US Gov’t Takes Step Forward in Plan to Re-shore Drug Manufacturing

The FDA has issued a list of 223 essential medicines as part of an executive order that directs the FDA and other agencies to develop strategies for acquiring the products on the list, accelerate domestic manufacturing in the US, and identify and address supply-chain vulnerabilities. What’s on the list, and what’s next?

FDA moves forward executive order

The issuance of the list of essential medicines follows up on an executive order issued by President Donald Trump in August (August 2020), which put forth the policy goals and authorization for certain federal departments and agencies, including the US Department of Health and Human Services (HHS) and the US Food and Drug Administration (FDA), to increase US-based production and federal procurement of essential medicines, medical countermeasures, and critical inputs. The executive order, which was issued to mitigate potential vulnerabilities in the US drug supply chain, particularly in light of the COVID-19 pandemic or other public health emergencies, directed the FDA, in consultation with federal partners, to identify a list of essential medicines, medical countermeasures, and critical inputs that are medically necessary to have available at all times in an amount adequate to serve patient needs and in the appropriate dosage forms.

For purposes of the executive order, “essential medicines” are defined as those necessary for the US and identified by the FDA Commissioner as such. “Critical inputs” refer to active pharmaceutical ingredients (APIs), API starting materials, and other ingredients of drugs and components of medical devices that the FDA Commissioner determines to be critical in assessing the safety and effectiveness of essential medicines and medical countermeasures. Medical countermeasures are FDA-regulated products (biologics, drugs, devices) that may be used in the event of a potential public health emergency stemming from a terrorist attack with a biological, chemical, or radiological/nuclear material or a naturally occurring emerging disease.

The FDA’s list of essential drugs and medical countermeasures includes 223 drugs and biological products. Additionally, 96 device medical countermeasures are included on the list. These devices include diagnostic testing kits and supplies for rapid test development and processing, personal protective equipment, active vital sign monitoring devices, devices for vaccine delivery and devices for management of acute illnesses such as ventilators, among others. The full list of essential medicines may be found here.

Generally, the essential medicines identified are those that are most needed for patients in US acute care medical facilities. The medical countermeasures are FDA-regulated products (biologics, drugs and devices) that meet the definition of a “medical countermeasure” provided in the executive order and that are anticipated will be needed to respond to future pandemics, epidemics, and chemical, biological and radiological/nuclear threats. The critical inputs identified include APIs of essential medicines and medical countermeasures as well as ingredients or components that possess unique attributes essential in assessing the safety and effectiveness of such products.

On therapeutic-sector basis, the list of 223 essential medicines includes 24 antibiotic/antimicrobial products, the largest therapeutic area on the list (aside of those specifically for certain chemical/biologic threats), followed by 16 antihypertensives/cardiovascular drugs, 12 fractionated plasma products, 10 anticoagulants/antiplatelets, and seven additives. The breakdown in other therapeutic categories include: six drugs each in the following categories: antivirals, reversal agents (antidotes), sedatives/hypnotics,and volume expanders. The list also includes five analgesics, and four drugs each in the following therapeutic categories: gastrointestinal, pulmonary drugs, endocrine (non-diabetes), and vasopressors.

The FDA has also opened a public docket seeking comments on the following: (1) the criteria used by the FDA for putting together the list; (2) whether products should be added or removed; and (3) how frequently, and by what type of process, the list should be evaluated to determine the need for any additions or removals and periodic review of the list.

Manufacturing impact

The executive order issued in August (August 2020) also directs the FDA to coordinate with its federal partners on a number of additional issues, including strategies for acquiring the products on the essential medicines list, accelerating domestic manufacturing in the US, and identifying and addressing supply-chain vulnerabilities.

“The FDA is working on this coordination,” said the agency in an October 30, 2020 statement. “The FDA believes that the adoption of innovative technologies, such as advanced manufacturing techniques could enable US-based pharmaceutical manufacturing to bolster its competitiveness with foreign countries and help ensure a stable supply of drugs critical to the health of US patients. As companies look to increase domestic manufacturing of the products on this list, we encourage them to consider adopting advanced manufacturing technologies. The FDA will continue to collaborate with the Department of Health and Human Services and other federal partners on this issue as directed by the executive order.”

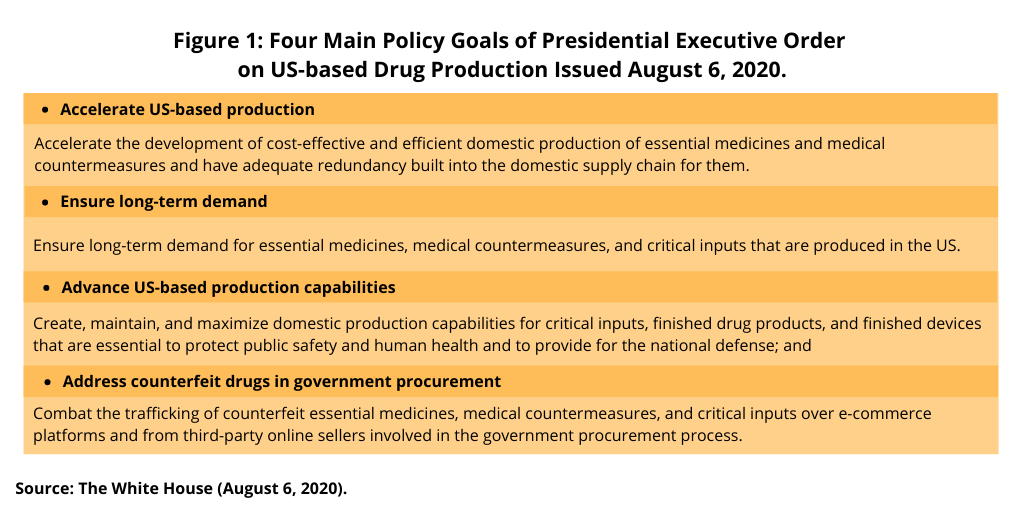

These actions are part of the executive order issued in August (August 2020) and as outlined in Figure 1.These goals are: (1) accelerate the development of cost-effective and efficient domestic production of essential medicines and medical countermeasures and have adequate redundancy built into the domestic supply chain for them; (2) ensure long-term demand for essential medicines, medical countermeasures, and critical inputs that are produced in the US; (3) create, maintain, and maximize domestic production capabilities for critical inputs, finished drug products, and finished devices that are essential to protect public safety and human health and to provide for the national defense; and (4) combat the trafficking of counterfeit essential medicines, medical countermeasures, and critical inputs over e-commerce platforms and from third-party online sellers involved in the government procurement process.

The executive order further provides authorization for federal departments and agencies to increase US-based production of essential medicines, medical countermeasures, and critical inputs and to limit federal procurement for such products to be made in the US. To mitigate supply-chain vulnerabilities, the HHS Secretary is authorized, either through revising regulations or guidance, to require certain information from drug manufacturers. This information would include: (1) the sources of finished drug products, finished devices, and critical inputs; (2) the use of any scarce critical inputs; and (3) the date of the last FDA inspection of the manufacturer’s regulated facilities and the results of that inspection. In addition, the executive order also seeks to remove certain regulatory barriers to US-based drug production for essential medicines, medical countermeasures, and critical inputs by authorizing the HHS Secretary to review FDA regulations to determine if they may be a barrier to domestic production of these products and to advise the President whether such regulations should be repealed or amended.

The executive order also provides further authorization for the HHS Secretary, through the FDA Commissioner, with regard to inspections and facility approvals and for facilitating the use of advanced manufacturing, such as continuous manufacturing and 3-D printing. While facilitating US-based drug production, the executive order does provide for certain exemptions. It allows for a broad measure to exempt actions that would not be in the public interest. It more specifically exempts products not produced in the US in sufficient and reasonably available commercial quantities and of a satisfactory quality if their application would cause the cost of procurement to increase by more than 25%.

To what extent, and how these policy goals will be implemented has yet to be determined and will depend on the outcome of the US Presidential election as any executive order previously issued could be changed or amended. Although the specifics of a given plan may differ, both US Presidential nominees—President Trump through the issuance of his executive order in August (August 2020) and former Vice President Joe Biden through a proposed plan issued in July (July 2020)— have both put forth policy proposals for increasing US-based manufacturing, including for pharmaceuticals.