The Innovation Makers: First-in-Class New Drug Approvals

A measure of innovation in the bio/pharma industry is to look at “first-in-class” new drug approvals, referring to drugs with new mechanisms of actions than existing therapies. A look at key trends, the companies, and products for first-in-class drugs.

First-in-class new drug approvals: the trends

New product innovation is crucial for the bio/pharmaceutical industry, and one way to delve more deeply into a measure of new product innovation is to look at “first-in-class” new drug approvals. First-in-class, as defined by the US Food and Drug Administration (FDA), refers to new drug approvals with a new mechanism of action different from existing therapies as of the time of approval by the FDA’s Center for Drug Evaluation and Research (CDER). New drug approvals refer to new molecular entities approved under new drug applications or as new therapeutic biologics approved under biologics license applications by the FDA’s CDER.

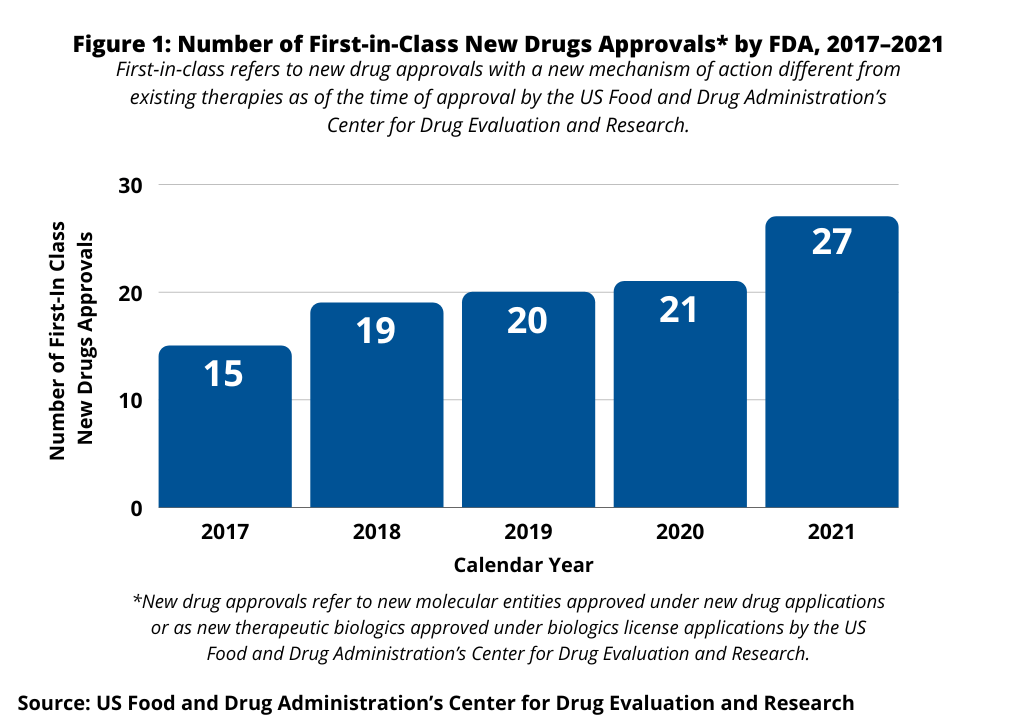

Table I at the end of the article identifies the first-in-class new drug approvals in 2021. In 2021, there 27 first-in-class new drug approvals, which was an uptick from 2020, when there were 21 first-in-class new drug approvals (see Figure 1). The 21 first-in class drug approvals in 2020 were on par with prior years: 2019, when 20 new first-in-class new drugs were approved, and 2018, when 19 were approved (see Figure 1).

Of the 27 first-in-class new drug approvals in 2021 (see Table I at end of article), 17 (63%) were small molecules and 10 (37%) were biologics. Also, of the 27 first-in-class new drug approvals in 2021, 13, or 48% received orphan drug designation by the FDA; an orphan disease is a rare disease or condition that affects fewer than 200,000 people in the US.

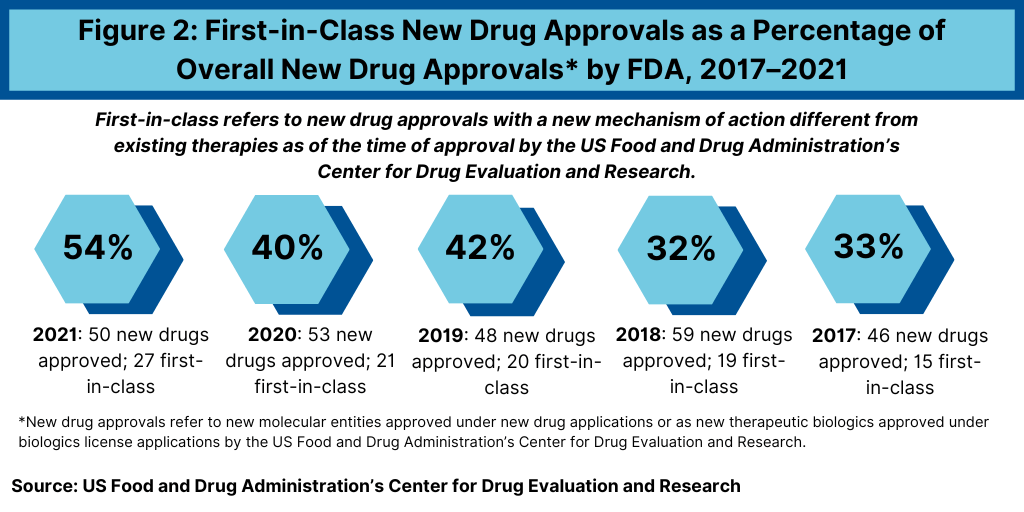

As a percentage of overall new drug approvals in 2021, first-in-class drugs accounted for more than half (54%) of new drug approvals in 2021. Of the 50 new drugs approved by the FDA’s CDER in 2021, 27 were characterized as first-in-class drugs (see Figure 2). This is a sizable uptick on a percentage basis comparative to the prior five years, when first-in-class drugs accounted for 40% of new drug approvals in 2020, 42% in 2019, 32% in 2018, and 33% in 2018 (see Figure 2).

First-in-class new drug approvals: the companies and products

Among the large bio/pharmaceutical companies, AstraZeneca, Bayer, and Merck & Co. each had two first-in-class drug approvals in 2021. Amgen, Biogen/Eisai, Johnson & Johnson, Novartis, Sanofi, and Takeda each had one (see Table 1 at the end of the article).

Amgen received approval for Lumakras (sotorasib), a RAS GTPase family inhibitor, for treating adult patients with KRAS G12C mutated locally advanced or metastatic non-small cell lung cancer (NSCLC) as determined by an FDA-approved test, who have received at least one prior systemic therapy. The KRAS inhibitor class of cancer medicines is a promising area. FDA’s approval of Lumakras made it the first-ever FDA-approved drug for treating that specific form of NSCLC. The drug is also being studied in multiple other solid tumors.

Amgen is also seeking to gain another first-in-class drug with its pending $3.7-billion acquisition of ChemoCentryx, a San Carlos, California-based bio/pharmaceutical company developing oral drugs to treat autoimmune diseases, inflammatory disorders, and cancer, primarily for orphan and rare diseases. The company’s lead product, a first-in-class drug approved in 2021, is Tavneos (avacopan). a drug to treat anti-neutrophil cytoplasmic autoantibody-associated vasculitis, an umbrella term for a group of multi-system autoimmune diseases with small-vessel inflammation. Amgen announced its agreement to acquire ChemoCentryx earlier this month (August 2022). The deal is expected to close in the fourth quarter of 2022.

AstraZeneca received two first-in-class drug approvals: Saphnelo (anifrolumab) for treating systemic lupus erythematosus, which is the most common type of lupus, a disease in which the immune system attacks the body’s own tissues, and for Tezspire (tezepelumab) as an add-on treatment for patients aged 12 and older with severe asthma.

Biogen’s/Eisai received approval for Aduhelm (aducanumab), an amyloid beta-directed antibody, for treating Alzheimer’s disease. It was approved in 2021 as the first therapy for Alzheimer’s that targets the fundamental disease pathophysiology and was the first drug approved for the disease since 2003, according to the FDA. Although holding much promise and projected as a key revenue contributor for the companies, the drug has experienced much lower-than-expected results and diminished commercial prospects. The poor commercial showing for the drug resulted in Biogen’s CEO, Michel Vounatsos, who had served as Biogen’s CEO since 2017, announcing in May (May 2022) that he was stepping down; he is continuing to serve as CEO and on the company’s Board of Directors until his successor is appointed.

Aduhelm came to be approved by the FDA under unusual circumstances. An FDA advisory committee had recommended not to approve the drug, citing the need for additional research. Recommendations by FDA advisory committees are non-binding, but are usually in line with final FDA decisions, although not in this particular case, and the drug was approved under FDA’s accelerated approval program. The accelerated approval pathway provides earlier access to drugs when there is an expectation of clinical benefit despite some uncertainty about the clinical benefit with follow-up clinical trials required.

Biogen incurred a major setback for the drug earlier this year (April 2022) that dimmed its commercial prospects when the US Centers for Medicaid and Medicare Services (CMS) restricted coverage under Medicare, the US federal health insurance program for individuals 65 or older, for Aduhelm and other anti-beta-amyloid drugs for treating Alzheimer’s disease. The CMS issued a national policy for coverage of Aduhelm and any future monoclonal antibodies directed against amyloid for treating Alzheimer’s disease that are approved under FDA’s accelerated approval pathway only to patients taking part in approved clinical trials, which includes post-approval confirmatory trials. Added to the mix was that in April 2022, Biogen withdrew its marketing authorization application (MAA) from the European Medicines Agency for Aduhelm following discussions with the EMA, which had indicated that data provided would not be sufficient to support a positive opinion for marketing authorization. Biogen’s MAA had been under review by an EMA advisory committee in response to the company’s request for a re-examination of a negative opinion issued by the committee in December 2021.

Bayer received approval for two first-in-class drugs in 2021: Kerendia (finerenone) for reducing the risk of several serious complications in adults with chronic kidney disease associated with Type 2 diabetes, and Verquvo (vericiguat), a drug for treating chronic heart failure, in which it is partnered with Merck & Co. Merck & Co. has commercial rights to Verquvo in the US, and Bayer has exclusive commercial rights in the rest of world. Merck also received approval for Welireg (belzutifan), a rare-disease drug to treat Von Hippel-Lindau disease, an inherited disorder characterized by the formation of tumors and fluid-filled sacs.

Johnson & Johnson received approval for Rybrevant (amivantamab) for treating adults with certain forms of non-small cell lung cancer whose tumors have specific mutations. Rybrevant was the first FDA-approved treatment for this subset of non-small cell lung cancer, according to the FDA.

.Novartis received approval for Leqvio (inclisiran) to treat heterozygous familial hypercholesterolemia, a genetic condition that causes severely high cholesterol, and to treat clinical atherosclerotic cardiovascular disease, which involves cholesterol buildup in the arteries. Among mid-sized companies, Regeneron Pharmaceuticals received approval for Evkeeza (evinacumab) as an add-on treatment for patients aged 12 years and older with homozygous familial hypercholesterolemia, a genetic condition that causes severely high cholesterol.

Sanofi, through its $1.9-billion acquisition in 2021 of Kadmon, a New York-based bio/pharmaceutical company, gained approval for Rezurock (belumosudil), a drug for treating chronic graft-versus-host disease after failing at least two previous systemic (throughout the body) therapies.

Takeda received approval for Livtencity (maribavir) for treating adults with posttransplant cytomegalovirus (CMV) infection. CMV is a common virus that doesn’t normally cause any symptoms, but people with weakened immune systems, including patients receiving transplants, can develop severe complications from CMV.

Last year (2021) also saw the approval of two first-in class new drugs that were antibody drug conjugates: ADC Therapeutics’ Zynlonta (loncastuximab tesirine) for treating certain types of relapsed or refractory large B-cell lymphoma and Seagen’s (formerly Seattle Genetics) Tivdak (tisotumab vedotin) for treating recurrent or metastatic cervical cancer with disease progression on or after chemotherapy.

Among smaller companies, there were several notable first-in-class drug approvals in 2021. Aurinia Pharmaceuticals received approval for Lupkynis (voclosporin) for treating adults with active lupus nephritis, a serious kidney disease and complication of lupus, a disease in which the immune system attacks the body’s own tissues. Cara Therapeutics received approval for Korsuva (difelikefalin) for treating moderate-to-severe pruritus (itching) associated with chronic kidney disease in adults undergoing hemodialysis.

Leo Pharma’s Adbry (tralokinumab) was approved for treating moderate-to-severe atopic dermatitis (eczema) in adults whose disease cannot be adequately controlled by therapies applied directly on the skin. G1 Therapeutics’ Cosela (trilaciclib) was approved for reducing the frequency of chemotherapy-induced bone marrow suppression in certain adults treated for extensive-stage small cell lung cancer. Scynexis’ Brexafemme (ibrexafungerp) was approved to treat vulvovaginal candidiasis, a type of yeast infection. This was the first approved drug in a new antifungal class in more than 20 years, according to the FDA.

For a full listing of first-in-class new drugs approved in 2021, see Table I below.

Table I: First-in-Class New Drug Approvals* by FDA, 2021

First-in-class refers to new drug approvals with a new mechanism of action different from existing therapies as of the time of approval by the US Food and Drug Administration’s Center for Drug Evaluation and Research

| Company | Proprietary Name (active ingredient); Drug type | Indication (also specified if approved as orphan drug**) |

| ADC Therapeutics*** | Zynlonta (loncastuximab tesirine-lpyl); Biologic | Certain types of relapsed or refractory large B-cell lymphoma; orphan drug |

| Albireo | Bylvay (odevixibat);Small molecule | Pruritus (itchy skin); orphan drug |

| Amgen | Lumakras (sotorasib); Small molecule | Non-small cell lung cancer with the KRAS G12C genetic mutation called KRAS G12C; orphan drug |

| Apellis Pharmaceuticals*** | Empaveli (pegcetacoplan); Small molecule | Paroxysmal nocturnal hemoglobinuria, a rare blood disorder; orphan drug |

| Argenx | Vyvgart (efgartigimod alfa-fcab); Biologic | Generalized myasthenia gravis, a rare and chronic autoimmune disease where IgG autoantibodies disrupt communication between nerves and muscles, causing muscle weakness. ; orphan drug |

| AstraZeneca | Saphnelo (anifrolumab-fnia); Biologic | Moderate-to severe systemic lupus erythematousus with standard therapy |

| AstraZeneca | Tezspire (tezepelumab-ekko); Biologic | Severe asthma as an add-on maintenance therapy |

| Aurinia Pharmaceuticals | Lupkynis (voclosporin); Small molecule | Lupus nephritis |

| Bayer | Kerendia (finerenone); Small molecule | Reduce the risk of kidney and heart complications in chronic kidney disease associated with Type 2 diabetes |

| Biogen/Eisai*** | Aduhelm (aducanumab); Biologic | Alzheimer’s disease |

| BioMarin Pharmaceutical | Voxzogo (vosoritide); Small molecule | Improve growth in children five years of age and older with achondroplasia and open epiphyses; orphan drug |

| Cara Therapeutics | Korsuva (difelikefalin); Small molecule | Moderate-to-severe pruritus associated with chronic kidney disease in certain patient groups |

| ChemoCentryx*** | Tavneos (avacopan); Small molecule | Severe active anti-neutrophil cytoplasmic autoantibody-associated vasculitis in combination with standard therapy, including glucocorticoids; orphan drug |

| G1 Therapeutics*** | Cosela (trilaciclib); Small molecule | Chemotherapy-induced myelosuppression in adult patients with small-cell lung cancer |

| Johnson & Johnson’s Janssen Biotech | Rybrevant (amivantamab-vmjw); Biologic | Non-small-cell lung cancer with epidermal growth factor receptorexon 20 insertion mutations |

| Leo Pharma | Adbry (tralokinumab-ldrm); Biologic | Moderate-to-severe atopic dermatitis |

| Merck & Co. | Welireg (belzutifan); Small molecule | Von Hippel-Lindau disease, an inherited disorder characterized by the formation of tumors and fluid-filled sacs; orphan drug |

| Merck & Co./Bayer*** | Verquvo (vericiguat); Small molecule | Chronic heart failure |

| Novartis | Leqvio (inclisiran); Small molecule | Heterozygous familial hypercholesterolemia or clinical atherosclerotic cardiovascular disease as an add-on therapy |

| On Target Laboratories | Cytalux (pafolacianine); Small molecule | Fluorescent imaging agent to identify ovarian cancer lesions; orphan drug |

| PharmaEssentia | Besremi (ropeginterferon alfa-2b-njft); Biologic | Polycythemia vera, a type of blood cancer; orphan drug |

| Regeneron Pharmaceuticals*** | Evkeeza (evinacumab-dgnb); Biologic | Homozygous familial hypercholesterolemia, a rare condition marked by elevated circulating levels of low-density lipoprotein cholesterol (LDL-C); ; orphan drug |

| Sanofi*** | Rezurock (belumosudil); Small molecule | Chronic graft-versus-host disease after failure of at least two prior lines of systemic therapy; orphan drug |

| Scynexis | Brexafemme (ibrexafungerp); Small molecule | Vulvovaginal candidiasis |

| Seagen (formerly Seattle Genetics) | Tivdak (tisotumab vedotin-tftv); Biologic | Recurrent or metastatic cervical cancer with disease progression on or after chemotherapy |

| Sentynl Therapeutics*** | Nulibry (fosdenopterin); Small molecule | To reduce the risk of death caused by Molybdenum Cofactor Deficiency Type A, a rare, genetic metabolic disorder that typically presents in the first few days of life, causing intractable seizures, brain injury and death; orphan drug |

| Takeda | Livtencity (maribavir); Small molecule | Post-transplant cytomegalovirus (CMV) infection/disease that does not respond to available antiviral treatment for CMV; ; orphan drug |

**An orphan disease is a rare disease or condition that affects fewer than 200,000 people in the US.

***Company Notes:

ADC Therapeutics’ Zynlonta (loncastuximab tesirine-lpyl) is an antibody drug conjugate.

Apellis and Sobi entered a collaboration to develop and commercialize systemic pegcetacoplan in October 2020 and have global co-development rights. Apellis has exclusive US commercialization rights for systemic pegcetacoplan and retains worldwide commercial rights for ophthalmological pegcetacoplan, including for geographic atrophy. Sobi has exclusive ex-US commercialization rights for systemic pegcetacoplan.

Aurinia Pharmaceuticals formed a collaboration and license agreement in December 2020 with Otsuka Pharmaceutical for the development and commercialization of oral voclosporin for the treatment of lupus nephritis in the European Union, Japan, as well as in the UK, Russia, Switzerland, Norway, Belarus, Iceland, Liechtenstein and Ukraine.

Biogen licensed Aduhelm (aducanumab) from Neurimmune, a Zurich, Switzerland-based bio/pharmaceutical company. Beginning in 2017, Biogen and Eisai collaborated on the development and commercialization of aducanumab globally. In March 2022, Biogen assumed sole decision making and commercialization rights worldwide for Aduhelm. Effective January 1, 2023, Eisai will receive a tiered royalty based on net sales of Aduhelm rather than sharing global profits and losses.

Amgen agreed to acquire ChemoCentryx for $3.7 billion in August 2022; the deal is expected to close in the 4Q 2022.

G1 Therapeutics announced in June 2021 a three-year co-promotion agreement with Boehringer Ingelheim for Cosela in small-cell lung cancer in the US and Puerto Rico.

Merck & Co. has commercial rights to Verquvo (vericiguat in the US), and Bayer has exclusive commercial rights in the rest of world.

Regeneron is responsible for the development and distribution of Evkeeza (evinacumab-dgnb) in the US and is collaborating with Ultragenyx to clinically develop, commercialize and distribute Evkeeza outside of the US.

Sanofi completed its $1.9-billion acquisition of Kadmon in November 2021, and with the acquisition, gained Rezurock (belumosudil).

Seagen’s (formerly Seattle Genetics) Tivdak (tisotumab vedotin) is an antibody drug conjugate.

Sentynl Therapeutics acquired the global rights to Nulibry (fosdenopterin) from BridgeBio Pharma in March 2022 and is responsible for the ongoing development and commercialization of Nulibry in the US and developing, manufacturing, and commercializing it globally.

Source: Center for Drug Evaluation and Research, US Food and Drug Administration