Catalent Adds Cell/Gene-Therapy Services with $315-M Buy of MaSTherCell

|

|

Mike Grippo |

Catalent is increasing its cell-and gene-product development and manufacturing capabilities through its recently completed $315-million acquisition of MaSTherCell, a CDMO specializing in development and manufacturing services for cell and gene therapies. Mike Grippo, Senior Vice President, Strategy and Corporate Development, Catalent Pharma Solutions, outlined the capabilities and facilities gained in the acquisition in the DCAT Member Company Announcement Forum—Virtual Edition, a special online forum of the major news announcements from DCAT member companies originally to be made March 23, 2020 at DCAT Week ’20 in New York.

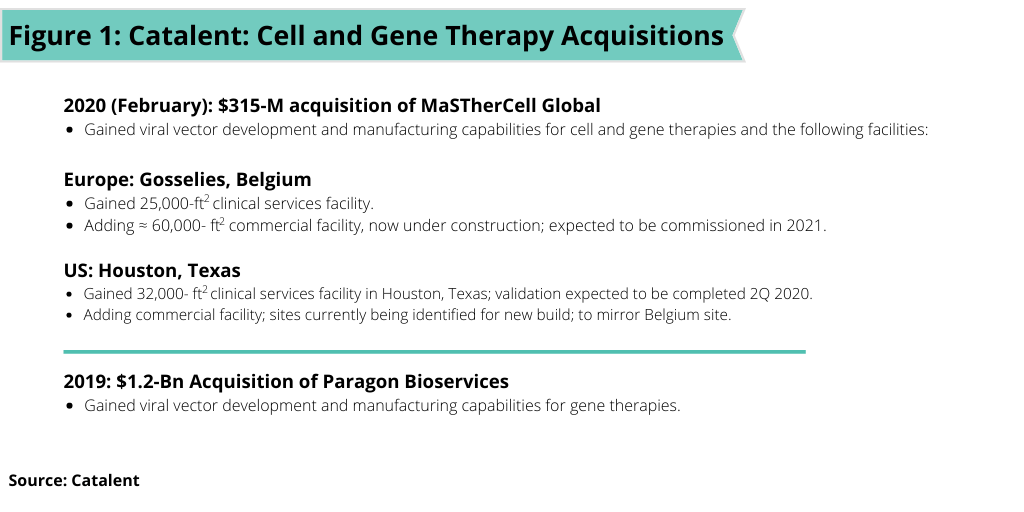

Catalent’s acquisition of MaSTherCell, which was completed earlier this year (February 2020), builds on the company’s $1.2-billion acquisition of Paragon Bioservices, a CDMO of gene therapies in 2019 (see Figure 1). The acquisition of MaSTherCell adds development and manufacturing capabilities of both autologous and allogeneic cell therapies. MaSTherCell’s cell-therapy capabilities span a variety of cell types, including mesenchymal stem cells (MSCs), tumor-infiltrating leukocytes (TILs), natural killer cells (NKs), induced pluripotent stem cells (iPSCs), and chimeric antigen receptor T cells (CAR-T).

On a facility basis, Catalent acquired planned and existing clinical and commercial manufacturing facilities in Gosselies, Belgium and Houston, Texas. In Gosselies, Catalent gained a 26,000-square-foot clinical manufacturing site with four process development labs, 10 cleanrooms for cGMP manufacturing, Grade B storage, nitrogen storage, fill–finish services, and in-house quality-control labs. Under construction adjacent to the existing site in Gosselies is a large-scale 60,000-square-foot manufacturing facility that will have dedicated commercial suites and that is expected to be fully commissioned in 2021.

In Houston, Catalent is gaining a 32,000-square-foot clinical facility with eight cleanrooms, three development labs, and in-house quality-control labs, which is expected to be fully validated in the second quarter of 2020 and that will employ a team of over 50 employees. In addition, a commercial manufacturing site, which will mirror the facility in Belgium, is in the preliminary planning stages with sites in Texas being identified.

Grippo explained that Catalent’s recent acquisitions, both Paragon Bioservices and MaSTherCell, is in response to industry projections for growth and the resulting demand for viral-vector production and immunotherapies. He offered industry estimates that the gene-therapy market is expected to increase at a compound annual growth rate of 20% to 2026 as measured by the number of gene therapies in the industry’s pipeline, which was estimated at approximately 300 projects in 2019 and which is projected to increase to approximately 1,100 by 2026. He added that current viral vector production capacity is unlikely to meet clinical and commercial needs over the next two to three years, which provides opportunities for manufacturing partners in this area.

In addition to the MaSTherCell acquisition, Catalent added to its European capabilities set through the purchase of Bristol-Myers Squibb’s oral solid, biologics, and sterile manufacturing and packaging facility in Anagni, Italy, in a deal that was completed in January 2020. Catalent plans to continue to manufacture the existing Bristol-Myers Squibb product portfolio currently produced at the site, as well as make further investments into the site. This facility adds to Catalent’s existing sterile fill–finish capabilities in Belgium and its drug-substance, analytical and fill–finish capabilities in North America.