Top 10 Key Trends in New Drug Approvals: Small Molecules & Biologics

DCAT Value Chain Insights provides its Top 10 Watchlist in new drug approvals, including the mix between small molecules & biologics, small & large companies, and blockbuster contenders.

Key trends in new drug approvals

What do the new drug approvals in 2022 show about product mix (small molecules versus biologics), product innovators (large bio/pharmaceutical companies versus small bio/pharma companies), and levels and types of product innovation (total number of new drug approvals, first-in-class new drug approvals, orphan new drug approvals, and breakthrough therapies new drug approvals). The key trends are outlined below.

New drug approvals down in 2022

The number of new drug approvals is an important measure of new product innovation in the bio/pharma industry, and the results from 2022 show a downturn from recent trends. The US Food and Drug Administration’s (FDA) Center for Drug Evaluation and Research (CDER) approved 37 new drugs in 2022, significantly down from the 50 new drugs approved in 2021 and the 53 new drugs approved in 2020. The new drug approvals include both new molecular entities and new therapeutic biologics approved by the FDA’s CDER and does not include vaccines, allergenic products, blood and blood products, plasma derivatives, cellular and gene therapy products, or other products approved by the FDA’s Center for Biologics Evaluation and Research. The 37 new drug approvals, in fact, represent a recent low for new drug approvals over the last decade. Only 2018 and 2013 had lower levels of new drug approvals, with 22 new drug approvals in 2018 and 27 in 2013.

Small molecules’ dominance in new drug approvals declined in 2022

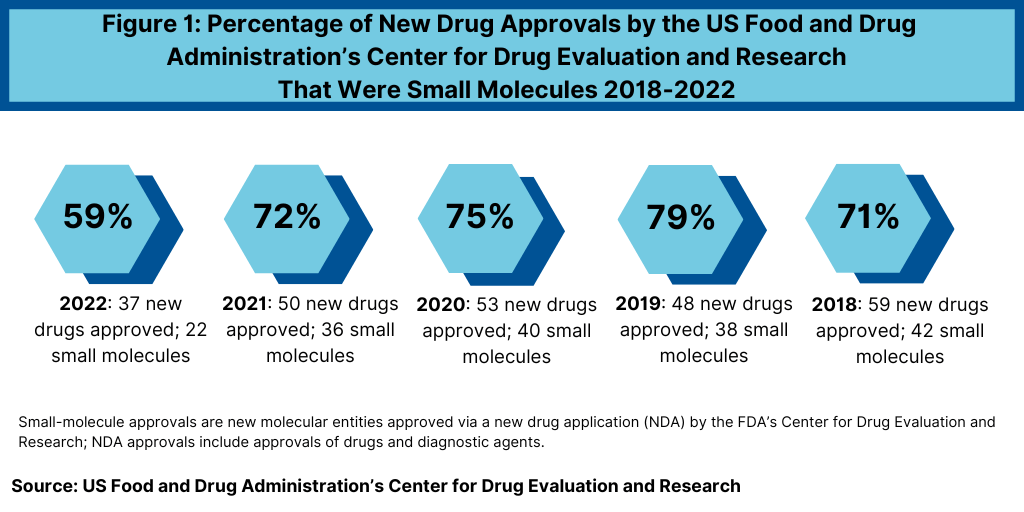

Another important development in 2022 was the reduced share of small molecules in new drug approvals. In 2022, 59% of the new drug approvals by FDA’s CDER were small molecules, significantly down from recent years—when small molecules accounted for approximately three-fourths of new drugs approvals (see Figure 1). In 2022, 22 of the 37 new drug approvals were small molecules, representing 59% of new drug approvals. In comparison, between 2018 and 2021, small molecules averaged 74% of new drug approvals (see Figure 1). In 2021, small molecules represented 72% of new drug approvals, 75% in 2020, 79% in 2019, and 71% in 2018.

On an absolute level, biologics’ new drug approvals increased only slightly in 2022

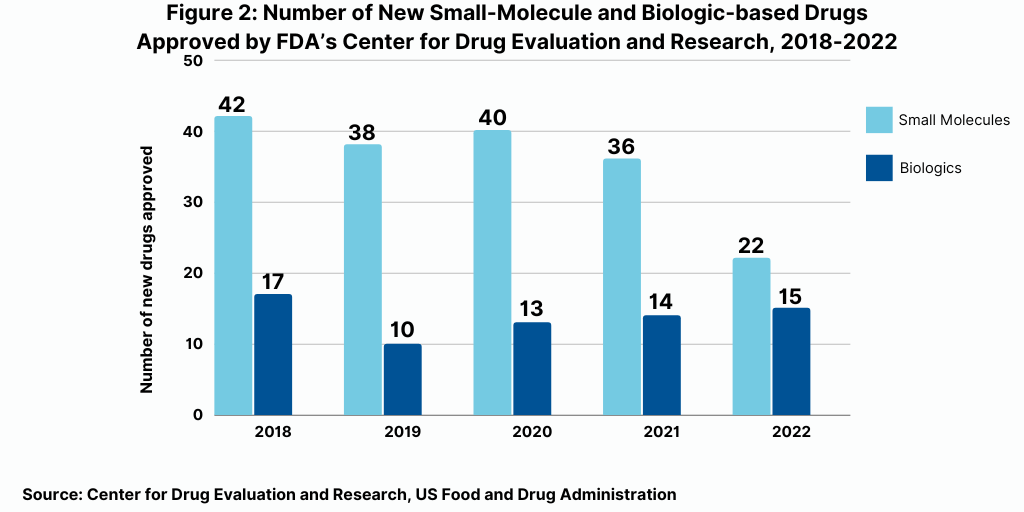

The decrease in small molecules’ share of new drug approvals is largely due to the overall decline in new drug approvals in 2022 and a corresponding decline in small-molecule drug approvals and a rise in new biologic drug approvals. In 2022, the FDA’s CDER approved 22 new small-molecule drugs and 15 new biologics, with the 15 new biologic drug approvals representing a recent high (see Figure 2). The 15 new biologic drug approvals in 2022 was one more than the 14 new biologic drug approvals in 2021. However, the 15 new biologic drug approvals in 2022 were only recently eclipsed by the 17 new biologic drug approvals in 2018 and surpassed recent new biologic drug approvals of 14 in 2021, 13 in 2020, and 10 in 2019 (see Figure 2).

Big Pharma accounted for only about one-third of new drug approvals in 2022

Continuing a trend, the large bio/pharmaceutical companies’ share of new drug approvals was surpassed by mid-to small-sized bio/pharmaceutical companies. Although the number of new drug approvals does not reflect the market potential of a given drug, it is an important measure of product innovation, and continuing a recent trend, smaller bio/pharmaceutical companies are outpacing product innovation of the larger companies.

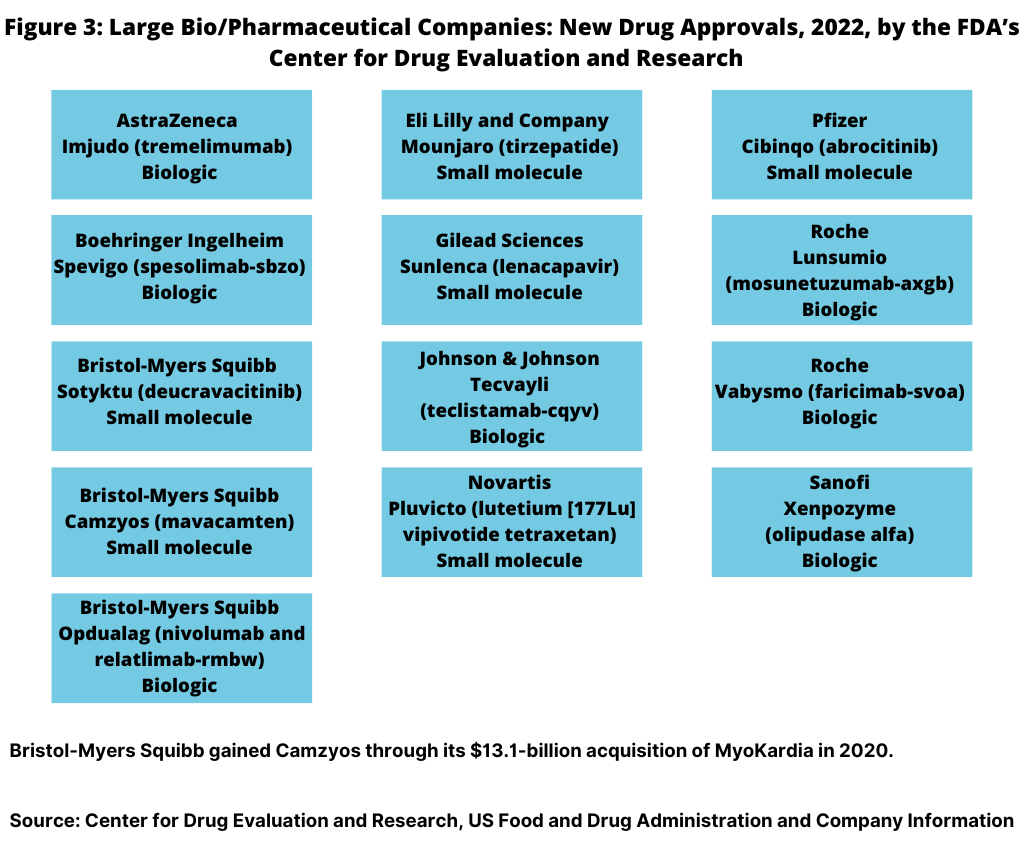

In 2022, 13, or 35%, of the new drug approvals were from the large bio/pharmaceutical companies (see Figure 3). Bristol-Myers Squibb (BMS) led all companies with three new drug approvals, followed by Roche with two new drug approvals. Eight large bio/pharmaceutical companies each had one new drug approval: AstraZeneca, Boehringer Ingelheim, Eli Lilly and Company, Gilead Sciences, Johnson & Johnson, Novartis, Pfizer, and Sanofi (see Figure 3).

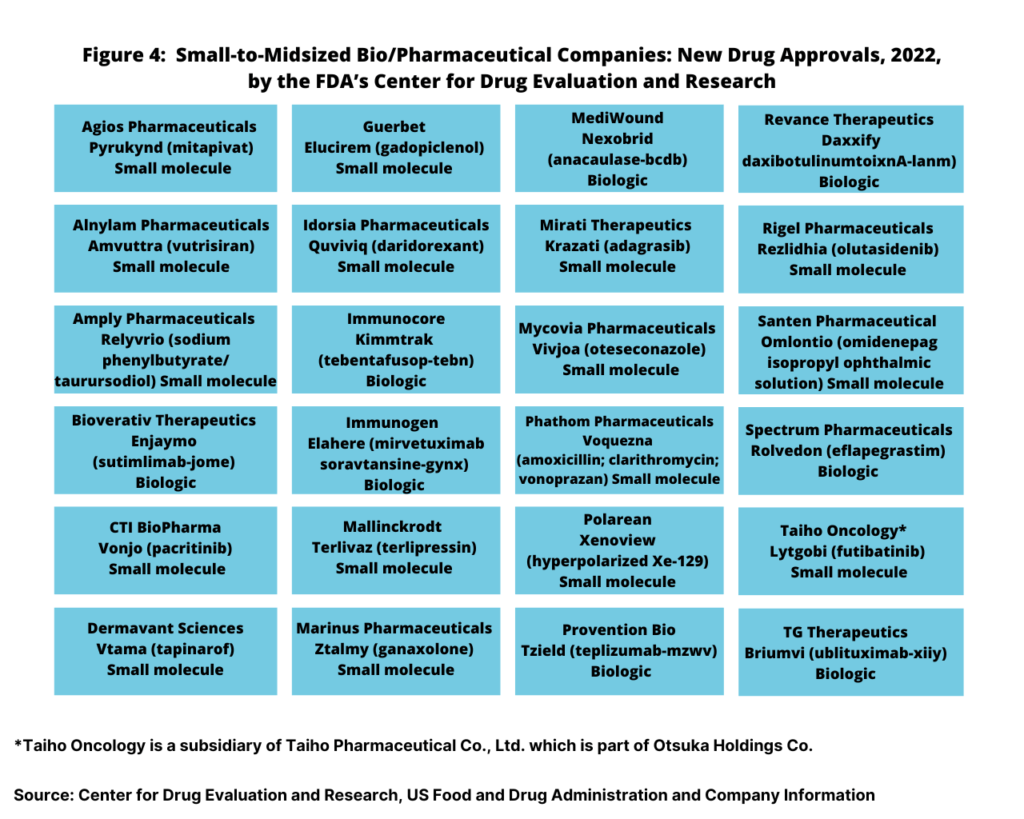

Smaller companies accounted for two-thirds of new drug approvals in 2022

While the large bio/pharma companies accounted for only 13, or 35% of the new drug approvals in 2022, small to mid-sized bio/pharma companies accounted for 24, or 65%, of new drug approvals in 2022 (see Figure 4). Small to mid-sized companies accounted for 16 small-molecule new drug approvals and for eight new biologic drug approvals.

Big Pharma had more biologics new drug approvals in 2022 than small-molecule new drug approvals

In looking at the product mix of new drug approvals in 2022 by the large pharmaceutical companies, the number of biologics new drug approvals slightly edged out small-molecule new drug approvals. In 2022, the large pharmaceutical companies had 13 new drug approvals by FDA’s CDER: seven biologics and six small-molecule drugs (see Figure 3 above).

Bristol-Myers Squibb received approval for two small-molecule drugs: Sotyktu (deucravacitinib) to treat moderate-to-severe plaque psoriasis and for Camzyos (mavacamten) to treat certain classes of obstructive hypertrophic cardiomyopathy, a disease in which the heart muscle becomes thickened. BMS gained Camzyos through its $13.1-billion acquisition of MyoKardia in 2020. BMS also received approval for a new biologic, Opdualag (nivolumab and relatlimab-rmbw), for treating unresectable or metastatic melanoma.

Roche received approval for two biologics in 2022: Lunsumio (mosunetuzumab-axgb) for treating relapsed or refractory follicular lymphoma, a type of non-Hodgkin lymphoma, and for Vabysmo (faricimab-svoa) for treating neovascular (wet) aged-related macular degeneration and diabetic macular edema.

AstraZeneca, Boehringer Ingelheim, Johnson & Johnson (J&J), and Sanofi each had one new biologic drug approval, and Lilly, Gilead Sciences, Novartis, and Pfizer each had one small-molecule drug approval.

On the biologics side, AstraZeneca received approval for Imjudo (tremelimumab) for treating unresectable hepatocellular carcinoma (liver cancer). Boehringer Ingelheim got the nod for Spevigo (spesolimab-sbzo) for treating generalized pustular psoriasis flares. J&J received approval for Tecvayli (teclistamab-cqyv) for treating relasped or refractory multiple myeloma among adults who have received at least four specific lines of therapy. Sanofi received approval for Xenpozyme (olipudase alfa) for treating acid sphingomyelinase deficiency, a rare genetic disease that causes premature death.

On the small-molecule side, Lilly received approval for Mounjaro (tirzepatide) to improve blood sugar control in adults with Type 2 diabetes. Gilead Sciences got the nod for Sunlenca (lenacapavir) to treat HIV-1 in patients whose HIV infections cannot be successfully treated with other available treatments. Novartis received approval for Pluvicto (lutetium (177Lu) vipivotide tetraxetan), a radiopharmaceutical to treat prostate cancer. Pfizer received approval for Cibinqo (abrocitinib) to treat refractory, moderate-to-severe atopic dermatitis (eczema)

Small bio/pharma companies had more small-molecule new drug approvals than biologics new drug approvals.

Unlike the large bio/pharmaceutical companies, small-molecules dominated the new drug approvals of small-to-mid-sized companies in 2022, accounting for twice as many biologics new drug approvals. In 2022, small to mid-sized companies had 16 small-molecule new drug approvals and eight new biologics drug approvals (see Figure 4 above).

Small-molecule drug approvals were from Agios Pharmaceuticals, Alnylam Pharmaceuticals, Amply Pharmaceuticals, CTI BioPharma, Dermavant Sciences, Guerbet, Idorsia, Mallinckrodt, Marinus Pharmaceuticals, Mirati Therapeutics, Mycovia Pharmaceuticals, Phathom Pharmaceuticals, Polarean, Rigel Pharmaceuticals, Santen Pharmaceutical, and Taiho Oncology. On the biologics side, new drug approvals were from Bioverativ Therapeutics, Immunogen, Immunocore, MediWound, Provention Bio, Revance Therapeutics, Spectrum Pharmaceuticals, and TG Therapeutics (see Figure 4 above).

First-in-class new drug approvals down in 2022 over 2021 but on par with prior-year levels

Another measure of product innovation is the number of “first-in-class drugs”—defined by the FDA as drugs with mechanisms of action different from those of existing therapies. In 2022, more than half (54%) or 20 of the 37 novel drugs approved in 2022 were characterized as first-in-class. The 20 first-in-class drugs approved in 2022 represented a decline from 2021, when there were 27 first-in-class new drug approvals, but it was comparable on a percentage basis to 2021 when 54% of new drugs approved in 2021 were also first in class. On an absolute level, the 20 first-in-class new drug approvals in 2022 were on par with levels prior to 2021. In 2020, there were 21 first-in-class new drug approvals, 20 in 2019, and 19 in 2018. On a percentage basis, the 54% share of new drugs approvals in 2022 and 2021 represented a sizeable gain over recent years, when first-in-class drugs accounted for 40% of new drug approvals in 2020, 42% in 2019, 32% in 2018, and 33% in 2018.

In 2022, some noteworthy first-in-class drug approvals, as reported by the FDA in its analysis of new drug approvals, included Bristol-Myers Squibb’s Camzyos (mavacamten) used to improve functional capacity and symptoms in patients with a type of obstructive hypertrophic cardiomyopathy, in which the heart muscle thickens, making it harder to pump blood, and Eli Lilly and Company’s Mounjaro (tirzepatide) to improve glycemic control in adults with Type 2 diabetes as an addition to diet and exercise. It activates two hormone receptors, which leads to improved glycemic control.

Also noted by the FDA was a radiopharmaceutical by Novartis: Pluvicto (lutetium 177 Lu vipivotide tetraxetan), to treat adults with prostate-specific, membrane-positive, metastatic, castration-resistant prostate cancer who have received at least two prior therapies, including a chemotherapy. Gilead Sciences received approval for Sunlenca (lenacapavir) tablets and injection for adults with HIV who have previously received many HIV therapies and whose disease cannot be treated with other available drugs due to resistance, intolerance, or safety concerns.

Among smaller companies, Provention Bio received approval for Tzield (teplizumab-mzwv) to delay the onset of Stage 3 Type 1 diabetes in adults and pediatric patients aged 8 years and older with Stage 2 Type 1 diabetes. Tzield is the first drug approved for this indication. Phathom Pharmaceuticals received approval for Voquezna Triple Pak (vonoprazan, amoxicillin, and clarithromycin) and Voquezna Dual Pak (vonoprazan and amoxicillin), co-packaged products containing combinations of tablets and capsules to treat adults with Helicobacter pylori infection, a bacterial infection in the stomach.

Breakthrough therapies accounted for more than one-third of new drug approvals in 2022

Another measure of product innovation is the number of new drugs approved thatt were designated as breakthrough therapies. Breakthrough therapy designation is a process designed to expedite the development and review of drugs that are intended to treat a serious condition and preliminary clinical evidence indicates that the drug may demonstrate substantial improvement over available therapies based on a clinically significant endpoint(s).

In 2022, 35%, or 13 of the 37 novel drugs approved by the FDA’s CDER, were designated as breakthrough therapies, a substantial increase on a percentage basis compared to 2021 but similar on an absolute level. In 2021, the FDA’s CDER designated 14 of the 50 novel drugs, or 28%, as breakthrough therapies. The number of breakthrough therapy approvals in both 2022 and 2021 were far below the level in 2020, when FDA’s CDER designated 22 of the 53 novel drugs, or 42% of new drug approvals, as breakthrough therapies.

Orphan drugs accounted for more than half of new drug approvals in 2022

In 2022, 54%, or 20 of 37 novel drug approvals, by FDA’s CDER were approved to treat rare or “orphan” diseases (diseases that affect fewer than 200,000 people in the US), a level on par with 2021 levels, and continuing a recent trend in which orphan drugs accounted for more than half of new drug approvals.

In 2021, 26 of the FDA’s CDER’s 50 new drug approvals, or 52%, were orphan drugs. This continues a recent trend in which approximately 40% to more than half of new drug approvals were for orphan drugs. In 2020, 58%, or 31, of the 53 new drug approvals in 2020 were orphan drugs. The 58% of new drug approvals in 2020 matched a recent high; in 2018, 58%, or 34, of the 59 new drug approvals were orphan drugs. In 2019, orphan drugs respectively accounted for 44% of new drug approvals and 39% in 2017.