Industry Scorecard: New Drug Approvals and Blockbusters

Is the blockbuster model still in play or has the paradigm to more specialized drugs and smaller patient populations narrowed the blockbuster field? DCAT Value Chain Insights looks at which drugs, approved over the past several years, have risen to the blockbuster class.

Inside new drug approvals

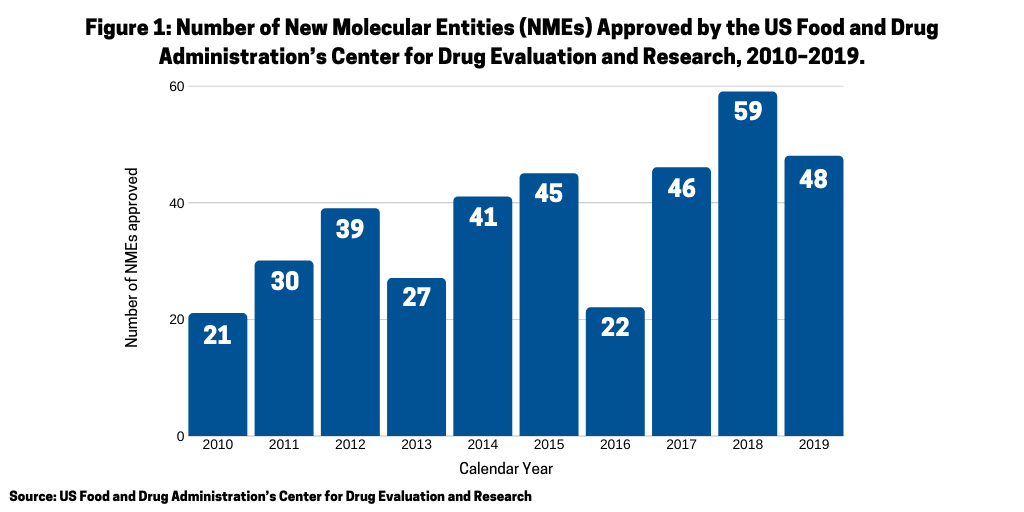

To evaluate which recent new drug approvals by the US Food and Drug Administration’s (FDA) Center for Drug Evaluation and Research (CDER) have reached blockbuster status (defined as drugs achieving sales of $1 billion or more), new molecular entities (NMEs) approved by FDA’s CDER from 2015–2018 and their corresponding sales revenues, based on 2019 sales, were reviewed. Between 2015 and 2018, a total of 172 NMEs (See Figure 1 were approved. This included 45 NMEs in 2015, 22 NMEs in 2016, 46 NMEs in 2017, and 59 in 2018, a recent record high.

The blockbuster class

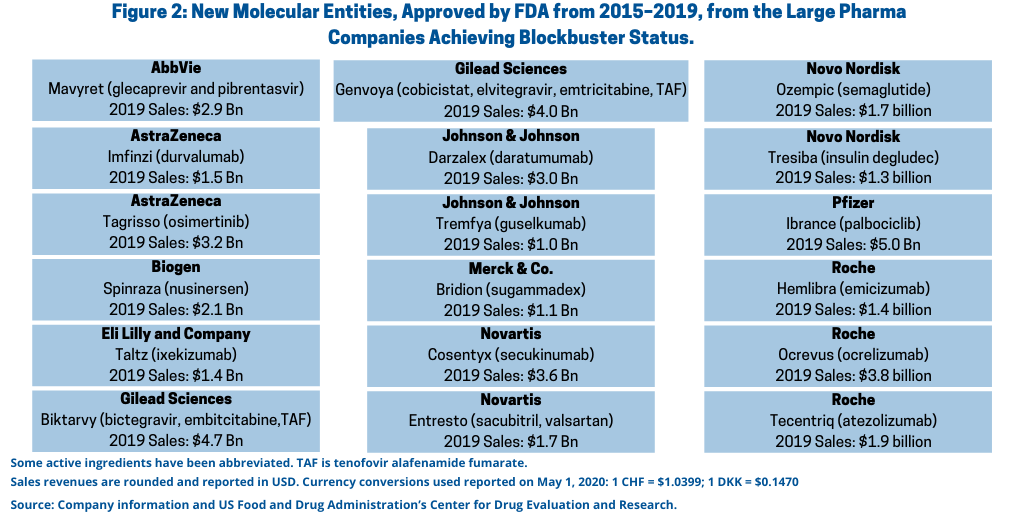

Of the 172 NMEs approved between calendar years 2015 and 2018, 20 NMEs went on to achieve blockbuster status (defined as sales of $1 billion or more) (see Table I at the end of the article ) or approximately 12% of the NMEs approved. Of these 20 NMEs, 18 NMEs, or 90%, were from the large pharmaceutical companies (see Figure 2).

Among the large pharmaceuticals, Roche led with three blockbuster NMEs approved (NMEs approved between 2015 and 2018) with Ocrevus (ocrelizumab), a drug for treating relapsing and primary progressive forms of multiple sclerosis, with approximate 2019 sales of $3.8 billion; Tecentriq (atezolizumab), now approved for multiple cancer indications and initially approved to treat bladder cancer, with 2019 sales of $1.9 billion; and Hemlibra (emicizumab) for treating Hemophilia A with 2019 sales of approximately $1.4 billion.

Five companies—AstraZeneca, Gilead Sciences, Johnson & Johnson (J&J), Novartis and Novo Nordisk—each had two NMEs approved between 2015 and 2018 that went on to become blockbusters (see Figure 2 and Table I at the end of the article). AstraZeneca had Imfinzi (durvalumab), a drug to bladder cancer with 2019 sales of $1.5 billion and Tagrisso (osimertinib), a drug for treating advanced non-small-cell lung cancer with 2019 sales of $3.2 billion. Gilead Sciences scored with two NME combination drugs for treating HIV: Biktarvy (bictegravir, embitcitabine, tenofovir alafenamide fumarate) with 2019 sales of $4.7 billion and Genvoya (cobicistat, elvitegravir, emtricitabine, tenofovir alafenamide fumarate) with 2019 sales of $4.0 billion. J&J had two recent NME approvals that went on to achieve blockbuster status: Darzalex (daratumumab), a cancer drug for treating multiple myeloma, with 2019 sales of $3.0 billion and Tremfya (guselkumab) for treating moderate-to-severe plaque psoriasis with 2019 sales of $1.0 billion. Novartis scored with Cosentyx (secukinumab), now approved for treating moderate-to-severe plaque psoriasis, psoriatic arthritis, or ankylosing spondylitis, with 2019 sales of $3.6 billion and Entresto (sacubitril; valsartan), a drug for treating heart failure, with 2019 sales of $1.7 billion. Novo Nordisk had two NMEs approved for Type II diabetes achieve blockbuster status: Ozempic (semaglutide) with 2019 sales of $1.7 billion and Tresiba (insulin degludec) with 2019 sales of $1.3 billion.

AbbVie, Biogen, Eli Lilly and Company, Merck & Co., and Pfizer each had one NME approved between 2015 and 2018 that went on to achieve blockbuster status based on 2019 sales (see Figure 2 and Table I at end of the article).

Blockbuster contenders

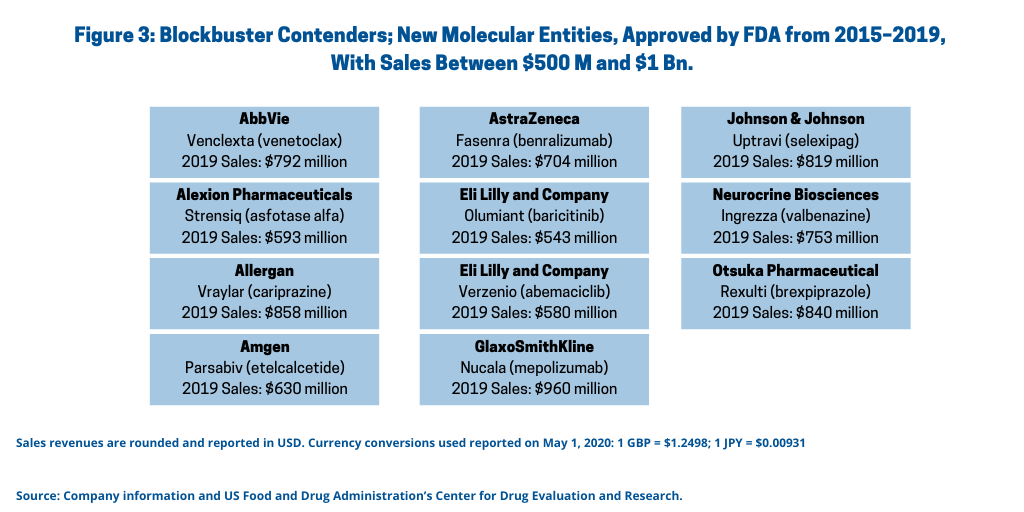

Figure 3 outlines companies with strong sales (between $500 million and $1 billion (not counting $1 billion) of NMEs approved between 2015 and 2018. Table II at the end of the article provides further drug information, including indications and year of approval.

| Table I: New Molecular Entities Approved by the FDA, 2015–2019, Achieving Blockbuster Status (Sales of $1 Billion or More) Based on 2019 Sales. | ||||

| Company | Proprietary name (active ingredient); application type | 2019 Sales | Indication | Year of Initial FDA Approval |

| AbbVie | Mavyret (glecaprevir and pibrentasvir); NDA | $2.9 billion | Chronic hepatitis C virus | 2017 |

| AstraZeneca | Imfinzi (durvalumab); BLA | $1.5 billion | Locally advanced or metastatic urothelial carcinoma in the bladder or urinary tract, or non-small cell lung cancer | 2017 |

| AstraZeneca | Tagrisso (osimertinib mesylate); NDA | $3.2 billion | Metastatic non-small cell lung cancer | 2015 |

| Biogen | Spinraza (nusinersen sodium); NDA | $2.1 billion | Infantile-onset spinal muscular atrophy (SMA), later-onset SMA, presymptomatic SMA | 2016 |

| Eli Lilly and Company | Taltz (ixekizumab); BLA | $1.4 billion | Moderate to severe plaque psoriasis, active psoriatic arthritis, or active ankylosing spondylitis | 2016 |

| Gilead Sciences | Biktarvy (bictegravir, embitcitabine, tenofovir alafenamide fumarate); NDA | $4.7 billion | HIV-1 infection | 2018 |

| Gilead Sciences | Genvoya (cobicistat, elvitegravir, emtricitabine, tenofovir alafenamide fumarate); NDA | $4.0 billion | HIV-1 infection | 2015 |

| Johnson & Johnson | Darzalex (daratumumab); BLA | $3.0 billion | Multiple myeloma | 2015 |

| Johnson & Johnson | Tremfya (guselkumab); BLA | $1.0 billion | Moderate-to-severe plaque psoriasis | 2017 |

| Merck & Co. | Bridion (sugammadex); NDA | $1.1 billion | To reverse effects of neuromuscular blocking drugs used during surgery | 2015 |

| Novartis | Cosentyx (secukinumab); BLA | $3.6 billion | Moderate to severe plaque psoriasis, psoriatic arthritis, or ankylosing spondylitis | 2015 |

| Novartis | Entresto (sacubitril; valsartan); NDA | $1.7 billion | Heart failure | 2015 |

| Novo Nordisk | Ozempic (semaglutide); NDA | DKK 11.237 billion ($1.7 billion) | Type II diabetes | 2017 |

| Novo Nordisk | Tresiba (insulin degludec); NDA | DKK 9.259 billion ($1.3 billion) | Diabetes | 2015 |

| Pfizer | Ibrance (palbociclib); NDA | $5.0 billion | Advanced (metastatic) breast cancer | 2015 |

| Roche | Hemlibra (emicizumab); BLA | CHF 1.380 billion ($1.4 billion) | Hemophilia A in patients who have developed antibodies called Factor VII inhibitors | 2017 |

| Roche | Ocrevus (ocrelizumab); BLA | CHF 3.708 billion ($3.8 billion) | Relapsing and primary progressive forms of multiple sclerosis | 2017 |

| Roche | Tecentriq (atezolizumab); BLA | CHF 1.875 billion ($1.9 billion) | Locally advanced or metastatic urothelial carcinoma in the bladder or urinary tract, non-small cell lung cancer, triple-negative breast cancer, or small cell lung cancer | 2016 |

| Vertex Pharmaceuticals | Orkambi (ivacaftor; lumacaftor); NDA | $1.3 billion | Cystic fibrosis in patients with certain mutations | 2015 |

| Vertex Pharmaceuticals | Symdeko (tezacaftor; ivacaftor); NDA | $1.4 billion | Cystic fibrosis in patients with certain mutations | 2018 |

|

Drugs approved as new molecular entities (NMEs) either as new drug application (NDA) or original biologics license application (BLA) by the US Food and Drug Administration’s (FDA) Center for Drug Evaluation and Research (CDER). Year of approval indicates year in which the drug was first approved as a new molecule entity by FDA’s CDER. Indication is for initial indication when first approved as an NME and subsequent approved indications. Sales revenues are rounded. Currency conversions used reported on May 1, 2020: 1 CHF = $1.0399; 1 DKK = $0.1470 Source: Company information and US Food and Drug Administration’s Center for Drug Evaluation and Research. |

||||

| Table II: New Molecular Entities Approved by the US Food and Drug Administration’s Center for Drug Evaluation and Research, 2015–2019, With Sales Between $500 Million and $1 Billion, Based on 2019 Sales Revenues. | ||||

| Company | Proprietary name (active ingredient); application type | 2019 Sales | Indication | Year of Initial FDA Approval |

| AbbVie | Venclexta (venetoclax); NDA | $792 million | Chronic lymphocytic leukemia or small lymphocytic lymphoma | 2016 |

| Alexion Pharmaceuticals | Strensiq (asfotase alfa); BLA | $593 million | Perinatal/infantile-and juvenile-onset hypophosphatasia (abnormal development of bone and teeth) | 2015 |

| Allergan | Vraylar (cariprazine hydrochloride); NDA | $858 million | Bipolar depression and bipolar I disorder in adults | 2015 |

| Amgen | Parsabiv (etelcalcetide); NDA | $630 million | Secondary hyperparathyroidism in adult patients with chronic kidney disease undergoing dialysis | 2017 |

| AstraZeneca | Fasenra (benralizumab); BLA | $704 million | Severe asthma in patients with an eosinophilic phenotype | 2017 |

| Eli Lilly and Company | Olumiant (baricitinib); NDA | $543 million | Moderately to severely active rheumatoid arthritis | 2018 |

| Eli Lilly and Company | Verzenio (abemaciclib); NDA | $580 million | Advanced or metastatic breast cancer | 2017 |

| GlaxoSmithKline | Nucala (mepolizumab); BLA | £768 million ($960 million) | Severe asthma in patients with an eosinophilic phenotype | 2015 |

| Johnson & Johnson | Uptravi (selexipag); NDA | $819 million | Pulmonary arterial hypertension | 2015 |

| Neurocrine Biosciences | Ingrezza (valbenazine); NDA | $753 million | Tardive dyskinesia (involuntary movements) | 2017 |

| Otsuka Pharmaceutical | Rexulti (brexpiprazole); NDA | JPY 89,822 million ($840 million) | Major depressive disorder | 2015 |

|

Drugs approved as new molecular entities (NMEs) either as new drug application (NDA) or original biologics license application (BLA) by the US Food and Drug Administration’s (FDA) Center for Drug Evaluation and Research (CDER). Year of approval indicates year in which the drug was first approved as a new molecule entity by FDA’s CDER. Indication is for initial indication when first approved as an NME and subsequent approved indications. Sales revenues are rounded. Currency conversions used reported on May 1, 2020: 1 GBP = $1.2498; 1 JPY = $0.00931 Source: Company information and US Food and Drug Administration’s Center for Drug Evaluation and Research. |

||||