Indian Government Looks To Increase Domestic API Mfg

In response to the novel coronavirus and India’s reliance on active pharmaceutical ingredient (API) production outside of the country, the Indian government has put forth a $1.3-billion multi-year plan to increase domestic production of key starting materials and APIs. What is the plan, and what is the potential impact on global supply chains?

India and pharmaceuticals: short term

India, like other countries, is facing the impact of the novel coronavirus (COVID-19), and this week (March 24, 2020), Prime Minister Shri Narendra Modi called for a complete lockdown of the entire nation for the next 21 days in an effort to contain the COVID-19 pandemic. The lockdown places a total ban on people from stepping out of their homes for a period of 21 days.

“All of you are also witnessing how the most advanced countries of the world have been rendered absolutely helpless by this pandemic,” said Modi, in a March 24, 2020 statement. “It is not that these countries are not putting in adequate efforts or they lack resources. The coronavirus is spreading at such a rapid pace that despite all the preparations and efforts, these countries are finding it hard to manage the crisis.”

Earlier (March 21, 2020) Modi met with the leaders of the pharmaceutical industry via video conferencing to emphasize that the government is committed to helping the industry in maintaining the supply of active pharmaceutical ingredients (APIs) and stressing the importance of the manufacture of APIs. He said that in order to ensure production of critical drugs and medical equipment within the country, the government has approved schemes worth INR 10,000 crore ($1.3 billion) and INR 4,000 crore ($5.2 billion), respectively.

In his meeting with members of the pharmaceutical industry, he added that it is imperative for the industry to work continuously and also ensure that there is not a shortage in the workforce in the pharma sector, which includes at the patient level. He suggested exploration of home-delivery models to allow for maintenance of social distancing at pharmacies and also promotion of usage of digital payment mechanisms to prevent the spread of the virus.

India and pharmaceuticals: longer term

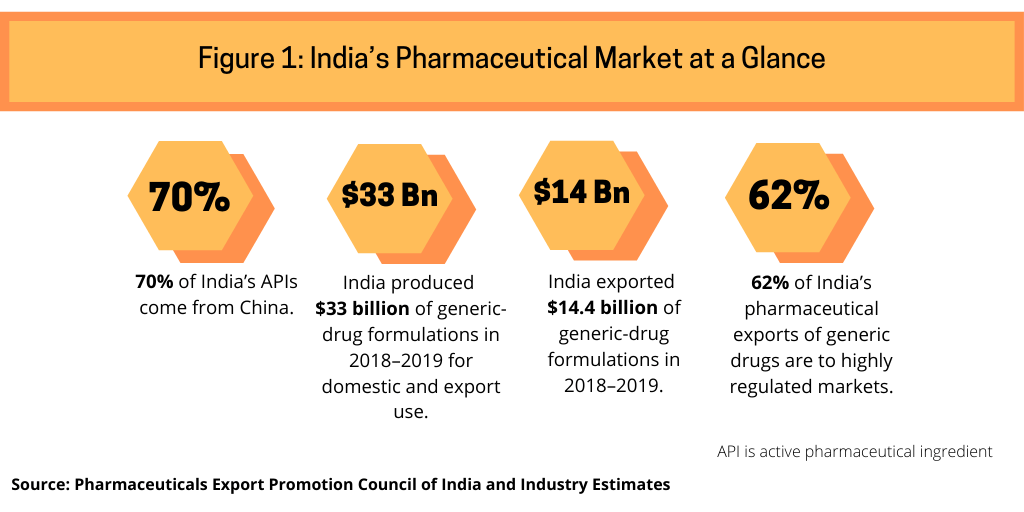

While India, like other countries, manages pharmaceutical supply during the current COVID-19 outbreak, it is also looking to the longer term to increase domestic production in India of APIs and key starting materials. As much as India is a large exporter of generic drugs globally, it is a large importer of APIs, particularly from China, from which it imports 70% of its APIs (see Figure 1), according to industry estimates. India uses these APIs to make drugs, particularly generic drugs, for domestic and export use. India’s pharmaceutical market in 2018–2019 totaled $40 billion (both domestic and export use), according to the Pharmaceuticals Export Council of India, the authorized agency of the government of India for promotion of pharmaceutical exports from India and supported by India’s Ministry of Commerce and Industry. India is self-sufficient in generic-drug formulations and produced $33 billion worth of generic-drug formulations in 2018–2019, of which it exported $14.4 billion, of which 62% of such exports went to highly regulated markets (see Figure 1).

With its reliance on China for APIs and key starting materials, however, the Indian government approved a plan earlier this month (March 2020) aimed at increasing domestic API production in India. The approved plan would provide financing of INR 3,000 crore ($394 million) for common infrastructure facilities for three bulk drug parks in India over the next five years. Under the plan, the government of India will provide grants-in-aid to states with a maximum limit of INR 1,000 crore ($131 million) for each bulk drug park. Parks will have common facilities such as solvent recovery plant, distillation plant, power and steam units, and common effluent treatment plants.

The approved plan also creates a Production-Lined Incentive (PLI) Scheme for promotion of domestic manufacturing of critical key starting materials, drug intermediates, and APIs in the country with financing of INR 6,940 crore ($910 million) for the next eight years. Under the PLI Scheme, financial incentives will be given to eligible manufacturers of 53 critical bulk drugs on their incremental sales over the base year (2019-20) for a period of six years. Out of 53 identified bulk drugs, 26 are fermentation-based bulk drugs, and 27 are chemically synthesized-based bulk drugs. The rate of incentive will be 20% (of incremental sales value) for fermentation-based bulk drugs and 10% for chemically synthesized-based bulk drugs.

The plan to increase domestic API production in India is supported by the country’s pharmaceutical industry. “India has the capability and competence to manufacture all APIs,” said Satish Reddy, President of the Indian Pharmaceutical Alliance (IPA) and Chairman, Dr Reddy’s Laboratories. “The announcement by the Government will help revive the API industry in the country and will help the sector regain the dominance that was lost over the years. The investment in creating bulk drug parks is an important step in the right direction for the development of the industry.” The IPA represents 24 research-based national pharmaceutical companies in India. Collectively, IPA companies account for over 85% of the private-sector investment in pharmaceutical research and development in India, contribute more than 80% of the country’s exports of drugs and pharmaceuticals, and service over 57% of the domestic market, according to information from the IPA.

The goal of India’s government is clear, namely, to reduce the company’s dependence on imported APIs, which the government estimates for some specific bulk drugs can be as high as 80% to 100%. The Indian government said the plan is expected to reduce manufacturing costs of bulk drugs in the country and dependency on other countries for bulk drugs. The bulk drug park plan will be implemented by State Implementing Agencies (SIA) to be set up by the respective state governments in India.

The PLI scheme intends to boost domestic manufacturing of critical key starting materials, drug intermediates, and APIs by attracting large investments in the sector to ensure sustainable domestic supply and thereby reduce India’s import dependence on other countries. The scheme will be implemented through a Project Management Agency (PMA) to be nominated by the Department of Pharmaceuticals. The PLI plan will be applicable only for manufacturing of the 53 identified critical bulk drugs (i.e., key starting materials, drug intermediates and APIs).