Pharma Pulse: What is on the Horizon for 2021?

What may be in store for the pharma industry in 2021? What trends will continue and what will emerge? From telemedicine to new models in drug development, to supply-chain adjustments, to increased deal-making, DCAT Value Chain Insights takes the pulse of the industry.

What to watch for in 2021

Economic rebound in the making. An overarching issue for the pharma industry in 2021 is to what extent the broader economy may or may not recover in 2021. The global economy is projected to grow in 2021 by around 5% in market exchange rates, the fastest rate recorded in the 21st century, returning the global economy in aggregate to pre-pandemic levels of output by the end of 2021 or early 2022, according to a recent PwC analysis. Despite projected expansion of 5% in market exchange rates in 2021, the predictions caution that the next three to six months will continue to be challenging, particularly for the Northern Hemisphere countries going through the winter months as they could be forced to further localized or full economy-wide lockdowns. Output in some advanced economies could contract in the first quarter, and growth overall is more likely to pick up in the second half of the year, when it is expected that large advanced economies will have vaccinated at least two thirds of their population.

”While it’s good news that the global economy in aggregate is likely to be back to its pre-crisis levels of output by the end of 2021 or early 2022, a distinguishing feature of the Great Rebound is that it will be uneven across different countries, sectors and income levels,” said Barret Kupelian, senior economist at PwC, in commenting on the company’s recent report, Global Economy Watch for 2021 – From the Great Lockdown to the Great Rebound. For example, the Chinese economy is already bigger than its pre-pandemic size, but other advanced economies‒‒particularly heavily service based economies like the UK, France and Spain or those focused on exporting capital goods, such as Germany and Japan‒‒are unlikely to recover to their pre-crisis levels by the end of 2021.”

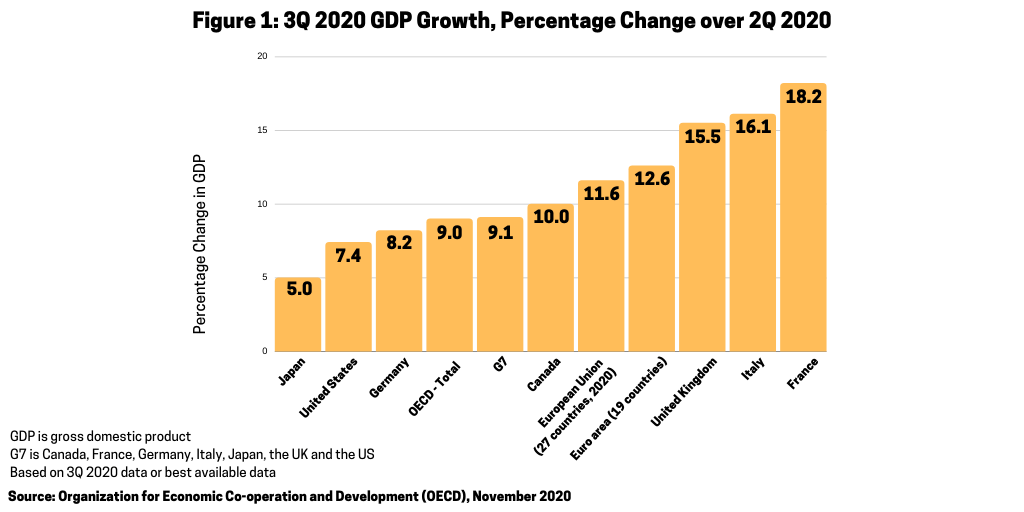

The projected rebound, although uneven depending on the country, is in part due to improving economic activity in the second half of 2020. Following the unprecedented falls in real gross domestic product (GDP) in the first half of 2020 in the wake of COVID-19 containment measures, GDP in countries in the Organization for Economic Co-operation and Development (OECD) area rebounded by 9.0% in the third quarter of 2020 (see Figure 1) although GDP growth remained 4.3% below its pre-crisis high, according to an OECD analysis released in late November 2020. The OECD consists of 37 member countries, including advanced economies.

Among the major seven economies (US, Germany, UK, France, Italy, Japan, and Canada), GDP in the third quarter of 2020 rebounded most strongly in those economies that also saw the sharpest falls in the second quarter of 2020 (see Figure 1 ) by: 18.2% in France, (following a contraction of 13.7%), 16.1% in Italy (following a contraction of 13.0%), and 15.5% in the UK (following a contraction of 19.8%). GDP also rebounded in all other major economies: in Canada (by 10%, following a contraction of 11.5% in the second quarter 2020), Germany (8.2%, minus 9.8%), Japan (5.0%, minus 8.2%), and the US (7.4%, minus 9.0%). In the euro area and the European Union, GDP increased by 12.6% and 11.6% respectively, following contractions of 11.8% and 11.4% in the second quarter of 2020 (see Figure 1). GDP growth through the first three quarters of 2020, however, remained significantly below the levels of the first three quarters in 2020 in the OECD area as a whole (minus 4.1%) and in all major seven economies, with the U.S. (minus 2.9%) recording the smallest annual fall and the UK (minus 9.6%) the largest.

M&A rebound in pharma and life sciences industry. Last year (2020) was a down year for deal-making in the pharmaceutical and life sciences sector compared to 2019, but it is expected to rebound in 2021, according to a recent PwC analysis. In 2021, PwC projects a return to normal for the pharmaceutical and life sciences sector with around $250 billion to $275B billion in deal activity. The impact of COVID-19 in 2020 put a hold on many deals during the early stages of the pandemic and also impacted the medical device sub-sector. These factors, among others, resulted in approximately $184 billion in deals for the sector, which was one of the lowest years in deal making in almost a decade. PwC projects a return to a normal level of deal making will be driven by activity across all sub-sectors. Large pharma will continue to use mergers and acquisitions (M&A) to achieve scale as companies look to invest for the long-term. Some of these may be larger ($30 billion to $40 billion) along with the continued flurry of smaller deals ($5 billion to $15 billion) in the oncology and cell and gene therapy space. New and larger players in specialty pharma, such as Organon (the pending spin-off of Merck & Co.’s women’s health, legacy products, and biosimilar business) and Viatris (the merger of Mylan and Pfizer’s Upjohn, its off-patent and established medicines business), will likely do more bolt-on deals focused in traditional therapeutic areas in 2021, creating large upside potential for further M&A.

Changes in drug development and clinical trials. The COVID-19 pandemic obliged pharmaceutical companies to adjust clinical trials administration with few in-person interactions and more digitally based and remote interaction. A recent PwC survey found that almost all pharmaceutical and life sciences executives (98%) surveyed said they expect digital investment in clinical trials to increase in 2021. A key trend to watch in 2021 would be further moves, post-pandemic, on applying decentralized models in clinical trial administration.

Increasing supply-chain transparency. Overall in the health industry, including the pharmaceutical industry, a recent PwC analysis projects increased focus for supply-chain transparency and risk mitigation in supply chain. It projects that health industry in 2021 to start to reconstruct the supply chain to function more flexibly as it does in other industries, such as automotive or technology, and to further mitigate supply risk. Where possible, the health system is expected to begin to triangulate supply chain risks. These actions will likely mean near term incremental investments into supply-chain capabilities resulting in marginally higher direct costs, but lay the groundwork for a more flexible and responsive supply chain.