Pharma Industry Outlook: Where is the Growth?

Graham Lewis, Vice President, Global Pharma Strategy, IQVIA, gave a bio/pharma market overview at DCAT Week and outlined what lies ahead for the industry.

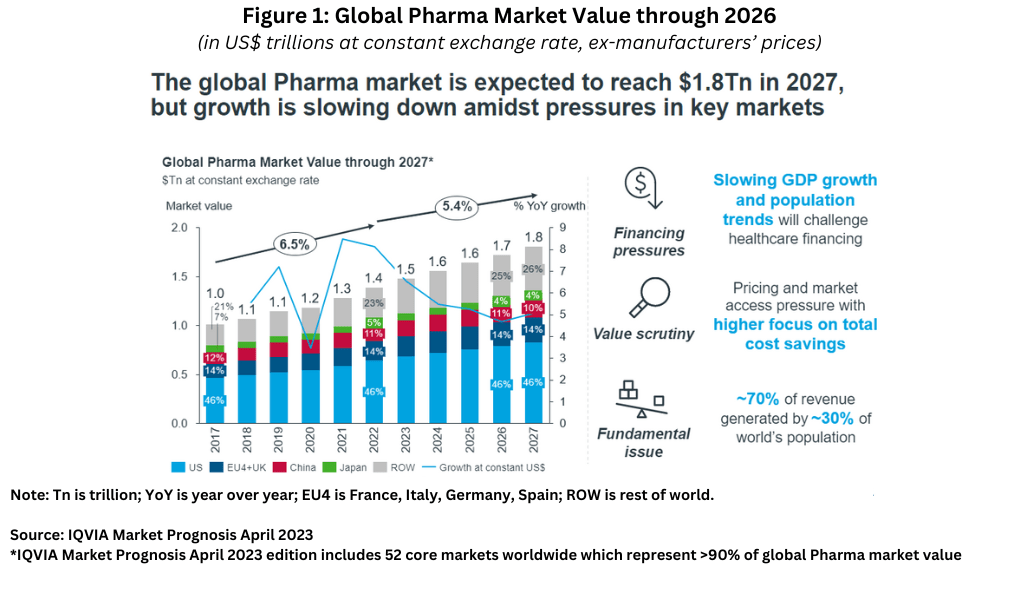

The global bio/pharmaceutical industry is expected to reach $1.8 trillion in 2027 at ex-manufacturer prices, but growth is slowing due to increased pricing and market access pressures. There are also profitability challenges in core markets as healthcare systems seek to achieve lower net prices to mitigate budget shortfalls driven by growing inflation and the demands of other priorities.

Vice President,

Global Pharma Strategy,

IQVIA

Big strategic issues loom large

Big strategic issues are facing Healthcare as governments and other payers struggle to repair the damage to effective health services caused by the COVID pandemic. While Pharma is an important part of the recovery, “Pharma is in the cart, but is not the horse leading the cart,” remarked Graham Lewis, Vice President, Global Pharma Strategy, IQVIA, at the Pharma Industry Outlook program, held on March 20, 2023, at DCAT Week, the flagship event of the Drug, Chemical & Associated Technologies Association (DCAT).

He explained that the COVID pandemic and major geopolitical events have and are exerting unprecedented pressures on healthcare systems with impact for years to come. In 2023 and going forward to 2030, key dynamics are affecting the bio/pharmaceutical industry: (1) overall cost pressures on healthcare systems as a whole; (2) tighter resource allocation by governments and payers relating to the need to fund social care and healthcare delivery; (3) more payer influence on pharma spending levels resulting in higher evidence requirements and ultimately stricter market access and pricing pressure; and (4) devoting more resources to preventative healthcare and earlier diagnoses as the pandemic signaled the inherent fragility of healthcare systems in responding adequately to the growing demands posed by ageing populations. In adapting to these changes, Lewis explained: “Pharma will have to decide whether to ‘stick to the knitting,’ i.e., the discovery and commercialization of medicines, or embrace a wider role in healthcare provision.”

Lewis emphasized that for Pharma, doing the latter and adapting company strategies to respond to changes in the external environment as well as inherent market challenges, may be necessary to thrive in the longer term.

The emergence of targeted therapies pioneered by the bio/pharmaceutical industry has been a key contributor to the more efficient use of medicines in improving outcomes, he explained, and says it is clear that earlier intervention made possible by efficient screening and diagnoses, supported by the monitoring of patients over time, would be a major contributor to improved health outcomes. At the same time, the devotion of more resources to drug-delivery simplification could be a major contributor to patient management in the community, allowing the hospital sector to eliminate backlogs. He explains that it has been difficult for Pharma to achieve a “premium” for treatment enhancements which “go beyond the pill,” but the current budgetary pressures on healthcare do offer an opportunity to obtain funding for these enhancements.

Looking at the numbers: global and geographic markets

Given these challenges, the global bio/pharmaceutical market is expected to see moderate growth in the near term. The global medicine market—using ex-manufacturer price levels—is expected to grow at a compound annual growth rate (CAGR) of 5.4% through 2027, down from 6.5% over the past five years, to reach about $1.8 trillion in 2027, with diverging trends by region, according to the latest version of IQVIA Market Prognosis Forecasts published in April 2023 (restricted to 52 core markets worldwide). Figure 1 outlines historical and projected data (through 2027) for overall market size, market shares of key regions, and growth trends. Lewis pointed out that three main trends are influencing growth: financing pressures, increased value scrutiny, and revenue/population mix.

Slowing growth in GDP (gross domestic product) and population trends (i.e., a rising aging population) will challenge overall healthcare financing, and hence, spending on medicines. In addition, funding by both governments and payers on healthcare in general and pharmaceuticals specifically will place increased scrutiny on the value outcome of products with a higher focus on total cost of savings as pricing and market access pressures continue. Lastly, the industry faces a fundamental growth issue of having a concentrated customer base: approximately 70% of the industry’s revenue is generated by approximately 30% of the world’s population, placing greater emphasis on the market conditions in the industry’s four highest revenue-generating geographic areas: the US, the EU4 (France, Italy, Germany, and Spain) & the UK, China, and Japan.

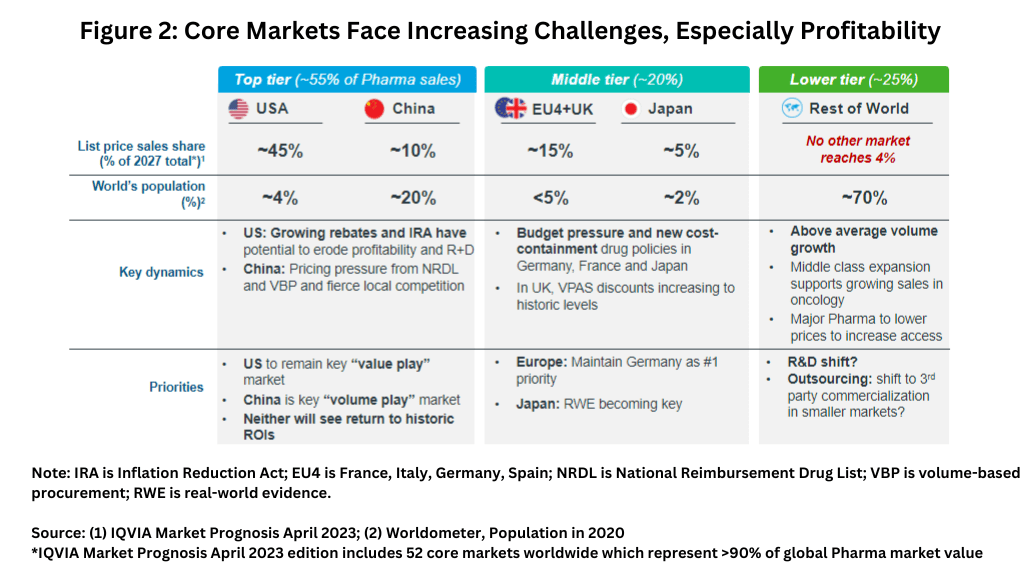

Figure 2 outlines the approximate market share of these areas (based on 2027 projections) and summarizes key growth challenges in these areas.

The US is the largest market in the global bio/pharmaceutical industry, accounting for an approximate 45% share (based on ex-manufacturers’ prices, i.e., list prices, on 2027 projected revenues).

The growing use of rebates, particularly in the US, has been and will continue to be a major challenge to growth in net sales, said Lewis, as well as the impact of the Inflation Reduction Act, which was signed into law in August 2022, and which proposes certain drug-pricing reforms in the US. Notable provisions include the ability of the US government to negotiate drug prices for select high-cost mature products under Medicare, the US government healthcare program for individuals aged 65 or older, to drive system savings, as well as other pricing reforms such as benchmarking prices from previous years to limit year-over-year price increases as well as capping of out-of-pocket costs for drugs under Medicare.

These drug-pricing reforms will have implications for Pharma, but the full impact has yet to be seen as the industry waits for the implementation of the new law, which sets the first group of 10 drugs subject to price negotiations under Medicare for 2026. As Lewis pointed out, the changes in the Medicare Part D benefit redesign shifts liabilities from the US Centers for Medicare and Medicaid Services, the US federal entity that administers the Medicare program, to insurers and companies with substantially higher exposure for plan sponsors, resulting in greater gross-to-net pressure, with payers anticipated to “share” costs with Pharma while statutory discounts grow.

Another key consideration for the global bio/pharmaceutical industry growth will be how China performs. Combined, the US, with its approximate global bio/pharma market share of 45%, and China, with an approximate 10% global market share, are projected to account for approximately 55% of the global bio/pharma market by 2027. In China, market dynamics are dictated by pricing pressure from the country’s National Reimbursement Drug List, a list of drugs fully or partially reimbursed by national health insurance, and policies relating to volume-based procurement.

In Europe, growth prospects are limited by ongoing cost-containment measures. The four largest markets in the European Union (EU), France, Germany, Italy, and Spain, the so-called “EU4” and the UK face budget pressures and cost-containment measures by national governments in various degrees. Overall, the EU4 and the UK account for approximately 15% of global bio/pharma sales (see Figure 2).

Like Europe, Japan, which accounts for approximately 5% of the global bio/pharmaceutical market, will see limited growth as it too faces budget pressures and cost-containment measures.

The rest of the world (RoW) accounts for approximately 30% of the global bio/pharma market, but more than 70% of the world’s population (see Figure 2) and will see above average volume growth. Fifteen countries account for approximately 65% of the expected growth in these non-core markets, which are projected to reach sales of $470 billion by 2026, up from $364 billion in 2022, representing a CAGR of 6.6%, above the global CAGR benchmark of 5.4% in this forecast period. Key country contributors to growth in select regions are Russia (C.I.S. region), India (Indian subcontinent), Brazil (Latin America), South Korea (Southeast Asia), and Saudi Arabia (Middle East & Africa).

Among the non-core markets, Lewis noted that Africa, the second most populous continent with a population of approximately 1.4 billion, “is largely underinvested at the present time,” and offers potential for Pharma based on several upward-moving trends. These trends include: projected GDP growth through 2024 in Africa exceeding global GDP growth (2024 GDP growth in Africa of 4.1% compared to 3.1% globally); increased investment in Africa’s healthcare infrastructure (e.g., $600-billion investment from the G7 countries by 2027); and increased population growth (25% of world’s population to be in Africa by 2050).

Bio/pharmaceutical industry growth: therapeutic areas

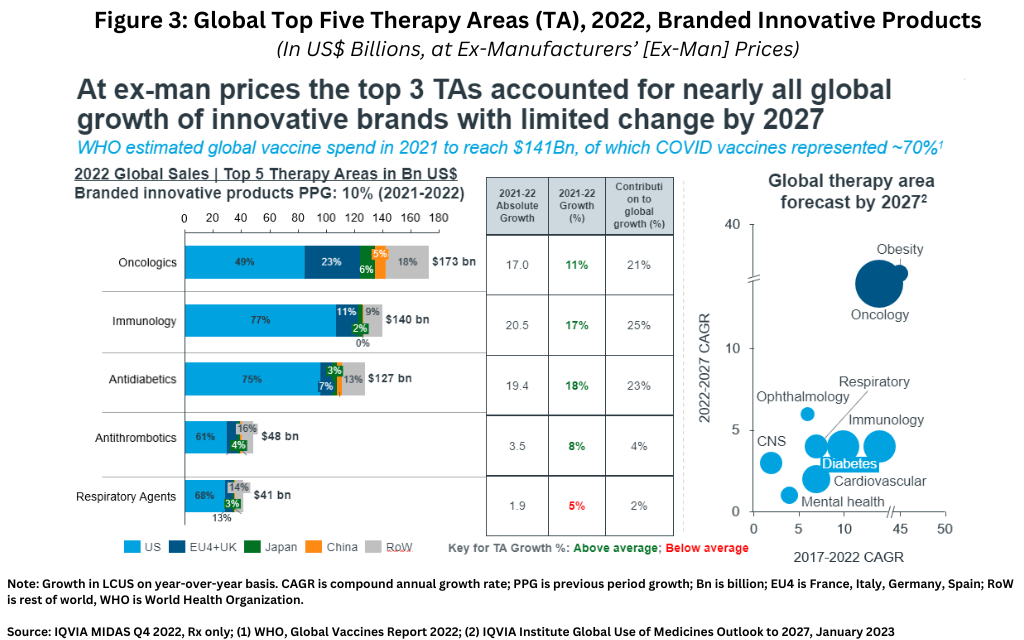

In looking at industry growth on a therapeutic area basis, the top three therapeutic areas (oncology, immunology, and diabetes) account for nearly all global growth of innovative brands with limited change projected by 2027 (see Figure 3).

Lewis explained that each of these three leading therapeutic areas face certain challenges to growth. In oncology, growth is impacted by increasingly fragmented opportunities, “me-too” innovation, and higher payer management. In immunology, growth is impacted by increasingly difficult-to-displace standards of care and greater pricing pressures in a highly competitive environment. In diabetes, while discounts in recent years have grown significantly, the emergence of their efficacy in weight reduction is currently producing a large stimulus to growth.

Given these challenges, what other therapeutic areas show growth potential? Lewis pointed to three therapeutic areas: obesity (as mentioned above), certain central nervous system (CNS) disorders, and mental health. “Obesity is anticipated to dominate Pharma’s future growth driven by high unmet need, cost-saving potential, and a large patient population,” he said. “In CNS, Alzheimer’s and Parkinson’s are the two most researched indications, but success has been elusive.” Drugs for mental health also represent a growth area as demand has increased post-pandemic. For example, there has been an approximate 70% increase in depression-based clinical trial starts in 2022 versus pre-pandemic levels, says Lewis.

Lewis emphasized that these overall market dynamics create new commercial imperatives for bio/pharma companies. “Pharma needs to rethink its focus in how to drive growth with acceptable returns on investment,” he said. That decision-making involves bio/pharma companies re-evaluating their R&D focus as well as using innovation as a means to alleviate the pressure on medicines spending in constrained healthcare systems. In addition, he emphasized that “Pharma needs to think ‘outside of the box’ on how to deliver patient-relevant, meaningful improvement over the current standard of care to succeed commercially.”

Generics outlook

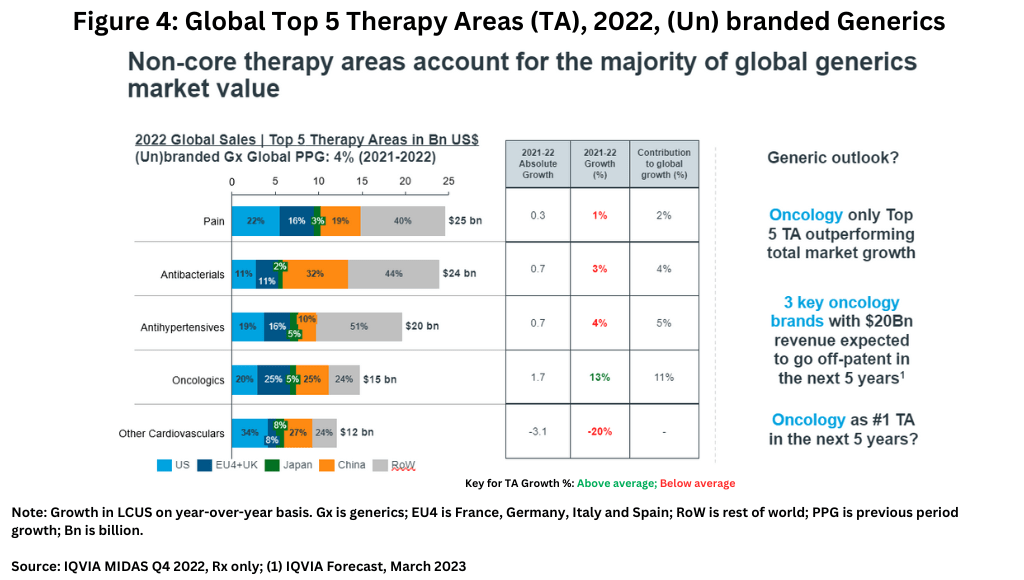

Generics companies face their own set of challenges. On a therapeutic area basis, non-core therapy areas account for the majority of global generics market value (see Figure 4), led by pain-management drugs, antibacterials, and antihypertensives. In the generics market, oncology is the only top five therapeutic area outperforming total market growth (see Figure 4). However, three major oncology brands with revenues of $20 billion are expected to go off-patent in the next five years, so it is likely that this will become a very significant field for generics growth, especially as biosimilar adoption intensifies.

On a geographic basis, North America represents a shrinking share of the global generics market value due to rising competition and downward pricing pressures. Although the US generics market has begun to stabilize since 2019, strong pricing pressures remain. In turn, non-core geographic markets have greater generics growth potential. For example, over the past five years, volume and sales growth in Africa/the Middle East have outperformed the market average. In India and the Commonwealth of Independent States (C.I.S), higher value growth has been driven by branded generics uptake.

Lewis explained that for future growth, generic companies will have to re-evaluate their business models and growth strategies both geographically and product-wise. “In the past, generic companies won through scale and reputation; now they have to rethink their business model,” he said. He pointed to four opportunities for generic companies to reimagine their business modes to drive growth: (1) specialty generics; (2) increased uptake in biosimilars; (3) new partnership models; and (4) differentiation through sustainability initiatives.

Specialty generics, which represent approximately 14% of the generics market, are defined by IQVIA as medicines that treat specific, complex diseases with four or more of the following attributes: initiated only by a specialist; administered by a practitioner; require special handling; unique distribution; high cost; warrants intensive patient care; and requires reimbursement assistance. Sales of specialty generics have outpaced growth of traditional generics and increased at a CAGR of 10% between 2017 and 2022 to reach sales of approximately $42 billion.

For biosimilars, the global biosimilars market is expected to double over the next five years and provide approximately $400 billion in cost saving to healthcare systems. Lewis explained that biosimilars’ uptake is expected to increase and be a priority for payers, but new skills from generics companies are needed to succeed.

In addition, partnerships are becoming an attractive option as multinationals begin to shrink their global footprint for both innovative products late in their product life cycles and for generics. “Major pharma players are increasingly interested in outsourcing commercial operations in smaller or ‘difficult’ markets,’” he said.

Lastly, ESG (environmental, social and governance) activities and Pharma’s push to reduce its carbon footprint are a pressing issue and may present opportunities to differentiate downstream value-chain services for generics companies.

Looking ahead

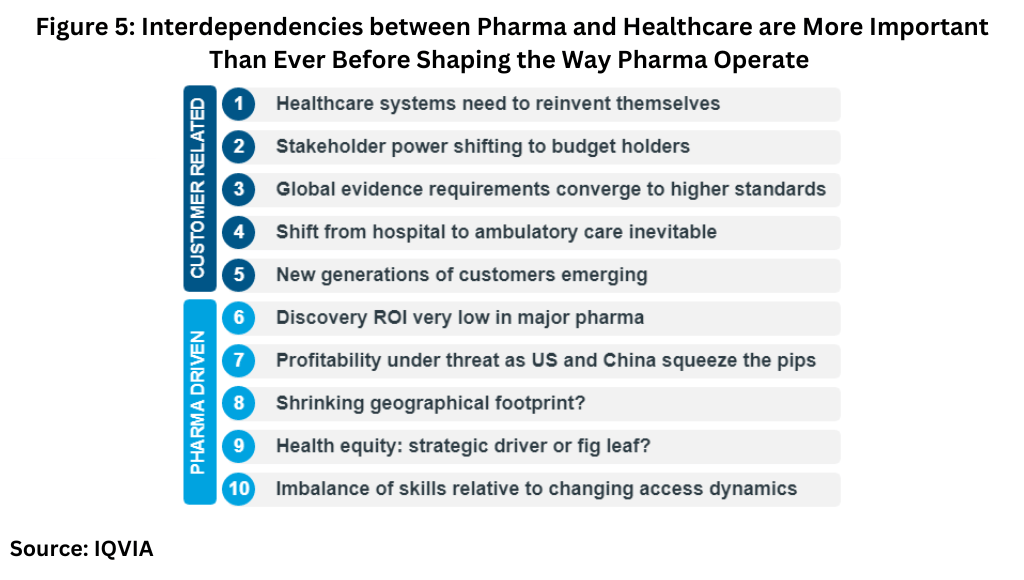

The key take-away, says Lewis, is that “interdependencies between Pharma and healthcare are more important than ever before in shaping the way Pharma operates.” . He pointed to 10 fundamental shifts, five customer-related and five Pharma-related, influencing how Pharma will have to operate (see Figure 5 below).

The delivery of healthcare, whether in the form of services or pharmaceuticals, is shifting, where possible, from hospital/clinical settings to outpatient/at-home settings to create the so-called “homespital.” “This shift to remote care will transform everything from R&D, commercial strategy, to the supply chain,” explained Lewis. Although the general shift to homecare will likely take a decade, smart homecare services and products may give brands a competitive edge, he added.

Large Pharma recognizes the opportunities emerging as healthcare priorities change. However, this transformation will require new ways to innovate and new skill sets, such as increased digitalization, including the use of artificial intelligence, for not only healthcare itself, but for Pharma in its R&D and commercialization activities.