President Biden Issues Executive Order on US-Based Manufacturing

President Joe Biden issued a “Made in America” executive order this week (January 25, 2021) for federal procurement of goods, materials, and products. It includes establishing a Made in America Director in the Office of Management and Budget and specifying measures for domestic supplier sourcing and domestic content requirements for products. What does it mean for pharma?

Strategy for increasing US-based manufacturing

President Joe Biden’s “Made in America” executive order strengthens certain requirements that goods, materials, and products purchased by the US federal government be manufactured in the US. The US government spends approximately $600 billion annually in purchasing, and the measures are intended to increase US-based manufacturing as part of an overall economic recovery and investment plan and a way to further reduce supply-chain vulnerabilities for critical goods.

“Under the Build Back Better Recovery Plan, we’ll invest hundreds of billions of dollars in buying American products and materials to modernize our infrastructure, and our competitive strength will increase in a competitive world,” said President Biden in commenting on the executive order. “…It also means replenishing our stockpiles to enhance our national security. As this pandemic has made clear, we can never again be in a position where we have to rely on a foreign country that doesn’t share our interest in order to protect our people during a national emergency. We need to make our own protective equipment, essential products and supplies. And we’ll work with our allies to make sure they have resilient supply chains as well.”

The executive order applies only to federal procurement of goods, materials, and products, so for the pharmaceutical industry, the direct impact thus far would apply only to those products purchased by federal agencies of the US government. The yet-to-be seen implications would be to further define the Administration’s policy for its goal of strengthening supply chains for essential products and supplies overall and specifically what that may mean for the pharma industry.

Under the previous Administration, there were several executive orders to increase US-based drug manufacturing for essential drugs and it is still to be seen how the current Administration will define its policy as it relates to increasing US-based drug manufacturing specifically and its scope. In 2020, President Donald Trump issued an executive order that set forth the policy goals and authorization by certain federal departments and agencies, including the US Department of Health and Human Services and the US Food and Drug Administration, to increase US-based production and federal procurement of essential medicines, medical countermeasures, and critical inputs and to limit federal procurement for such products to be made in the US. The HHS/FDA was charged to identify a list of essential medicines, medical countermeasures, and critical inputs (inclusive of active pharmaceutical ingredients [APIs]) that are medically necessary to have available at all times in an amount adequate to serve patient needs and in the appropriate dosage forms. The FDA issued such a list, subject to public comment, compromised of 223 drugs and biological products, primarily generic drugs. What measures the Biden Administration may take or not as it specifically relates to pharmaceuticals and US-based drug manufacturing is a key policy issue to watch for 2021. Its executive order for overall federal prodcurement of goods, materials, and products and US-based manufacturing requirements is its first policy in this area.

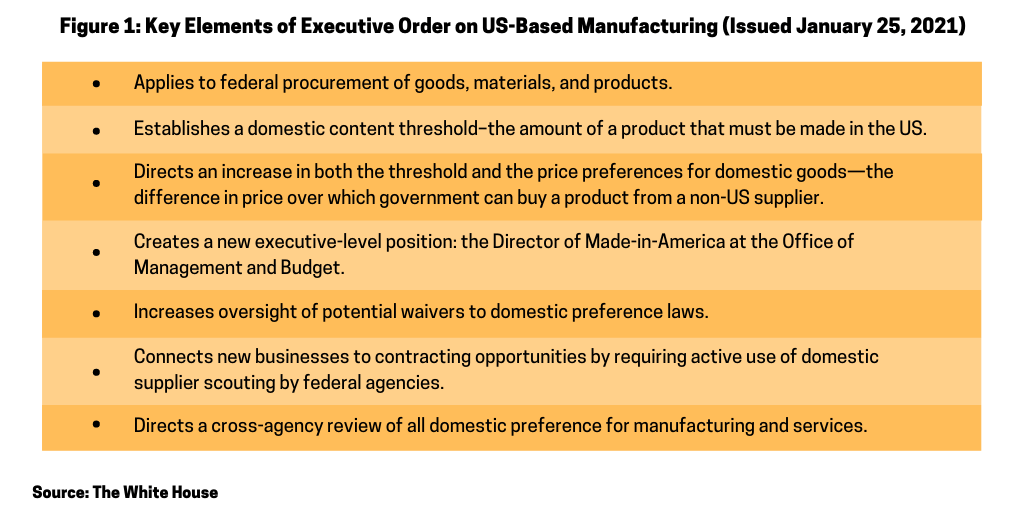

Key elements of the executive order

Figure 1 outlines the key elements of the executive order on US-based manufacturing requirements for federal procurement of goods, materials and services; the details of these measures are further outlined below.

Establishes a domestic content threshold and increases both the threshold and the price preferences for domestic goods. Existing rules establish a domestic content threshold—the amount of a product that must be made in the U.S. for a purchase to qualify under US government procurement rules. The executive order directs an increase in both the threshold and the price preferences for domestic goods—the difference in price over which government can buy a product from a non-US supplier. It creates a test under which domestic content is measured by the value that is added to the product through U.S.-based production or U.S. job-supporting economic activity.

Creates a new executive-level position: the Director of Made-in-America at the Office of Management and Budget. The executive order creates a new executive-level position, the Director of Made-in-America at the Office of Management and Budget (OMB) to oversee the implementation of the executive order, ensure that the corresponding rules are followed, and coordinate such activities with executive agency partners.

Increases oversight of potential waivers to domestic preference laws. The executive order creates a central review of agency waivers of “Buy American” requirements and directs the General Services Administration to publish relevant waivers on a publicly available website.

Requires use of domestic supplier scouting by federal agencies. The executive order directs federal agencies to utilize the Manufacturing Extension Partnership—a national network in all 50 states and Puerto Rico, that supports small and medium-size manufacturers—to help agencies connect with new domestic suppliers.

Directs a cross-agency review of all domestic preference for manufacturing and services. The executive order requires agencies to report on their implementation of current “Made in America” laws and make recommendations for achieving the President’s “Made in America” goals and to continue to do so on a bi-annual basis. This review includes a requirement that federal agencies submit recommendations for ways to ensure items offered to the general public on federal property are manufactured in the US—to the fullest extent possible—and to consider service industries in addition to manufacturing.

Industry feedback

Thus far, the Association for Accessible Medicines (AAM), which represents generic and biosimilar developers and manufacturers, offered support for the Biden Administration’s policy. “We also strongly support the Administration’s efforts to strengthen the US pharmaceutical supply chain and domestic manufacturing,” said the AAM in a January 21, 2021 statement. “More than 60 billion doses of generic medicines are made each year in the U.S., but more is possible with the right incentives in place. By ensuring that more essential medicines are produced in the United States, American patients and our health care system will be better prepared to withstand any future pandemics, natural disasters or global supply chain disruptions.” In April 2202, AAM issued its proposal for re-shoring drug manufacturing of designated essential medicines in the US through various measures, such as providing tax incentives, grants, and volume guarantees to incentivize drug manufacturers and make re-shoring drug manufacturing economically feasible.

Thus far, the Association for Accessible Medicines (AAM), which represents generic and biosimilar developers and manufacturers, offered support for the Biden Administration’s policy. “We also strongly support the Administration’s efforts to strengthen the US pharmaceutical supply chain and domestic manufacturing,” said the AAM in a January 21, 2021 statement. “More than 60 billion doses of generic medicines are made each year in the U.S., but more is possible with the right incentives in place. By ensuring that more essential medicines are produced in the United States, American patients and our health care system will be better prepared to withstand any future pandemics, natural disasters or global supply chain disruptions.” In April 2202, AAM issued its proposal for re-shoring drug manufacturing of designated essential medicines in the US through various measures, such as providing tax incentives, grants, and volume guarantees to incentivize drug manufacturers and make re-shoring drug manufacturing economically feasible.