ADC Trends: Pipelines, Products & CDMO Growth

Driven by oncology indications, strong growth is on tap for the global market for antibody drug conjugates (ADCs) and the ADC contract manufacturing market. DCAT Value Chain Insights takes an inside look.

The ADC market: a snapshot view

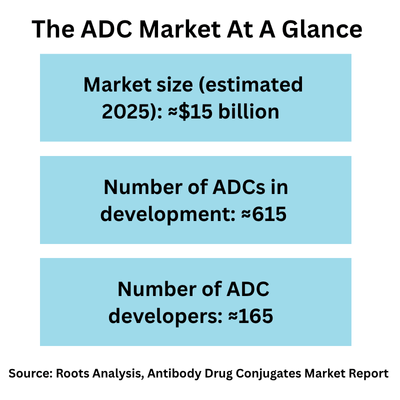

“The ADC space has been evolving rapidly over the last decade,” says Gaurav Chaudhary, CEO, Roots Analysis, a business intelligence firm serving the bio/pharmaceutical industry, which recently released reports on the ADC market and the ADC contract manufacturing market. “We estimate the current ADC market in 2025 at approximately $15 billion and project the market to double over the next decade,” says Chaudhary, who recently participated in the DCAT Value Chain Insights podcast, Production to Prescription; listen to the full interview.

ADCs are engineered therapeutics consisting of a monoclonal antibody chemically linked to a small-molecule payload (a cytotoxic payload in oncological indications). Oncology is the leading therapeutic sector on a value basis in the global bio/pharmaceutical industry overall, and is also the key driver in ADC development. In addition, recent advances in ADC development, including site-specific conjugation, novel linker technology, and innovative payloads are improving ADC efficacy and safety and fueling development of more targeted cancer therapies.

Approximately 90% of ADCs in development are for cancer, specifically for solid tumors. The high unmet need in oncology and demand for cancer medicines are fueling growth in the number of companies developing ADCs. More than 55% of the companies developing ADCs have established themselves in the ADC space since 2010, and approximately 46% of the total partnerships in the ADC sector have been formed since 2023, according to information from Roots Analysis. Overall, partnership activity in the ADC sector has grown at a compound annual growth rate (CAGR) of 7.5% since 2020, with a recent high in partnerships signed in 2022 (52 partnerships) followed by 48 partnerships inked in 2023.

Of the 165 companies developing ADCs, more than three-fourths (76%) are small (43%) or mid-sized (33%) companies with large/very large companies accounting for the remaining 24%, according to Roots Analysis. On a geographic basis, the majority of these ADC developers are headquartered in North America and Europe, with North America accounting for 39% and Europe 33% of the ADC developers and Asia-Pacific and the rest of the world the remaining 39%.

Although oncology is by far the driver in ADC development, some ADCs are also being evaluated for the treatment of non-oncological indications such as autoimmune disorders, infectious diseases, neurological conditions, and metabolic diseases. “Although non-oncological indications now represent a very small part of the ADCs in development, perhaps 10 to 15 programs, I think we will be looking at a lot more in the coming decade—but these non-oncological ADC candidates for the most part are now still in a very early stage of development, including the discovery phase” says Roots Analysis’ Chaudhary.

ADC contract manufacturing market

In line with the strong growth in the ADC market on a product level, growth is strong in the ADC contract manufacturing market. For CDMOs/CMOs, the manufacture of an ADC requires specialized manufacturing conditions under high-containment to produce the cytotoxic small-molecule compound and conjugation capabilities to link the small-molecule compound to the monoclonal antibody. Similar high-containment conditions are required for the manufacture of the drug product.

The global contract ADC market is estimated at approximately $1.7 billion in 2025 and is expected to nearly double over the next decade to $3.2 billion by 2035, representing a CAGR of 6.4%, according to information from Roots Analysis. Increasing investments by pharmaceutical companies to expand their ADC pipeline, coupled with various licensing agreements, are driving innovation and growth in the ADC contract manufacturing market. Part of that growth is being fueled from demand by smaller ADC developers. “About 40% of the 600-plus ADC programs currently under development are from small companies that lack the capital to set up a manufacturing facility and that is why they need to rely on contract manufacturers,” says Roots Analysis’ Chaudhary, and that is one factor driving growth in the contract market. “On a CDMO level, the contract ADC market is significant given that is represents approximately 35 CDMOs,” he says.

On a sector basis, the ADC contract manufacturing market is segmented based on the production process: antibody (40% of the market), the high-potency active pharmaceutical ingredient (HPAPI)/payload (20%), the conjugation/linker (30%), and the drug product (fill-finish) 10%.

About 70% of the players are offering services for manufacturing antibodies and/or HPAPI / cytotoxic payloads, but a key trend in the contract ADC market is for CDMOs/CMOs to provide more than one service offering in the production process to become a more fully integrated or end-to-end provider of ADCs. “There is a trend for CDMOs/CMOs to be ‘one-stop shops’ to offer capabilities in the various steps of the manufacturing process for ADCs,” says Chaudhary, for example, adding fill–-finish capabilities to antibody or HPAPI production or conjugation services.

Other complex conjugates

Aside from ADCs, other complex conjugates represent a niche but potentially growing area both an end-market/product level and a manufacturing basis. These next-generation conjugates include peptide conjugates, radioconjugates, ligand-conjugated antisense medicines and small-molecule drug conjugates as some examples. “Overall, our research shows about 300 of these next-generation conjugates in development, mostly in discovery/early development, from about 40 to 45 companies,” says Roots Analysis’ Chaudhary. “Once again, these are in the very early stages of development, but in the coming 10 years, provided some of these are approved, there is market potential.”