in 2022 and 2023 globally and in China, with growth being fairly equalized at less than 2%. Meanwhile, negative volume growth in the US is projected between 2021 and 2023, ranging from 0.5% and 0.8%, and volume growth in the EU and UK (combined) and Japan will be flat (see Figure 6).

Lewis advised that global bio/pharma companies need to adapt their strategies to the opportunities and challenges of the Chinese market. The Chinese government is supporting generics, more local innovators, and expansion outside China, he said, while global bio/pharma companies operating in China still rely on mature brands and late launches. He argued that China will need to become a launch priority and that the three years post-initial launch it currently takes innovator companies to introduce a new product to China will need to be shortened.

Big changes to the industry

In the end, Lewis painted a picture of a bio/pharmaceutical industry transformed by the COVID-19 pandemic and its aftermath. Many observers have noted that the industry’s R&D model will undergo substantial changes thanks to what was learned from the rapid development of vaccines and the conduct of clinical trials with constrained access to patients. But Lewis’s expectations of industry changes go well beyond that: he envisions that as a result of the lingering financial and human resource stresses on healthcare systems, new drug development and commercialization will be less driven by science and more by patient outcomes and value for resources consumed, based on real-world evidence and less on traditional clinical trials. That shift will be manifested in new R&D priorities, such as a greater focus on high-volume morbidities, such as infectious diseases, and favoring simpler treatment options, such as home-delivered therapies over treatments delivered in traditional in- and out-patient settings. That latter development portends the emergence of new technologies to facilitate more rapid diagnoses and remote monitoring of patient status and responsiveness to medications.

Lewis foresees a much-changed bio/pharmaceutical industry in the coming years than exists today, one that is much more integrated into the healthcare system and more engaged in the provision of services alongside medicines as patients exert more influence on their treatment pathways. In this way, the industry would move into an integrated partnership with healthcare systems much in need of restoration to satisfy future needs (see Figure 7).