Profits and Pharma: The Impact of COVID-19

Reflecting the fallout from the COVID-19 pandemic, real GDP in the US decreased at an annual rate of 32.9% in the second quarter, and GDP in the eurozone shrank by 12.1%, both historical lows. How has the pharma industry fared facing such strong headwinds?

Economic fallout from COVID-19

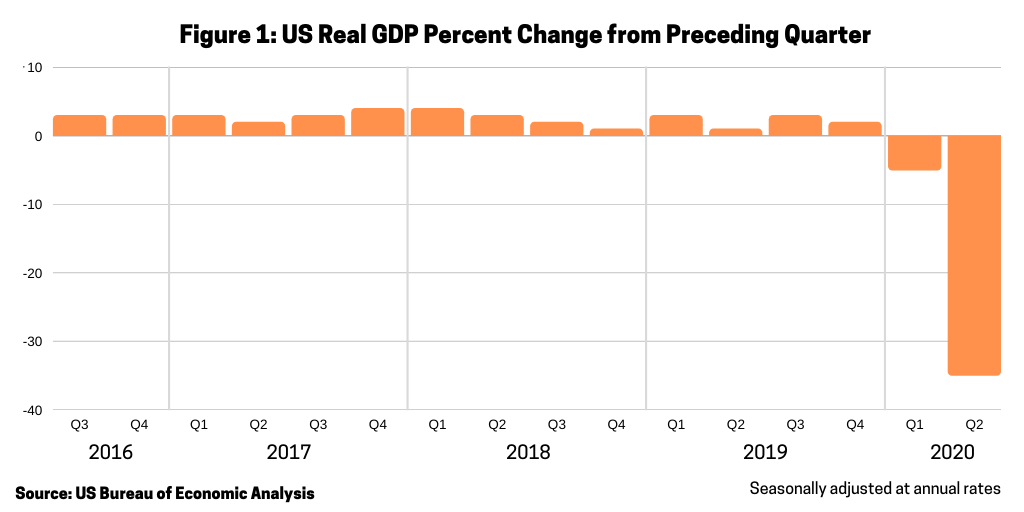

Overall, the economic fallout from the novel coronavirus (COVID-19) has been severe, with both the US and Europe recording record declines in gross domestic product (GDP). Real GDP in the US decreased at an annual rate of 32.9% in the second quarter of 2020 (see Figure 1 ), according to an advanced estimate released by the US Bureau of Economic Analysis (BEA). In the first quarter, real GDP decreased 5.0%. The GDP estimate, which was released last week (July 30, 2020), is based on source data that are subject to further revision; a “second” estimate for the second quarter, based on more complete data, will be released on August 27, 2020.

The decline in second quarter GDP reflected the response to COVID-19 as “stay-at-home” orders that were issued in March and April (March and April 2020) were partially lifted in some areas of the country in May and June (May and June 2020), and government pandemic assistance payments were distributed to households and businesses. “This led to rapid shifts in activity, as businesses and schools continued remote work and consumers and businesses canceled, restricted, or redirected their spending,” said the BEA. The BEA notes that the full economic effects of the COVID-19 pandemic cannot be quantified in the GDP estimate for the second quarter of 2020 because the impacts are generally embedded in source data and cannot be separately identified.

A decline in healthcare services was a contributing factor to the fall in GDP. The decrease in real GDP reflected decreases in personal consumption expenditures (PCE), exports, private inventory investment, nonresidential fixed investment, residential fixed investment, and state and local government spending that were partly offset by an increase in federal government spending, said the BEA. The decrease in PCE reflected decreases in services (led by healthcare) and goods (led by clothing and footwear).

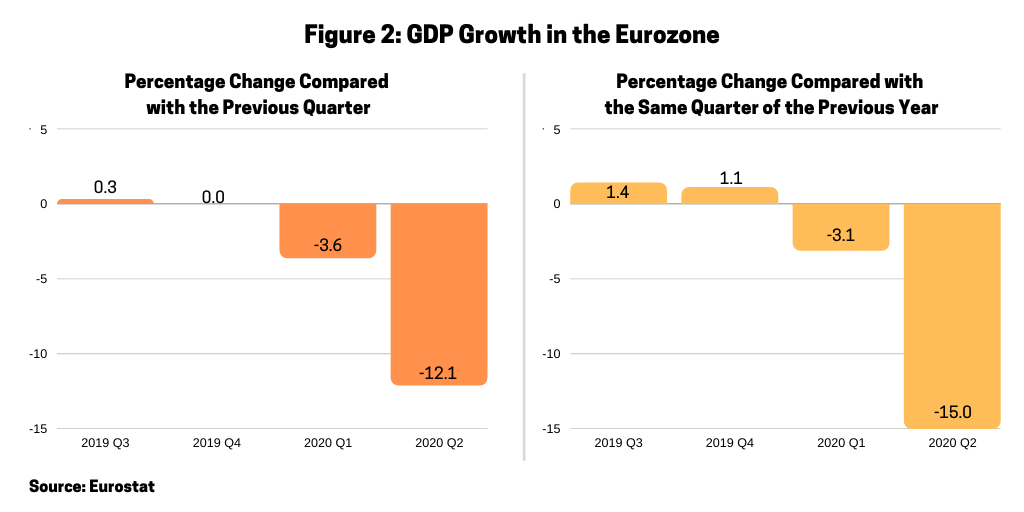

Europe also experienced a record fall in GDP in the second quarter (second quarter of 2020). In the second quarter 2020, still marked by COVID-19-containment measures in most member states of the European Union (EU), seasonally adjusted GDP decreased by 12.1% in the euro area and by 11.9% in the EU, compared with the previous quarter (see Figure 2), according to a preliminary estimate issued last week (July 31, 2020) by Eurostat, the statistical office of the EU. Comparing year-over-year estimates show a steeper decline. Compared with the same quarter of the previous year (2019), seasonally adjusted GDP decreased by 15.0% in the euro area and by 14.4% in the EU in the second quarter of 2020. These were the sharpest declines observed since the EU started such estimates in 1995 and were markedly higher than in the first quarter of this year (2020). In the first quarter of 2020, GDP had decreased by 3.6% in the euro area and by 3.2% in the EU. Among the EU member states, for which data are available for the second quarter 2020, Spain (-18.5%) recorded the highest decline compared to the previous quarter, followed by Portugal (-14.1%) and France (-13.8%). Final estimates for the second quarter of 2020 will be released next week (August 14, 2020).

Impact of COVID-19 on the pharmaceutical majors

Facing such strong headwinds, what has been the impact on the pharmaceutical industry? Many of the pharmaceutical majors, in reporting their second-quarter and first-half results, showed some effect of declining revenues year-over-year attributable to the COVID-19 pandemic.

For the second-quarter 2020, Pfizer reported revenues of $11.8 billion and $23.8 billion for the first half of 2020, respectively a 11% and 10% decline year-over-year, which reflected the impact from COVID-19. Pfizer pointed to a reduction in in-person meetings between sales representatives and physicians in the US and a decline in prescriptions as contributors to its revenue decline.

“Pfizer has experienced an impact on its sales and marketing activities due to widespread restrictions on in-person meetings with healthcare professionals and the refocused attention of the medical community on fighting COVID-19,” said the company in its second-quarter 2020 earnings release of July 30, 2020. “Access to prescribers for sales force colleagues during second-quarter 2020 was mixed, with those in most international markets able to meet with healthcare professionals for most of the quarter while those in the US were unable to meet in-person with doctors for nearly all of the quarter…. As a result of the lower number of in-person meetings with prescribers and restrictions on patient movements due to government-mandated work-from-home or shelter-in-place policies, the rate of new prescriptions for certain products and of vaccination rates for most vaccines slowed in certain markets, including the US, which negatively impacted second-quarter 2020 financial results.”

Merck & Co. reported second-quarter worldwide sales of $10.9 billion, a decrease of 8% compared with the second quarter of 2019, which the company said reflected the negative impact of COVID-19. Excluding the impact from foreign exchange, sales declined 5%.

Bristol Myers Squibb posted second-quarter revenues of $10.1 billion, an increase of 61% on a reported basis, or 63% when adjusted for foreign exchange driven primarily by the impact of the company’s $74-billion acquisition of Celgene, which was completed in November 2019. Revenues remained consistent on a pro forma basis, as sales were estimated to be negatively impacted by approximately $600 million due mainly to COVID-19- related channel inventory work-downs from the first quarter, as well as lower demand resulting from reduced new patient starts and fewer patient visits to physicians in the pandemic.

GlaxoSmithKline (GSK) reported group sales of £7.6 billion ($9.9 billion) in the second quarter of 2020, a 2% decline (in local currencies) and 3% decline (at constant exchange rates (CER)) compared to the second quarter of 2019. The company said that the sales decline in the second quarter reflected expected disruption from COVID-19, particularly in its vaccines business, as well as destocking from the first quarter 2020 in its pharmaceuticals and consumer healthcare businesses. First-half 2020 revenues were up 8% (both in local currencies and at CER) year-over-year to £16.714 billion ($21.966 billion).

”As expected, our performance this quarter was disrupted by COVID-19, particularly in our Vaccines business, as visits to healthcare professionals were limited due to lockdown measures,” said Emma Walmsley, CEO, GSK, in the company’s second-quarter results released July 29, 2020. “Overall, we are seeing good underlying demand for our major products and are confident this will be reflected in future performance when the impact of COVID measures eases.”

Roche reported that first-half 2020 company sales increased 1% at CER and declined 4% in Swiss francs to CHF 29.281 billion ($32.314 billion) as a result of continued appreciation of the Swiss franc against most currencies. It noted that the COVID-19 pandemic had a negative impact on sales during the second quarter, but that since June, sales are recovering. Sales in its Pharmaceuticals Division increased 1% to CHF 23.2 billion ($25.6 billion) in the first half of 2020. The company said that the COVID-19 pandemic had an overall negative impact on the pharmaceuticals sales, especially in May. Hospitalizations and out-patient visits decreased, which particularly impacted sales of certain products.

Eli Lilly and Company reported that second-quarter 2020 revenues declined 2% year-over-year to nearly $5.5 billion, comprised of volume growth of 6%, a 7% decrease in realized prices, and a 1% unfavorable impact from foreign exchange rates. The estimated negative impact of the COVID-19 pandemic on second-quarter 2020 revenue included approximately $250 million of decreased customer buying that largely offset product stocking that occurred in the first quarter of 2020, as well as approximately $250 million of lower revenue resulting from delayed new patient prescription trends. On a year-to-date basis, revenue in 2020 increased 6%, driven by 13% volume growth.

Reflecting the completion of its $63-billion acquisition of Allergan in May (May 2020), AbbVie reported worldwide net revenues in the second quarter of 2020 of $10.425 billion, an increase of 26.3% on a reported basis, or a decrease of 5.3% on a comparable operational basis, due to the COVID-19 pandemic.

Novartis reported a decline in sales as well although not as pronounced. During the second quarter, the company said that COVID-19 had an impact on its business with forward purchasing from the first quarter largely reversing. Overall, Novartis reported a 4% decline (in US dollars) in the second quarter comparative to year-over-year figures to $11.3 billion although first-half sales for 2020 increased 3% to $23.8 billion.

For Sanofi, net sales in the second quarter 2020 were EUR 8.207 billion ($9.755 billion), down 4.9% on a reported basis and a decline of 3.4% at CER on a year-over-year basis. First-half 2020 sales were up only slightly (0.9% on a reported basis and 1.6% at CER) to EUR 17.180 billion ($20.432 billion).

Despite the impact of the COVID-19 pandemic, Amgen reported that its total revenues increased 6% to $6.2 billion in the second quarter of 2020 in comparison to the second quarter of 2019, driven by higher unit demand and offset partially by lower net selling prices.

AstraZeneca reported strong growth in the second quarter and first half with what it characterized as “a modest inventory-related benefit to total revenue, reflecting the effects of the ongoing COVID-19 pandemic…” In the first half of 2020, total revenue increased by 12% (14% at CER) to $12.629 billion and an 8% increase in revenue (11% at CER) to $6.275 billion in the second quarter.