The Top 10 Deals for Pharma Innovation

Which pharma/biopharma companies are drawing the attention of investors and the pharmaceutical majors? What companies are pursuing novel approaches in drug development, and what products are gaining attention? DCAT Value Chain Insights looks at the top 10 deals thus far in 2020 and which companies are rising to the top.

Top 10 deals for bio/pharmaceutical innovation

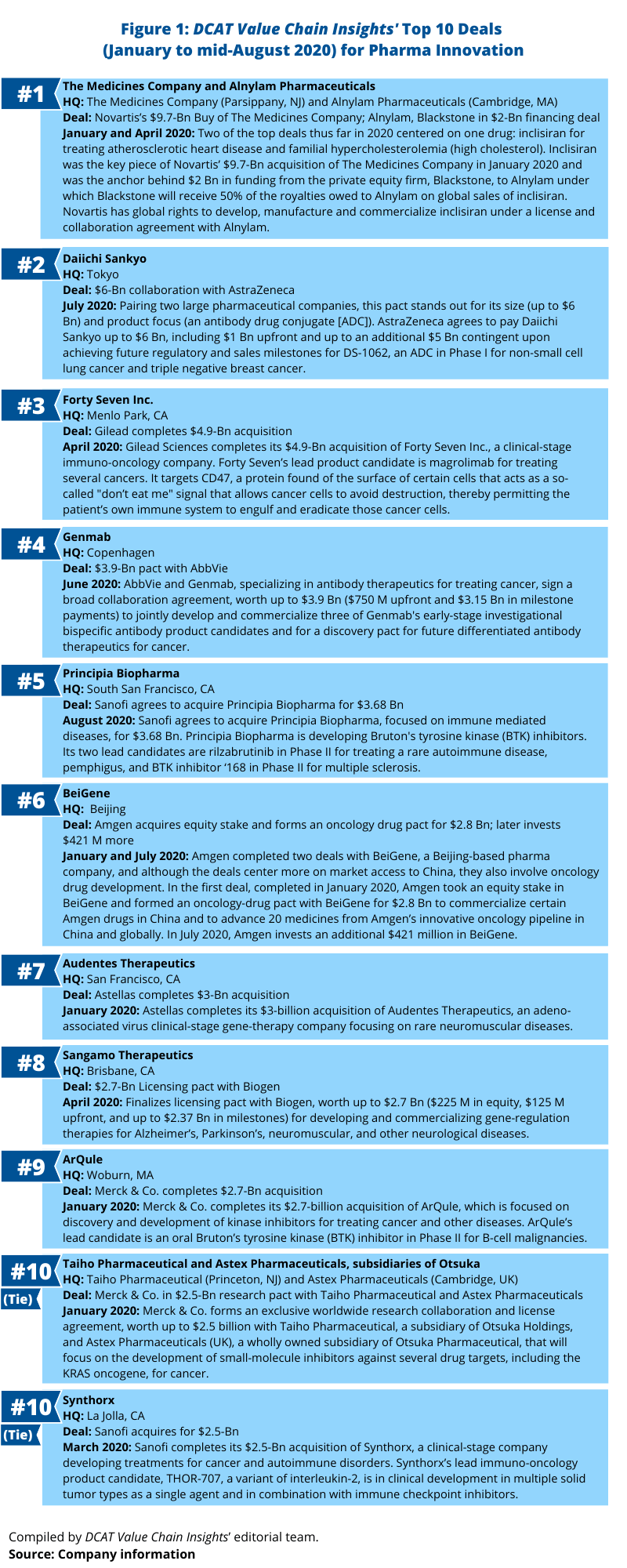

Whether through a merger/acquisition or through partnering activity, the pharmaceutical majors are continually evaluating potential deals to boost their pipelines or commercial portfolios. What deals, based on deal values, stand out this far in 2020 (as of mid-August 2020)? Omitting mega mergers, such as AbbVie’s $63-billion acquisition of Allergan, which closed in May (May 2020), Figure 1 outlines deals that have stood out: announced/closed mergers and acquisitions and partnering deals in 2020 to date.

1. Novartis’s $9.7-billion acquisition of The Medicines Company and Blackstone’s $2-billion investment in Alnylam Pharmaceuticals. Two of the top deals thus far in 2020 centered on one drug: inclisiran for treating atherosclerotic heart disease and familial hypercholesterolemia (high cholesterol). Inclisiran was the key piece of Novartis’ $9.7-billion acquisition of The Medicines Company in January 2020 and was the anchor behind $2 billion in funding from the private equity firm, Blackstone, to Alynlam Pharmaceuticals, a Cambridge, Massachusetts developing RNAi (RNA interference) therapeutics under which Blackstone will receive 50% of the royalties owed to Alnylam on global sales of inclisiran. Novartis has global rights to develop, manufacture and commercialize inclisiran under a license and collaboration agreement with Alnylam. Novartis reported in its second-quarter 2020 results released in late July (July 2020) that submissions to US and European Union regulatory authorities were complete with regulatory review on track; the action date for US Food and Drug Administration review is December 2020.

Inclisiran, with some analysts projecting blockbuster potential, is a small interfering RNA (siRNA) drug and PCSK9 (proprotein convertase subtilisin/kexin type 9) inhibitor. It would compete against PCSK9-targeting antibodies, such as Sanofi’s and Regeneron Pharmaceuticals’ Praluent (alirocumab) and Amgen’s Repatha (evolocumab) as well as other cholesterol-lowering drugs such as statins. Projected 2024 sales are $1.161 billion, according to a Clarivate Analytics’ Cortellis analysis.

2. Daiichi Sankyo’s and AstraZeneca’s $6-billion ADC collaboration. Pairing two large pharmaceutical companies, this pact stands out for its size (up to $6 Bn) and product focus (an antibody drug conjugate [ADC]). In a deal announced in July (July 2020), AstraZeneca agreed to pay Daiichi Sankyo up to $6 billion, including $1 billion upfront and up to an additional $5 billion contingent upon achieving future regulatory and sales milestones for DS-1062, an ADC in Phase I for non-small cell lung cancer and triple negative breast cancer.

DS-1062 is in development for treating multiple tumors that commonly express the cell-surface glycoprotein, TROP2. TROP2 is overexpressed in the majority of non-small cell lung cancers and breast cancers, according to information from the companies. Using Daiichi Sankyo’s proprietary DXd ADC technology, DS-1062 is designed to deliver chemotherapy selectively to cancer cells and to reduce systemic exposure. A comprehensive development program with DS-1062 is planned globally.

Under the agreement, AstraZeneca will pay Daiichi Sankyo an upfront payment of $1 billion in staged payments: $350 million is due upon completion of the deal, with $325 million after 12 months and $325 million after 24 months from the effective date of the agreement. AstraZeneca will pay additional conditional amounts of up to $1 billion for the successful achievement of regulatory approvals and up to $4 billion for sales-related milestones.

This is a second recent deal between AstraZeneca and Daiichi Sankyo for an ADC in oncology. In March 2019, the companies entered into a global collaboration to jointly develop and commercialize Enhertu (fam-trastuzumab deruxtecan-nxk), an HER2-directed ADC for treating breast cancer, worldwide, except in Japan, where Daiichi Sankyo maintains exclusive rights. The drug received approval from the US Food and Drug Administration in December 2019.

3. Gilead Sciences’ $4.9-billion acquisition of Forty Seven Inc. In April (April 2020), Gilead Sciences completed its $4.9-billion acquisition of Forty Seven Inc., a clinical-stage immuno-oncology company. Forty Seven’s lead product candidate is magrolimab for treating several cancers. It targets CD47, a protein found on the surface of certain cells that acts as a so-called “don’t eat me” signal that allows cancer cells to avoid destruction, thereby permitting the patient’s own immune system to engulf and eradicate those cancer cells.

4. Genmab’s $3.9-billion cancer antibody pact with AbbVie. In June (June 2020), AbbVie and Genmab, a Copenhagen-based biopharmaceutical company specializing in antibody therapeutics for treating cancer, signed a broad collaboration agreement, worth up to $3.9 billion ($750 million upfront and $3.15 billion in milestone payments) to jointly develop and commercialize three of Genmab’s early-stage investigational bispecific antibody product candidates and for a discovery pact for future differentiated antibody therapeutics for cancer.

5. Sanofi’s pending $3.68-billion acquisition of Principia Biopharma. Earlier this month (August 2020), Sanofi agreed to acquire Principia Biopharma, a South San Francisco, California-based biopharmaceutical company focused on immune-mediated diseases, for $3.68 billion. Principia Biopharma is developing Bruton’s tyrosine kinase (BTK) inhibitors. Its two lead candidates are rilzabrutinib in Phase II for treating a rare autoimmune disease, pemphigus, and BTK inhibitor ‘168 in Phase II for multiple sclerosis.

6. Amgen’s $3.2-billion combined deals with BeiGene. In 2020, Amgen completed two deals with BeiGene, a Beijing-based pharma company, and although the deals center more on market access to China, they also involve oncology drug development. In the first deal, completed in January 2020, Amgen took an equity stake in BeiGene and formed an oncology-drug pact with BeiGene for $2.8 billion to commercialize certain Amgen drugs in China and to advance 20 medicines from Amgen’s innovative oncology pipeline in China and globally. In July 2020, Amgen invested an additional $421 million in BeiGene.

7. Astellas’s $3-billion acquisition of Audentes Therapeutics. Earlier this year (January 2020), Astellas completed its $3-billion acquisition of Audentes Therapeutics, a San Francisco-based clinical-stage gene-therapy company focusing on rare neuromuscular diseases. With the completion of the deal, Audentes is operating as a wholly owned subsidiary of Astellas and serves as the Center of Excellence for Astellas’s newly created Genetic Regulation Primary Focus to provide leadership for adeno-associated virus (AAV) pipeline advancement through commercialization, manufacturing expansion, and research initiatives. In February (February 2020), Audentes announced that it plans to invest $109 million to build a new 135,000-square-foot gene-therapy manufacturing facility in Sanford, North Carolina. The plant is expected to be operational in 2021.

8. Sangamo Therapeutics’ $2.7-billion licensing pact with Biogen. In April (April 2020), Sangamo Therapeutics, a Brisbane, California-based biopharmaceutical company, finalized a licensing pact with Biogen, worth up to $2.7 billion ($225 million in equity, $125 million upfront, and up to $2.37 billion in milestones) for developing and commercializing gene-regulation therapies for Alzheimer’s, Parkinson’s, neuromuscular, and other neurological diseases.

Under the deal, the companies will develop and commercialize two investigational drug candidates (ST-501 and ST-502) of Sangamo’s for treating neurodegenerative disorders, including Alzheimer’s disease and Parkinson’s disease, a third undisclosed neuromuscular disease target, and up to nine additional undisclosed neurological disease targets. ST-501 is in preclinical development for treating tauopathies, including Alzheimer’s disease. Tauopathies are neurodegenerative disorders characterized by the deposition of abnormal tau protein in the brain. ST-502 is in preclinical development for treating synucleinopathies, including Parkinson’s disease. Synucleinopathies are neurodegenerative diseases characterized by the abnormal accumulation of aggregates of alpha-synuclein protein in neurons, nerve fibers, or glial cells.

The companies will use Sangamo’s proprietary zinc finger protein (ZFP) technology delivered via adeno-associated virus (AAV) vectors to modulate the expression of key genes involved in neurological diseases. Sangamo’s genome-regulation technology, zinc finger protein transcription factors (ZFP-TFs), is currently delivered with AAV vectors and functions at the DNA level to selectively repress or activate the expression of specific genes to achieve a desired therapeutic effect. Highly specific, potent, and tunable repression of tau and alpha synuclein has been demonstrated in preclinical studies using AAV vectors to deliver tau-targeted (ST-501) and alpha synuclein-targeted (ST-502) ZFP-TFs, according to information from the companies.

9. Merck & Co’s $2.7-billion acquisition of ArQule. In January (January 2020), Merck & Co. completed its $2.7-billion acquisition of ArQule, a Woburn, Massachusetts-based biopharmaceutical company focused on discovery and development of kinase inhibitors for treating cancer and other diseases. ArQule’s lead candidate is an oral Bruton’s tyrosine kinase (BTK) inhibitor in Phase II for B-cell malignancies.

10 (Tie): Merck & Co.’s $2.5-billion research pacts with Taiho Pharmaceutical and Astex Pharmaceuticals, subsidiaries of Otsuka. In January (2020), Merck & Co. formed an exclusive worldwide research collaboration and license agreement, worth up to $2.5 billion with Taiho Pharmaceutical, a subsidiary of Otsuka Holdings, and Astex Pharmaceuticals (UK), a wholly owned subsidiary of Otsuka Pharmaceutical, that will focus on the development of small-molecule inhibitors against several drug targets, including the KRAS oncogene, for cancer. KRAS is among the most frequently mutated oncogenes in cancer, according to information from Merck. It is estimated to occur in more than 90% of pancreatic cancers and approximately 20% of non-small cell lung cancers and is associated with poorer outcomes.

Under the agreement, Merck, Taiho and Astex will combine preclinical candidates and their data with knowledge and expertise from their respective research programs. In exchange for providing Merck an exclusive global license to their small-molecule inhibitor candidates, Taiho and Astex will receive an aggregate upfront payment of $50 million and will be eligible to receive approximately $2.5 billion contingent upon the achievement of preclinical, clinical, regulatory and sales milestones for multiple products arising from the agreement, as well as tiered royalties on sales. Merck will fund research and development and will be responsible for commercialization of products globally. Taiho has retained co-commercialization rights in Japan and an option to promote in specific areas of South East Asia.

10 (Tie): Sanofi’s $2.5-billion acquisition of Synthorx. In January (January 2020), Sanofi completed its $2.5-billion acquisition of Synthorx, a clinical-stage company developing treatments for cancer and autoimmune disorders. Synthorx’s lead immuno-oncology product candidate, THOR-707, a variant of interleukin-2, is in clinical development in multiple solid tumor types as a single agent and in combination with immune checkpoint inhibitors.