FDA Issues Guidance for Competitive Generic Therapies

As part of its Drug Competition Action Plan, the FDA has finalized guidance to outline a new regulatory pathway for “competitive generic therapies” (CGTs). What are CGTs, and how is the FDA seeking to incentivize their market entry?

FDA’s Drug Competition Action Plan and competitive generic therapies

“Competitive generic therapies” (CGTs) refer to a designation, granted by the US Food and Drug Administration (FDA), for drugs for which there is “inadequate generic competition.” The term “inadequate generic competition” refers to a situation where there is not more than one approved drug included in the active section of the Orange Book, the commonly known name of the FDA’s publication, Approved Drug Products with Therapeutic Equivalence Evaluations, which identifies drugs approved by the FDA and the related patent and exclusivity information. The designation as a “competitive generic therapy” or CGT provides a new approval pathway by the FDA to expedite the development and review of a generic drug for products that lack competition. Applicants for drugs that receive a CGT designation may receive review enhancements and expedited review of their abbreviated new drug applications (ANDA). Applicants for drugs that receive a CGT designation are also eligible for a 180-day period of marketing exclusivity if they are the first-approved applicant for that CGT and meet certain other conditions.

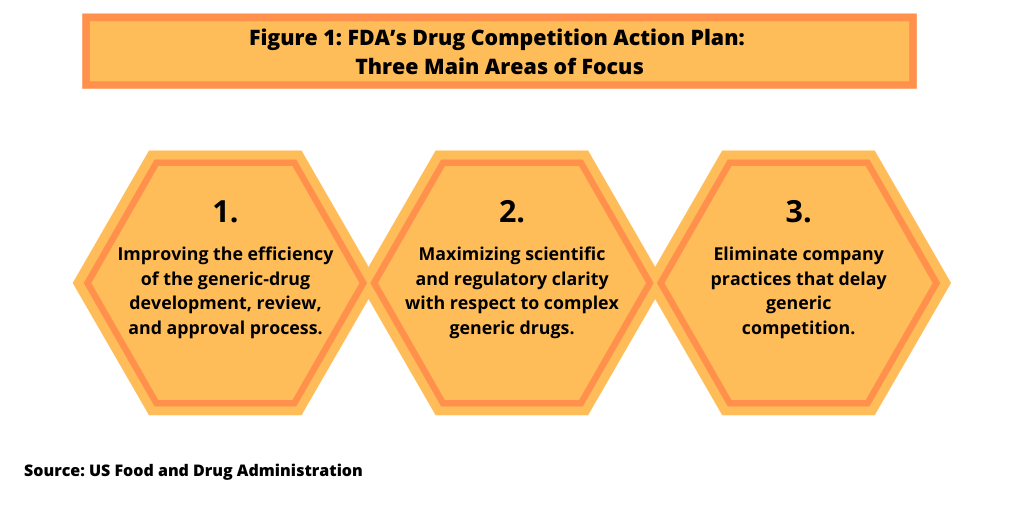

The creation of the CGT regulatory pathway, which was authorized under the FDA Reauthorization Act of 2017, is part of a larger strategy, the Drug Competition Action Plan, by the FDA. The FDA’s Drug Competition Action Plan was announced in 2017 as a way to address the cost of prescription drugs by increasing drug competition by improving the process for generic-drug development, review, and approval, one of three main focus areas of the plan (see Figure 1). The plan also includes ways to provide regulatory and scientific clarity, including the issuance of guidances, for “complex generic drugs.” Complex generic drugs are drugs that, by the nature of their formulation, delivery systems, or the complexity of their active ingredients, are harder to “genericize” under traditional approaches and as a result, often face less competition. The plan also seeks to eliminate practices by companies that may delay generic competition, such as the use of citizen’s petitions or restricting access to samples of brand-name drugs needed by generic-drug companies for bioequivalence testing or other testing.

The creation of the CGT regulatory pathway, which was authorized under the FDA Reauthorization Act of 2017, is part of a larger strategy, the Drug Competition Action Plan, by the FDA. The FDA’s Drug Competition Action Plan was announced in 2017 as a way to address the cost of prescription drugs by increasing drug competition by improving the process for generic-drug development, review, and approval, one of three main focus areas of the plan (see Figure 1). The plan also includes ways to provide regulatory and scientific clarity, including the issuance of guidances, for “complex generic drugs.” Complex generic drugs are drugs that, by the nature of their formulation, delivery systems, or the complexity of their active ingredients, are harder to “genericize” under traditional approaches and as a result, often face less competition. The plan also seeks to eliminate practices by companies that may delay generic competition, such as the use of citizen’s petitions or restricting access to samples of brand-name drugs needed by generic-drug companies for bioequivalence testing or other testing.

New FDA guidance on competitive generic therapies

Earlier this month (March 2020), the FDA issued final guidance that provides a description of the process that applicants should follow to request designation of a drug as a CGT and the criteria for designating a drug as a CGT. It also includes information on the actions the FDA may take to expedite the development and review of ANDAs for drugs designated as CGTs. Finally, it provides information on how the FDA implements the statutory provision for a 180-day exclusivity period for certain first-approved applicants that submit ANDAs for CGTs.

Competitive generic therapy designations and expedited development and review

The FDA’s final guidance specifies that applicants may submit requests to designate a drug as a CGT concurrently with, or at any time prior to, the original ANDA submission. In its final guidance, the FDA says it intends to make a determination on a request for designation within 60 calendar days of receipt of the applicant’s request. The FDA, in assessing whether inadequate generic competition for a particular drug exists, will rely on the information contained in the Orange Book at the time it makes its determination.

The FDA’s final guidance specifies that applicants may submit requests to designate a drug as a CGT concurrently with, or at any time prior to, the original ANDA submission. In its final guidance, the FDA says it intends to make a determination on a request for designation within 60 calendar days of receipt of the applicant’s request. The FDA, in assessing whether inadequate generic competition for a particular drug exists, will rely on the information contained in the Orange Book at the time it makes its determination.

Expedited development and review of competitive generic therapies. Applicants for drugs that the FDA has designated as CGTs may request expedited development and review of their ANDA. Although the FDA says it will strive to act on applications for drugs designated as a CGT prior to the Generic Drug User Fee Amendments (GDUFA) goal date, a CGT designation does not result in a shorter GDUFA goal date.

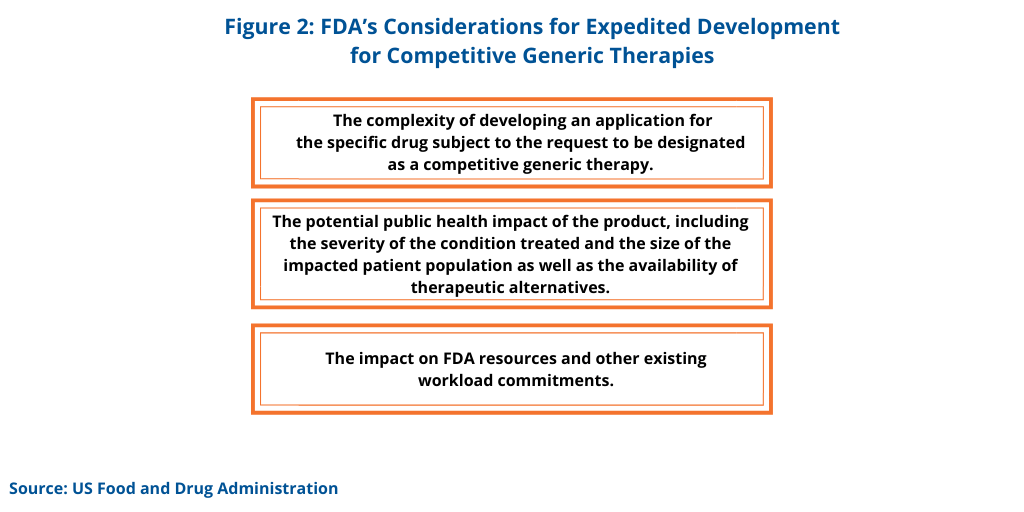

To facilitate expedited development, applicants may request to meet with the FDA to discuss specific scientific and/or regulatory questions related to an ongoing development program, or to discuss the content and format of an ANDA submission, for a drug designated as a CGT. In determining whether to grant certain requests to facilitate the development of a drug designated as a CGT, the FDA considers several factors (see Figure 2).

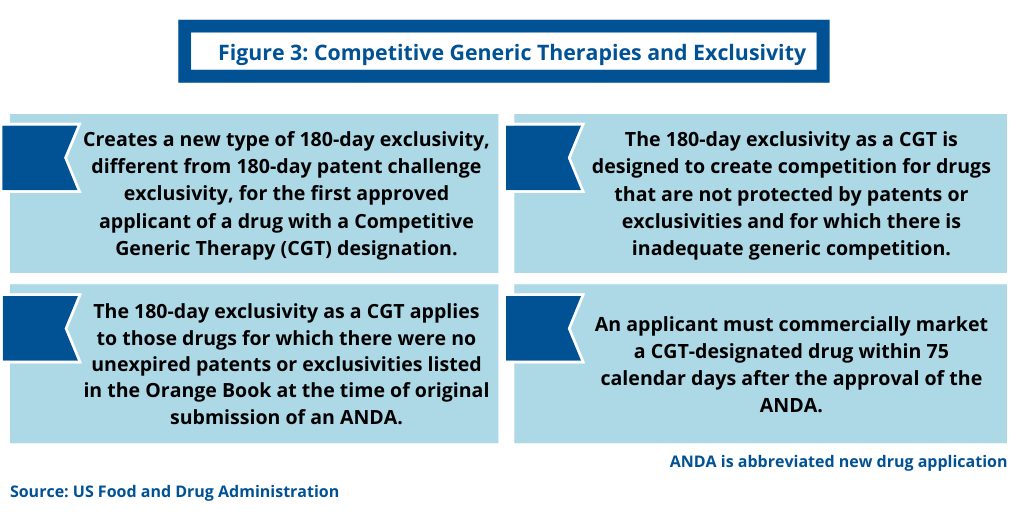

Competitive generic therapies and exclusivity

To provide incentives to and reward companies to develop, gain approval of, and market CGTs, the FDA provides a new type of 180-day marketing exclusivity period for ANDA applicants of certain drugs that the FDA has designated as CGTs (see Figure 3). Such exclusivity applies to the first-approved applicant that: (1) obtains approval of an ANDA for a drug that has been designated as a CGT and for which there were no unexpired patents or exclusivities listed in the Orange Book for the relevant reference-listed drug at the time the applicant submitted the original ANDA to the FDA and (2) commercially markets such drug within 75 calendar days after the approval of the ANDA.

To provide incentives to and reward companies to develop, gain approval of, and market CGTs, the FDA provides a new type of 180-day marketing exclusivity period for ANDA applicants of certain drugs that the FDA has designated as CGTs (see Figure 3). Such exclusivity applies to the first-approved applicant that: (1) obtains approval of an ANDA for a drug that has been designated as a CGT and for which there were no unexpired patents or exclusivities listed in the Orange Book for the relevant reference-listed drug at the time the applicant submitted the original ANDA to the FDA and (2) commercially markets such drug within 75 calendar days after the approval of the ANDA.

To qualify as the “first-approved applicant,” for a CGT, the applicant must obtain approval of its ANDA for a CGT on the first day that the FDA approves an ANDA for that particular CGT. There may be multiple ANDA applicants approved on the same day for the same CGT, which means that there may be multiple “first-approved applicants,” according to information from the FDA. The ”first-approved applicant” in terms of CGT exclusivity does not necessarily mean the first applicant to have their ANDA approved for the drug product. In some cases, there may be an already approved ANDA that references the same reference-listed drug but that did not receive a CGT designation. In this situation, when the FDA approves the first ANDA for that drug product that has been designated as a CGT, the applicant for that ANDA may still qualify as a “first-approved applicant.”

The definition of a “first-approved applicant” for a CGT also includes two additional criteria that an ANDA applicant must meet to qualify as a “first-approved applicant.” First, an ANDA would not qualify for CGT exclusivity if it is also eligible for a 180-day patent challenge exclusivity, which is the exclusivity that the first generic-drug applicant who submits a substantially complete ANDA containing a Paragraph IV certification to a patent listed in the Orange Book may qualify for. Under the 180-day patent challenge exclusivity, the “first applicant” to challenge a drug patent is entitled to 180 days of exclusivity against subsequent generic applicants. Second, the potential first-approved applicant’s ANDA for a CGT cannot be for a drug for which other ANDA applicants were eligible for 180-day patent challenge exclusivity.

Number of competitive generic therapies

As of February 28, 2020, the FDA had approved 31 competitive generic therapies. A listing of those drugs may be found here.