Oncology Pharma Market: Immunotherapies on the Rise

Immunotherapies represent a growing sector in the global oncology pharmaceutical market. Now led by Merck & Co.’s Keytruda (pembrolizumab) and Bristol-Myers Squibb’s Opdivo (nivolumab), immunotherapies by Roche and AstraZeneca are joining the blockbuster class, and new modalities, such as CAR T therapies, begin to take market hold with some holding blockbuster potential.

Cancer immunotherapy market

Immunotherapy is a high-growth market segment in the global oncology drug market. Five mechanisms of action dominate the cancer immunotherapy market: programmed cell death protein 1 (PD-1) checkpoint inhibitors; programmed death-ligand 1 (PD-L1) checkpoint inhibitors; T cell stimulants; cytotoxic T lymphocyte antigen (CTLA) antibodies; and T cell surface glycoprotein CD3 antibodies, according to a recent report by Evaluate Ltd., Examining the Immunotherapy Landscape: 2020-2024: What are the top Mechanisms of Action in Immunotherapy?

PD-1 inhibitors leading cancer immunotherapy market

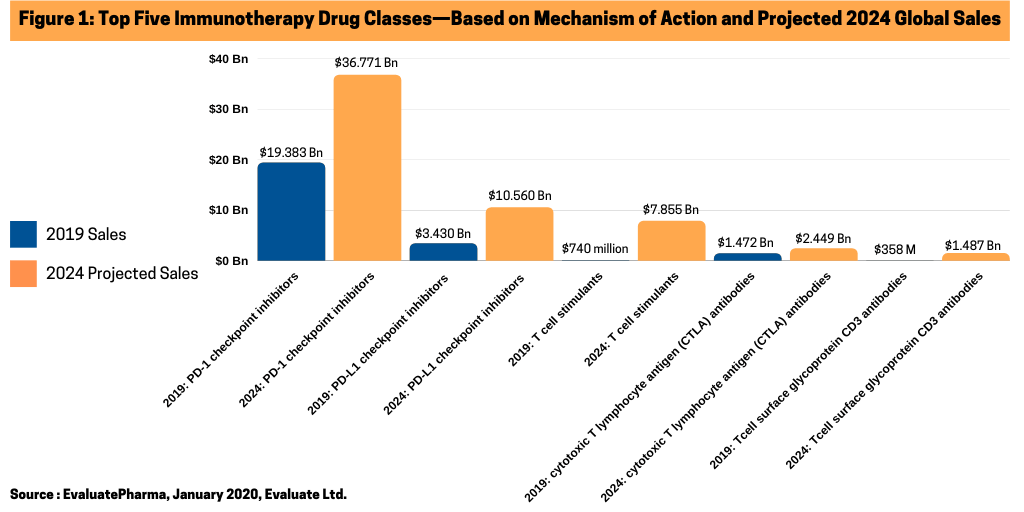

The strongest-performing immunotherapies on the market are the PD-1 checkpoint inhibitors, according to EvaluatePharma sales data. PD-1 checkpoint proteins live on the surface of immune cells called T cells. Drugs using this mechanism of action saw nearly $19.4 billion in worldwide sales in 2019, according to EvaluatePharma (see Figure 1). Based on the firm’s consensus sales forecasts, EvaluatePharma projects that the total global PD-1 market will be worth over $36 billion by 2024. Strong approval history—97% of Phase III products went on to receive FDA approval—supports these projections. Advances in therapies that combine PD-1 inhibitors with chemotherapy, radiation and CTLA-4 blockade, another immune checkpoint inhibitor, contribute to its projected growth.

Merck & Co’s Keytruda (pembrolizumab), a PD-1 inhibitor, holds a strong lead among top immunotherapy drugs on the market. Keytruda is approved as a monotherapy for treating multiple cancers, non-small-cell lung cancer, small-cell lung cancer, head and neck squamous cell carcinoma, classical Hodgkin Lymphoma, primary mediastinal large B-cell lymphoma, urothelial carcinoma, microsatellite instability-high (or mismatch repair deficient cancer), gastric or gastroesophageal junction adenocarcinoma, esophageal cancer, cervical cancer, hepatocellular carcinoma, and Merkel cell carcinoma and in combination with other therapies.

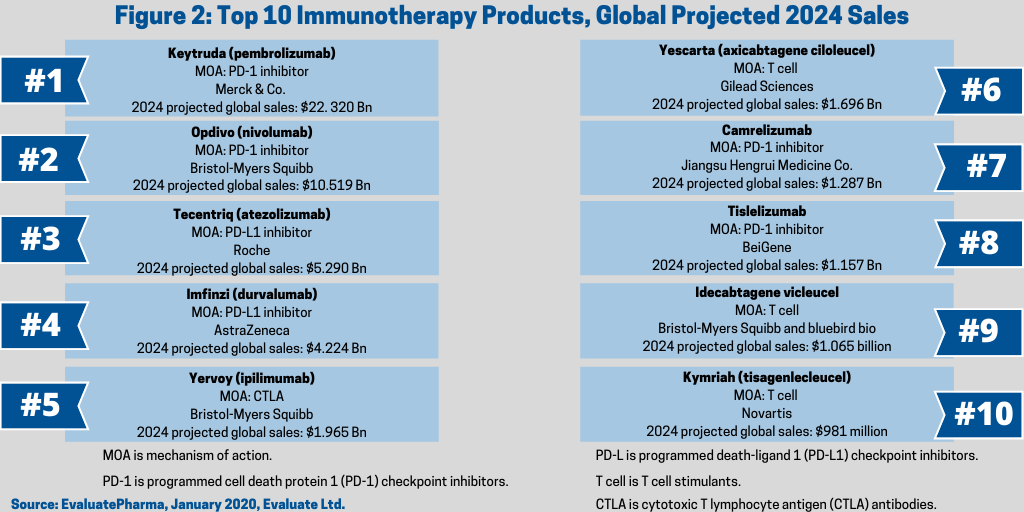

Keytruda had 2019 sales of nearly $11.1 billion. With about 1,000 reported active clinical trials currently evaluating Keytruda, combined with Merck’s R&D strength, EvaluatePharma projects the drug to double worldwide sales by 2024, provided it maintains its strong historical year-over-year increase, making it the number one cancer immunotherapy (see Figure 2).

Bristol-Myers Squibb’s Opdivo (nivolumab) is another PD-1 inhibitor with a strong market position. It had 2019 global sales of $7.2 billion. It has been approved for several anti-cancer indications, including bladder, blood, colon, head and neck, kidney, liver, lung, melanoma and stomach and continues to be evaluated in other cancers. Projected 2024 global sales are $10.5 billion.

PD-L1 inhibitors, second strongest sector

A separate sector within the cancer immunotherapy market is represented by PD-L1 inhibitors. PD-L1 proteins, another checkpoint protein, which bind to PD-1 and prevent T cells from attacking tumor cells. Drugs that target PD-1 boost immune response against cancer cells and prevent PD-L1 proteins from binding and protecting PD-1s. The PD-L1 sector is the second largest sector within the immunotherapy drug market with $3.43 billion in sales in 2019 and projected to grow to $10.5 billion by 2024 (see Figure 1).

To date, the US Food and Drug Administration (FDA) has approved three PD-L1 inhibitors: Roche’s Tecentriq (atezolizumab); AstraZeneca’s Imfinzi (durvalumab); and Merck KGaA’s and Pfizer’s Bavencio (avelumab). Roche’s Tecentriq has received FDA approval for urothelial carcinoma (bladder cancer), non-small-cell lung cancer, small-cell lung cancer, and heptatocellular carcinoma (liver cancer). AstraZeneca’s Imfinzi has received FDA approval for urothelial carcinoma (bladder cancer), non-small-cell lung cancer, and small-cell lung cancer. Merck KGaA’s and Pfizer’s Bavencio has received FDA approval for Merkel cell carcinoma (a rare form of skin cancer), urothelial carcinoma (bladder cancer), and in combination with axitinib for renal cell carcinoma.

Roche’s Tecentriq and AstraZeneca’s Imfinzi are targeted for strong growth. EvaluatePharma estimates 2024 global sales respectively of nearly $5.3 billion and $4.2 billion (see Figure 2), placing them only behind Merck’s Keytruda and Bristol-Myers Squibb’s Opdivo among the projected top-selling cancer immunotherapies based on 2024 estimates sales, according to EvaluatePharma data.

T cell stimulants on the rise

T cell stimulants, along with the PD-1 and PD-L1 inhibitors, are placed among the highest profitable sectors in the cancer immunotherapy sector and are projected for strong growth. The market was valued at $740 million in 2019, but is projected to increase to more than $7.8 billion by 2024 (see Figure 1), according to data from EvaluatePharma. The market is primarily lead by chimeric antigen receptor (CAR) T-cell therapy products, which include the two CAR T therapies approved thus far by the FDA: Gilead Sciences’ Yescarta (axicabtagene ciloleucel) and Novartis’ Kymriah (tisagenlecleucel), which have been approved for adults living with certain types of non-Hodgkin lymphoma and for people under age 25 living with acute lymphoblastic leukemia that has relapsed. EvaluatePharma projects blockbuster status (defined as products with sales of more than $1 billion) for Gilead’s Yescarta with 2024 projected sales of nearly $1.7 billion and near blockbuster status for Novartis’ Kymriah with 2024 projects sales of $981 million (see Figure 2).

Another T-cell therapy projected for blockbuster status is Bristol-Myers Squibb’s and bluebird bio’s idecabtagene vicleucel with projected 2024 sales of nearly $1.1 billion (see Figure 2), according to EvaluatePharma. Bristol-Myers Squibb gained the product in its $74-billion acquisition of Celgene in 2019. The therapy is being evaluated to treat multiple myeloma.

Other sectors in the immunotherapy market

Led by Bristol-Myers Squibb’s Yervoy (ipilimumab), the CTLA antibody sector in the cancer immunotherapy market was valued at nearly $1.5 billion in 2019 and is projected to increase to $2.5 billion by 2024 (see Figure 1), according to data from EvaluatePharma. Leading the way is Bristol-Myers Squibb’s Yervoy, which is approved to treat various forms of melanoma with 2024 projected sales of nearly $2.0 billion (see Figure 2). It is also approved in combination with Bristol-Myers Squibb’s Opdivo in multiple cancers.

Another sector in the cancer immunotherapy market, based on mechanism of action, are T cell surface glycoprotein CD3 antibodies, which has projected 2024 sales of $1.487 billion (see Figure 2), according to EvaluatePharma.