Inside the New J&J and Consumer Health Company

J&J plans to separate its pharma and medical devices businesses into one company and its consumer health business into another company. What’s behind the new J&J?

Plans for separation

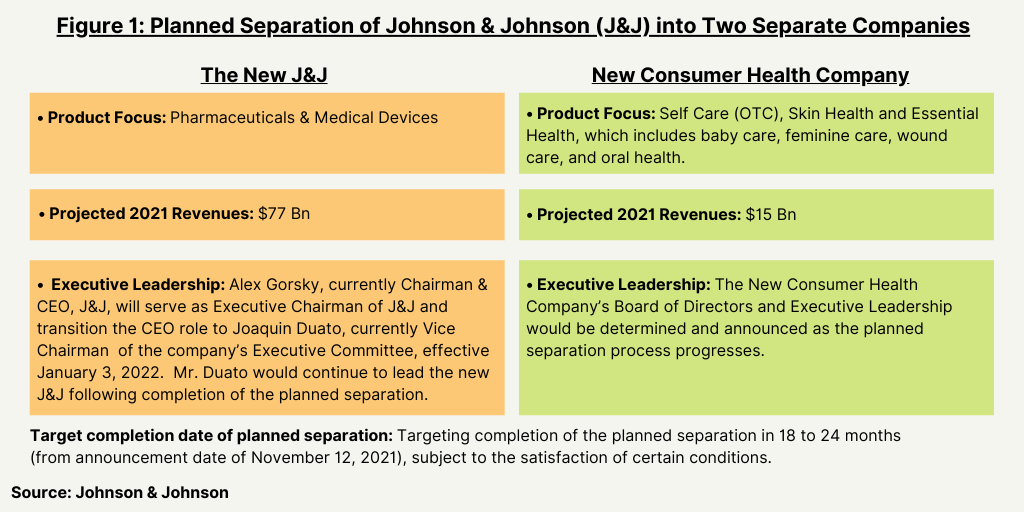

Last week (November 12, 2021), Johnson & Johnson (J&J) announced plans to split the company into two separate, standalone, publicly traded companies, one focused on pharmaceuticals and medical devices, and the other on consumer health (see Figure 1). The new J&J, focused on pharmaceutical and medical devices, is expected to have full-year 2021 revenues of approximately $77 billion, and the planned new Consumer Health company is projected to have full-year 2021 revenues of $15 billion.

In a previously announced move, Alex Gorsky, currently Chairman & CEO, J&J, will serve as Executive Chairman of J&J and transition the CEO role to Joaquin Duato, currently Vice Chairman of the company’s Executive Committee, effective January 3, 2022. Mr. Duato would continue to lead the new J&J following completion of the planned separation. The new Consumer Health company’s Board of Directors and executive leadership would be determined and announced in due course (as reported on November 12, 2021) as the planned separation process progresses.

The company is targeting completion of the planned separation in 18 to 24 months (as reported on November 12, 2021), subject to the satisfaction of certain conditions, including consultations with works councils and other employee representative bodies, as required; final approval of Johnson & Johnson’s Board of Directors; receipt of a favorable opinion and Internal Revenue Service ruling with respect to the tax-free nature of the transaction; and the receipt of other regulatory approvals.

The planned organizational design for the new Consumer Health company is expected to be completed by the end of 2022. The planned new Consumer Health company employees are expected to continue participating in their current J&J pay, benefits, and retirement programs through the end of 2022.

The Board of Directors’ intent is to effect the planned separation through the capital markets and create two independent companies. The transaction is intended to qualify as a tax-free separation for U.S. federal income tax purposes.

The new J&J: Pharma dominates

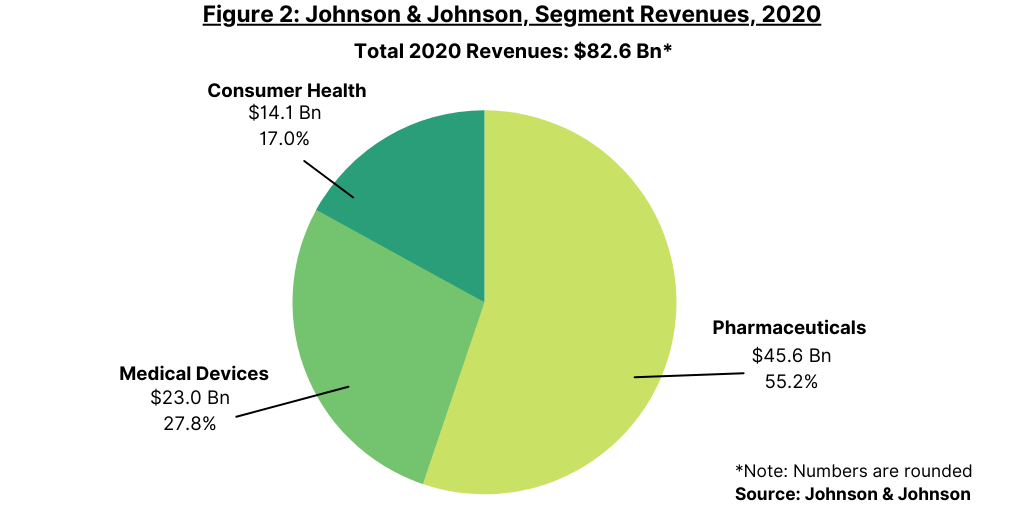

Pharmaceuticals, the largest business segment in J&J, will continue to be the leading piece of the new J&J. In 2020, J&J posted global revenues of $82.6 billion, of which pharmaceuticals accounted for 55%, or $45.6 billion, and medical devices, nearly 28%, or $23.0 billion (see Figure 2). The company’s consumer health segment accounted for 17% of 2020 global revenues, or $14.1 billion.

For the first nine months of 2021, global revenues from J&J’s pharmaceutical segment grew at a healthy pace—13.5% overall (11.3% operationally and 2.2% from currency effects)—to $37.8 billion compared to the year-ago period. Global revenues from its medical devices segment also showed strong growth—23.4% overall (20.5% operationally and 2.9% from currency effects)—to $20.2 billion. Revenues in its consumer health business increased 5.2% (3.1% operationally and 2.1% due to currency effects) to nearly $11.0 billion for the first nine months of 2021.

Top-selling pharmaceutical products and product areas

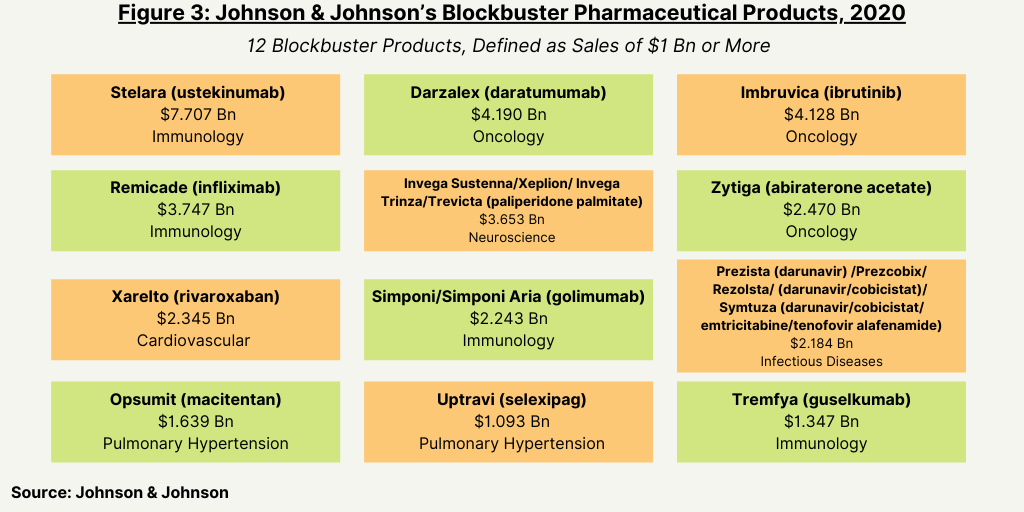

Based on 2020 global revenues, J&J had 12 blockbuster products in its pharmaceutical portfolio, defined as products with revenues of $1 billion or more (see Figure 3). Its top-selling product is Stelara (ustekinumab), a drug to treat several inflammatory disorders (psoriatic arthritis, plaque psoriasis, Crohn’s disease, and ulcerative colitis. The drug had 2020 revenues of $7.7 billion, which accounted for 17% of J&J’s 2020 global pharmaceutical revenues of $45.6 billion. The drug faces near-term biosimilar competition. The latest expiring patent in the US expires in 2023, and the latest expiring patent in Europe expires in 2024.

Two oncology drugs—Darzalex (daratumumab) for treating multiple myeloma and Imbruvica (ibrutinib) for treating several B cell cancers—were the next highest-selling drugs for J&J in 2020, with each posting sales of $4.1 billion. (see Figure 3).

Already facing biosimilar competition and declining sales, Remicade (infliximab), a drug to treat several inflammatory diseases, still ranked among the company’s top-selling drugs in 2020 with revenues of $3.7 billion. The drug is approved for treating Crohn’s disease, ulcerative colitis, rheumatoid arthritis, psoriatic arthritis, ankylosing spondylitis, and plaque psoriasis.

Rounding out the five top-selling drugs for J&J in 2020 was Invega Sustenna/Xeplion/Invega Trinza/Trevicta (paliperidone palmitate), a drug to treat schizophrenia and schizoaffective disorder, which posted sales of $3.65 billion in 2020 (see Figure 3).

Overall, Immunology is the company’s largest product area, with 2020 global revenues of $15.1 billion, representing an increase of 7.9% as compared to the prior year driven by strong uptake of Stelara (ustekinumab) in Crohn’s disease and ulcerative colitis and strength in Tremfya (guselkumab) in psoriasis, also a blockbuster drug in 2020. This was partially offset by COVID-19-related demand and lower sales of Remicade (infliximab) due to increased discounts/rebates and biosimilar competition.

Oncology is J&J’s second-largest product area with global 2020 revenues of $12.4 billion, representing an increase of 15.7% as compared to the prior year. Contributors to the growth were strong sales of Darzalex (daratumumab) driven by patient uptake in all lines of therapy and the launch of a subcutaneous formulation in the US and the European Union and by Imbruvica (ibrutinib) and Erleada (apalutamide), a drug to treat prostate cancer. Growth was negatively impacted by declining sales of Zytiga (abiraterone acetate), a drug to treat prostate cancer, due to generic competition but that still ranked as one of J&J’s blockbuster drugs in 2020 (see Figure 3).

Neuroscience products was J&J’s third-largest product area in 2020 with global revenues of $6.5 billion, driven mainly by Invega Sustenna/Xeplion/Invega Trinza/Trevicta (paliperidone palmitate), another blockbuster drug (see Figure 3).

Cardiovascular/metabolism/other drugs was the next largest product area in 2020 with revenue of $4.9 billion, a decline of 6.0% year over year. Xarelto (rivaroxaban) was the top-selling drug in this area, with sales of $2.3 billion, an increase of only 1.4% year over year.

Infectious disease products sales were $3.6 billion in 2020, with its drug Prezista (darunavir) /Prezcobix/Rezolsta/ (darunavir/cobicistat)/ Symtuza (darunavir/cobicistat/emtricitabine/tenofovir alafenamide) the top-selling drug in this area with sale of $2.2 billion. Pulmonary hypertension products achieved sales of $3.1 billion, representing an increase of 20.0% as compared to the prior year lead by sales of Opsumit (macitentan) and Uptravi (selexipag), both which achieved blockbuster status in 2020 (see Figure 3).