What’s in Store for Generics/Biosimilars?

The fortunes of the generics/biosimilars market will rest on one of the largest patent cliffs upcoming over the next five years. What do the numbers show, and what key trends are in the mix?

Ramping up the competition in generics/biosimilars market

A focus on healthcare cost containment from both payers and national governments bodes well for generics, but that sector continues to face competitive pressures. On a value basis, the global generics market in 2021 was $305 billion, according to IQVIA estimates, up from a 2016 level of $265 billion. The developed markets of the US, Japan, the EU 4 (France, Germany, Italy, and Spain), and the UK, accounted for a combined 46% of the $305-billion global generics market in 2021.

The generics sector, always highly cost competitive, continues to see pricing pressures, particularly in the US. Indian manufacturers have gained significant share of the US market since 2016, driven by a lower cost base that has allowed for aggressive price discounting. Prices have declined by more than 30% since 2016.

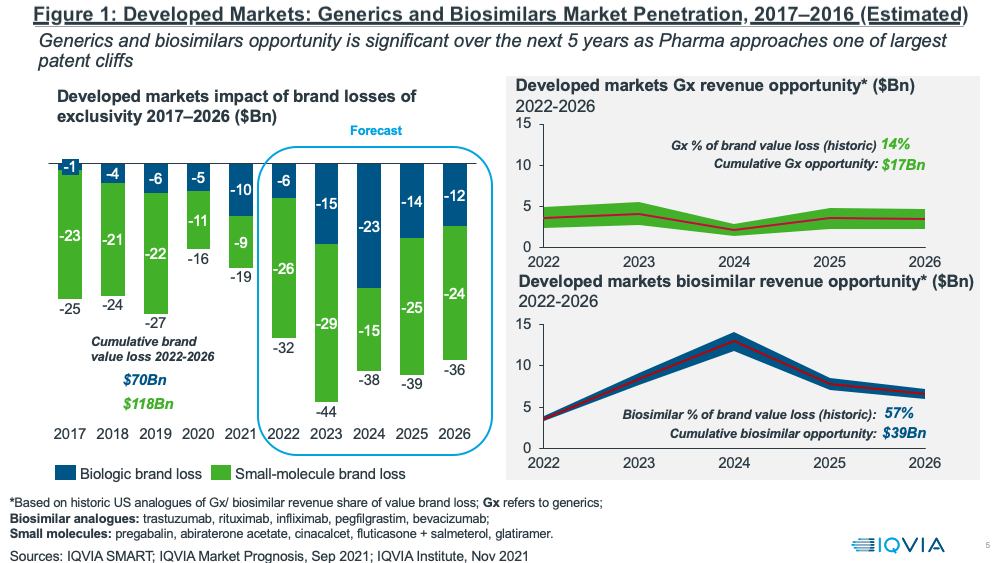

Despite these pressures, the near-term fortunes of the generics and biosimilars sector will largely rest on one of the largest patent cliffs upcoming over the next five years (2022–2026) with a cumulative brand loss by innovators of $188 billion in developed markets (see Figure 1). The resulting revenue opportunities for the generics and biosimilar sectors are significant: $17 billion for generics and $39 billion for biosimilars for the period 2022–2026, according to IQVIA estimates.

US market generics/biosimilars market

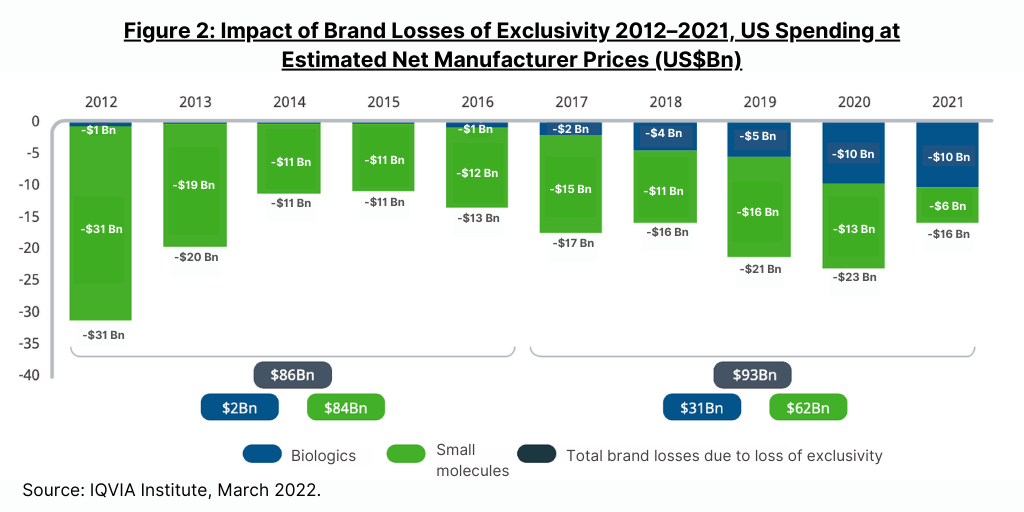

Most of the impact from loss of exclusivity of protected brands in 2021 in the US market was from biosimilars introduced in the prior three years, including three molecules in the oncology market—bevacizumab, rituximab, and trastuzumab, according to a new report by the IQVIA Institute for Human Data Science, The Use of Medicines in the U.S. 2022: Usage and Spending Trends and Outlook to 2026. Biologic brand losses were $10 billion in both 2020 and 2021, an increase from the $5 billion in 2019 and totaling $31 billion in the past five years (2017–2021) (see Figure 2). In the same five-year period, small-molecule brand losses were $62 billion, down from $84 billion in the prior five-year period (2016–2020).