The EU and Fine Chemicals: What’s Next

The European Commission took another step to address ways to improve the resilience of the EU’s pharmaceutical manufacturing value chain by issuing a revised roadmap for its Pharmaceutical Strategy for Europe. The revised roadmap, which is open to stakeholder input through April 27, includes measures for environmental risk assessment and increased transparency.

EU’s Pharmaceutical Strategy and the pharma supply chain

A reduction of reliance on offshore drug manufacturing is on the policy table in the European Union (EU) as part of the European Commission’s Pharmaceutical Strategy for Europe, which the European Commission adopted in late November (November 2020). It includes a process for a structured dialogue with and between stakeholders in pharmaceutical manufacturing and public authorities to identify vulnerabilities in the supply chain of critical medicines and shape policy options to strengthen the continuity and security of supply in the EU. The plan seeks to better understand and address those aspects that impact the resilience of the whole pharmaceutical manufacturing chain, starting with raw materials, intermediates, active pharmaceutical ingredients, and including finished dosage forms.

The structured dialogue initiative is a two-phase process steered by the European Commission. The main objective of Phase 1 is to close the knowledge gaps by gaining a better understanding of the functioning of global pharmaceutical supply chains and identifying the precise causes and drivers of different potential vulnerabilities. Building on the evidence gathered in Phase 1, Phase 2 will result in concrete measures that will address the identified issues. The structured dialogue initiative aims to deliver results by the end of 2021 and will cover all major steps of manufacturing of medicines in the EU and globally. Any potential measures will comply with EU competition and World Trade Organization (WTO) rules.

In late February (February 2021), The European Commission held a kick-off meeting of the structured dialogue process to discuss the objective of increasing the EU’s pharmaceutical supply-chain resilience and also to discuss the contributions by meeting participants. In addition to high-level representatives from the EU, EU member states, the European Medicines Agency (EMA), and the European Directorate for the Quality of Medicines & HealthCare (EDQM), pharma companies and CDMOs participated in the February 26, 2021 meeting. Among the companies listed as participants in the meeting were: AstraZeneca, Sanofi, Pfizer, Merck KGaA, Novartis’ Sandoz, Novo Nordisk, Teva, Fresenius Kabi, Seqens, Olon, Hovione, and Siegfried. Industry groups included: the European Federation of Pharmaceutical Industries and Associations (EFPIA), which represents innovator pharmaceutical companies in Europe; Medicines for Europe, which represents generic and biosimilar manufacturers in Europe; the European Fine Chemicals Groups, which represents fine chemical manufacturers in Europe; and the European Chemical Industry Council (CEFIC), which represents chemical manufacturers in Europe.

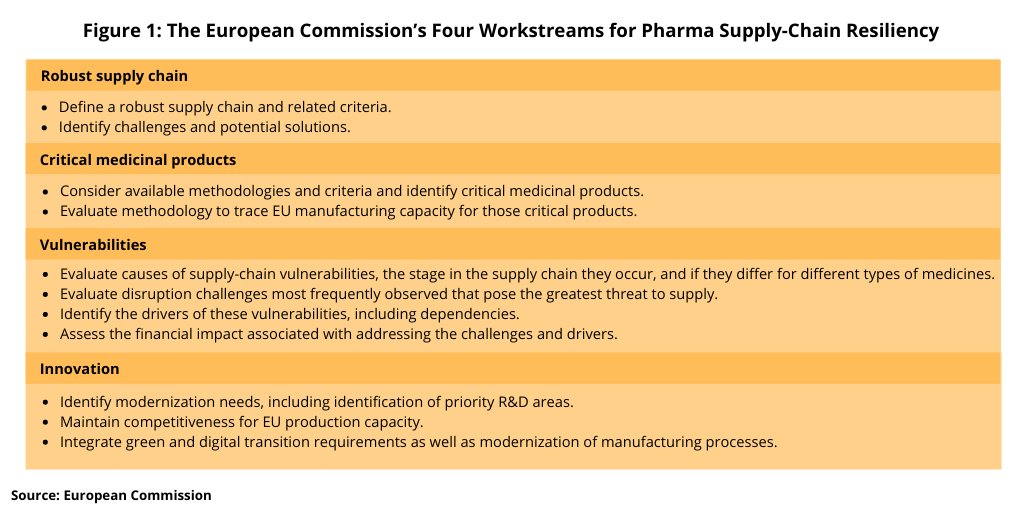

The February 26 meeting launched Phase 1 of the structured dialogue process. The first broad operational meeting was held in late March (March 2021) with the purpose to refine the scope of each workstream identified in the process (see Figure 1) and agree on key questions to be tackled as well as to discuss and agree on the working arrangements. Four workstreams were identified in Phase 1: (1) robust supply chains; (2) critical medicinal products; (3) vulnerabilities; and (4) innovation. The operational meeting will be followed by two rounds of meetings for each workstream. Each of the workstreams will prepare a document answering key questions predefined by each workstream. The contribution of the workstreams will be a basis for the European Commission to propose the way forward.

Revised roadmap for the Pharmaceutical Strategy for Europe

The implementation of the European Commission’s Pharmaceutical Strategy for Europe, of which the measures relating to bio/pharmaceutical manufacturing and supply, are just one piece, will result in a proposal for revision of the EU’s current pharmaceutical legislation, slated for 2022. In late March (March 2021), the European Commission published its roadmap on the revision of the general pharmaceutical legislation, which is open to public feedback until April 27, 2021.

The revision of the general pharmaceutical legislation is complementary to other ongoing EU initiatives, such as the EU Health Emergency Preparedness and Response Authority (HERA), which provides for a dedicated structure to support the development, manufacturing and deployment of medical countermeasures during a health crisis of natural or deliberate origin, and the European Green Deal, through the impact of pharmaceutical substances on the environment. The Pharmaceutical Strategy for Europe is in line with the objectives of the EU’s overall Industrial Strategy, with a pharmaceutical related focus, such as through measures for an investment-friendly environment for research and innovation, enabling key technologies, supporting industry, particularly small and medium-sized enterprises, the creation of European industrial ecosystems in areas of strategic importance, and diversification of supply with respect to starting and raw materials for pharmaceuticals.

In its revised roadmap of its Pharmaceutical Strategy for Europe, the European Commission says that current EU legislation needs to enhance security of supply through stronger obligations for supply and transparency, earlier notification of shortages and withdrawals of medicines, enhanced transparency of stocks, and stronger EU coordination and mechanisms to monitor, manage, and avoid shortages. The revised roadmap further calls for improving the transparency and oversight of the supply chain, particularly with regards to the international supply chain, by revising manufacturing and distribution provisions in the current pharmaceutical legislation. It says that provisions relevant for manufacturing and quality control should be assessed in light of production technologies and the supply chain and that the responsibility of actors could be improved to increase transparency, ensure the quality of medicines, and strengthen security of supply. It also says that the current EU legislation needs to be improved in terms of its environmental risk-assessment provisions by enhancing the environmental sustainability of bio/pharmaceutical production, including green manufacturing, and through the use and disposal of medicines.