AI Front and Center for Supply Chain Management

How will artificial intelligence (AI) shape sourcing and supply chain management? A newly released study by DCAT and a panel discussion at DCAT Week examined AI’s potential, the types of projects and activities for which AI may be applied, and its challenges to its use and adoption.

AI in supply chain management in the bio/pharma industry

Artificial intelligence (AI)-based solutions hold great promise for a bio/pharma industry facing a need to reduce costs, increase productivity, and achieve greater supply chain security. However, the latest study from DCAT Research & Benchmarking from the Drug, Chemical & Associated Technologies Association (DCAT), The Emerging Role of Artificial Intelligence (AI) in Supply Chain Management, suggests that, despite the potential transformative benefits, much of the industry has been slow to apply AI solutions across all their operations, including supply chain management.

DCAT Research & Benchmarking provides in-depth studies examining the crucial issues impacting the bio/pharmaceutical manufacturing value chain and the bio/pharma customer—supplier relationship. The study was developed by the DCAT Research & Benchmarking Committee, composed of volunteers from DCAT Member Companies with diverse industry experience. When the Committee decided to benchmark the uptake of AI for supply chain management, it recognized that the technology would have vast implications for bio/pharma companies and suppliers as they need to be ready to operate in a world where AI drives, and increasingly will make, key supply chain decisions. Specifically, the DCAT Research & Benchmarking study had four main objectives:

- Gauge the status of AI in supply chain management in the bio/pharma industry;

- Understand the challenges when implementing the technology in the bio/pharma environment;

- Understand what the barriers to adoption are, where it is not being tried or adopted; and

- Help bio/pharma companies and their suppliers understand how the adoption of AI will impact how they work together, and how it might change their relationship.

To address these objectives, the Committee developed a survey tool consisting of approximately 20 content questions, plus several demographic questions. The survey was fielded to senior to mid-level executives at DCAT Member Companies from mid-October 2023 to mid-January 2024.

The survey results were unveiled at a special program during DCAT Week, the flagship event of DCAT, held March 18–21, 2024. A panel discussion provided further insight into the potential for and challenges of adopting AI in supply chain management, with perspectives provided by two providers of AI-enabled services, and two bio/pharma industry executives with hands-on AI experience. The panel consisted of:

- Martin Rand, CEO, Pactum, a leader in AI-driven supplier-management applications, including AI-driven negotiations, counting Walmart and Medline among its clients;

- Koray Köse, Chief Industry Officer, Everstream Analytics, a provider of services to monitor and anticipate potential supply-chain disruptions and used by several bio/pharma companies;

- David McCarthy, Senior Director, Enablement & Strategic Insights, Pfizer; and

- Jeet Sarkar, Global Head of Information Technology, SK pharmteco.

The panel was moderated by Vishal Bhandari, Partner, Healthcare & Life Sciences Practice and Co-Leader, Global Life Sciences’ Sector, of the international management consulting firm, Kearney.

AI adoption trends

The survey received 41 responses from DCAT Member Companies. Of those 41, 11 (27%) are using or piloting artificial intelligence (AI) applications for supply chain management, representing 42% of bio/pharma company respondents and 21% of supplier company respondents.

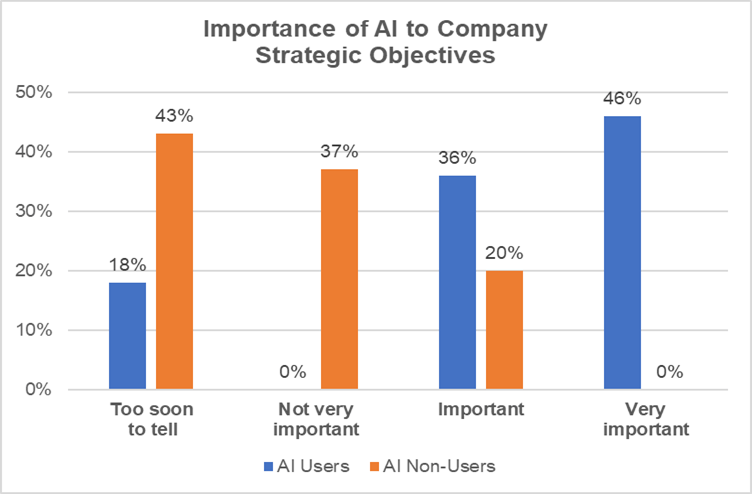

The survey found that companies that are already using AI in supply chain management have a broad corporate commitment to the technology. Over 80% of companies that are already using AI for supply chain consider AI to be “important” or “very important” to achieving corporate strategy objectives and are using it across an array of functions, including R&D, manufacturing, and general management. By contrast, 80% of companies not using AI in supply chain management do not view the technology as strategically important (see Figure 1).

Figure 1: Strategic Importance of AI

The Emerging Role of Artificial Intelligence (AI) in Supply Chain Management (May 2024).

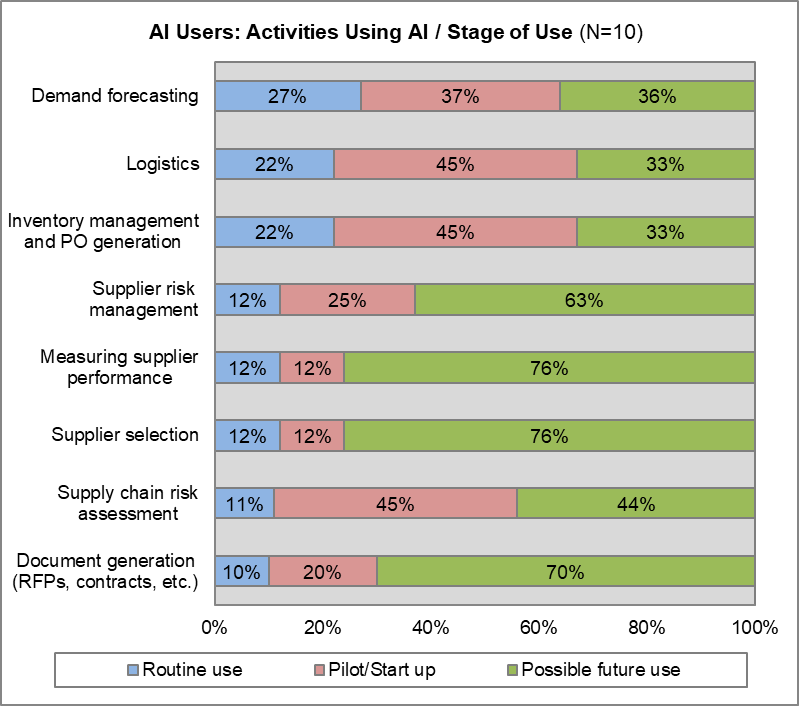

Among respondents that are actively using AI in supply chain management, the most common use cases are for demand forecasting, logistics, and inventory management (see Figure 2). More companies are also pursuing initiatives in supply chain risk management.

Figure 2: AI Users: How Users are Using AI in Supply Chain Management

Source: Drug, Chemical & Associated Technologies Association (DCAT),

The Emerging Role of Artificial Intelligence (AI) in Supply Chain Management (May 2024).

Most AI adopters use the technology to identify problems and opportunities, and recommend responses; none are allowing systems to act independently. Machine learning applications are most common; just 20% have experience with generative AI (i.e., ChatGPT-type applications). All users are leveraging vendors for applications and support, but about 30% have been building in-house capabilities as well.

Data challenges

The survey revealed that data availability and confidentiality are by far the biggest challenges for implementation of supply chain AI applications because AI systems need vast amounts of data to be effective. Data from legacy internal systems usually must be converted and cleaned to be used in AI-based systems. This is a common problem for AI adopters across industries. Most AI adopters are feeding their applications with a combination of internal and external data. This can be a real challenge for bio/pharma companies, for which confidentiality and data integrity are a major concern.

Overcoming resistance

Nearly 80% of AI adopters reported receiving some resistance from within the supply chain organization within their company, and nearly 50% got some pushback from corporate management. The panelists at the DCAT Week 2024 program emphasized the need to address the resistance directly and emphasized the need to educate staff about the technology as part of implementation efforts.

The panelists suggested that resistance can be lessened by focusing initial implementation efforts on applications where investment is limited but the payoff can be considerable. For example, Pactum’s Rand, whose company offers an AI-based system that autonomously negotiates with suppliers, gave an example of using an AI application to negotiate payment terms: the necessary data are relatively easy to access, and the payoff can be considerable and very measurable.

Getting on board

The responses of the non-AI-users to the DCAT Research & Benchmarking survey indicated that adoption is being held back largely by a lack of understanding of the benefits and implications of supply chain AI applications, and by the absence of expertise to mount an AI program. However, AI-based service providers, such as Pactum and Everstream Analytics, which participated in the DCAT Week panel discussion, explained that bio/pharma companies and suppliers can access the technology without making a large internal investment. Further, the panel’s suggestions to focus on narrow use cases with potentially large returns can generate buy-in and even help fund further applications.

Impact on suppliers

A very large, but fundamental question for bio/pharma companies and their suppliers is how may AI change the way companies do business? Over half of survey respondents with AI experience indicated that their suppliers will be expected to provide more data about their operations, requiring suppliers to make greater investments in their information technology. Adopters also expect suppliers will need to be more nimble as AI applications are likely to lead to more frequent changes, such as redirected shipments and altered specifications. Person-to-person relationships will be augmented, if not supplanted, by interactions with AI-driven systems. A reasonable conclusion is that late adopters will need to prepare now to respond as their customers implement AI-based systems with which they will have to interact.

Full report available to DCAT Member Companies

The full report, The Emerging Role of Artificial Intelligence (AI) in Supply Chain Management, is available on a complimentary and exclusive basis to DCAT Member Companies. Further information, including how to download the report, may be found here.