Pfizer Sets Record; Becomes First $100-Bn Company in Bio/Pharma Industry

Pfizer became the first $100-billion company in the industry in 2022 on the strength of its COVID-19 vaccine and COVID-19 drug. Will its record-breaking results hold in 2023, and how will non-COVID products perform?

Chairman and CEO

Pfizer

A record-breaking year

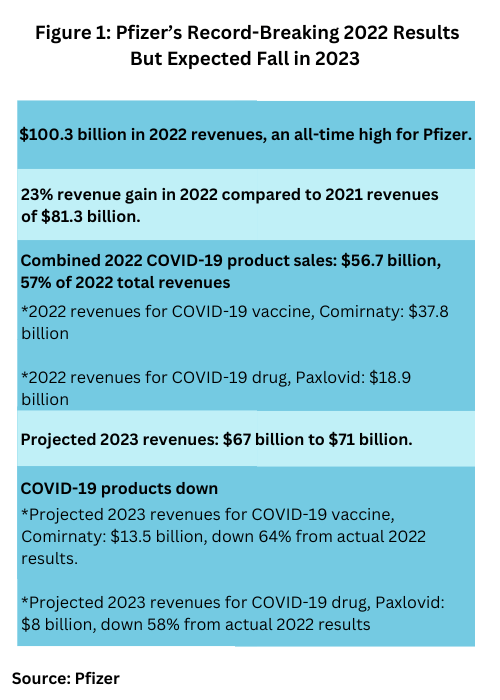

Pfizer had a record-breaking year in 2022, setting a high-mark in revenues for both itself and the industry as a whole. The company posted revenues of $100.3 billion in 2022, a 23% revenue gain compared to 2021, and far surpassing its 2021 revenues of $81.3 billion, which had set a record for revenues for Pfizer and the industry in 2021 (see Figure 1 below).

“2022 was a record-breaking year for Pfizer, not only in terms of revenue and earnings per share, which were the highest in our long history, but more importantly, in terms of the percentage of patients who have a positive perception of Pfizer and the work we do,” said Albert Bourla, Pfizer’s Chairman and CEO, in a January 31, 2023 statement in commenting on the company’s results. “As proud as we are about what we have accomplished, our focus is always on what is next. As we turn to 2023, we expect to once again set records, with potentially the largest number of new product and indication launches that we’ve ever had in such a short period of time. We believe that the combination of these expected near-term launches, additional pipeline products that could potentially come to market in the medium-term, and anticipated contributions from business development, has the potential to set the company up for continued robust growth through the rest of this decade and beyond.”

The principal drivers of growth for the company in 2022 were its COVID-19 products: its COVID-19 vaccine, Comirnaty, and its COVID-19 drug, Paxlovid (nirmatrelvir/ritonavir). Combined, these products accounted for $56.7 billion in revenues, or 57% of Pfizer’s 2022 total revenues. Revenues for Pfizer’s COVID-19 vaccine, Comirnaty was $37.8 billion in 2022, and 2022 revenues for its COVID-19 drug, Paxlovid, was $18.9 billion (see Figure 1 below). The nearly $57 billion in revenues for these two products alone were comparable to or exceeded the individual annual revenues of the top five bio/pharmaceuticals companies in 2021.

With the easing of the COVID-19 pandemic, revenues for these products are expected to fall as are overall revenues for Pfizer in 2023. Pfizer projects 2023 revenues of between $67 billion to $71 billion. The midpoint of the company’s financial guidance for revenues reflects a 31% operational decrease compared to 2022 revenues. Company revenues are anticipated to be lower in 2023 than in 2022 due entirely to expected revenue declines for Pfizer’s COVID-19 products. Projected 2023 revenues for its COVID-19 vaccine, Comirnaty are $13.5 billion, down 64% from actual 2022 results. Projected 2023 revenues for its COVID-19 drug, Paxlovid, are $8 billion, down 58% from actual 2022 results (see Figure 1).

The downward revenue projections are reflective of changes in public health policy toward the COVID-19 pandemic. This week (January 30, 2023), the White House announced its intention to extend the COVID-19 national emergency and public health emergency until May 11, 2023, at which point, both the national and public health emergency declarations will end. Currently, the emergency declarations are set to expire respectively on March 1, 2023, for the national health emergency and April 11, 2023, for the public health emergency.

The Biden-Harris Administration’s wind-down would align with the its previous commitments to give at least 60 days’ notice prior to termination of the public health emergency declaration for COVID-19. It comes following proposals in the US House of Representatives to end the declarations earlier (H.R. 382 a bill, and H.J. 7, a joint resolution. The COVID-19 national emergency and public health emergency were declared by the Trump Administration in 2020.

The White House said that continuation of the emergency declarations until May 11, 2023 does not impose any restriction at on individual’s conduct with regard to COVID-19. “They do not impose mask mandates or vaccine mandates,” said a January 30, 2023 Statement of Administration Policy, as issued by the Office of Management and Budget. “They do not restrict school or business operations. They do not require the use of any medicines or tests in response to cases of COVID-19. “

In addition, the World Health Organization (WHO)’s Director-General, Dr. Tedros Adhanom Ghebreyesus, reported earlier this week (January 30, 2023) that the COVID-19 pandemic “continues to constitute a public health emergency of international concern,” but that it is “probably at a transition point.” The Director-General concurred with the opinion provided by the International Health Regulations’ (IHR) Emergency Committee regarding the COVID-19 pandemic.

IHR’s Emergency Committee recommended that WHO, in consultation with partners and stakeholders, should develop a proposal for alternative mechanisms to maintain the global and national focus on COVID-19 after the public health emergency of international concern is terminated, including if needed, a possible Review Committee to advise on the issuance of standing recommendations under the IHR.

Blockbuster strengths

In all for 2022, Pfizer had 10 blockbuster products (defined as products with sales of $1 billion). Revenues of $37.8 billion for its COVID-19 vaccine and $18.9 billion for its COVID-19 drug, Paxlovid (nirmatrelvir/ritonavir), were the largest revenue-generating products for Pfizer in 2022 and far outpaced revenues for its other blockbuster products. Its two next highest revenue-generators in 2022 were Eliquis (apixaban), an anticoagulant developed with Bristol-Myers Squibb with 2022 global revenues of $6.48 billion. and the anti-cancer drug, Ibrance (palbociclib) with 2022 global revenues of $5.12 billion.

Looking to 2023, Pfizer says it expects strong topline growth of 7% to 9%, excluding its COVID-19 products and anticipated foreign exchange impacts.