Emerging Biopharma Companies: Tracking Their Contribution to Innovation

Emerging biopharma companies are an important source of new product development, but to what extent are they contributing to the industry’s pipeline and new product growth? A recent analysis by IQVIA examines the numbers to evaluate emerging biopharma companies’ place in pharmaceutical innovation.

Inside the numbers

A recent analysis by the IQVIA Institute for Human Data Science, Emerging Biopharma’s Contribution to Innovation: Assessing the Impact, released in 2019, shows the importance of these companies to product innovation. For purposes of the analysis, the report defines emerging biopharma companies as those having less than $200 million in estimated annual spending on research and development (R&D), or with global revenues under $500 million in prescription-drug sales. Key findings from the report are highlighted below.

- There were 3,212 companies defined as emerging biopharma in 2018.

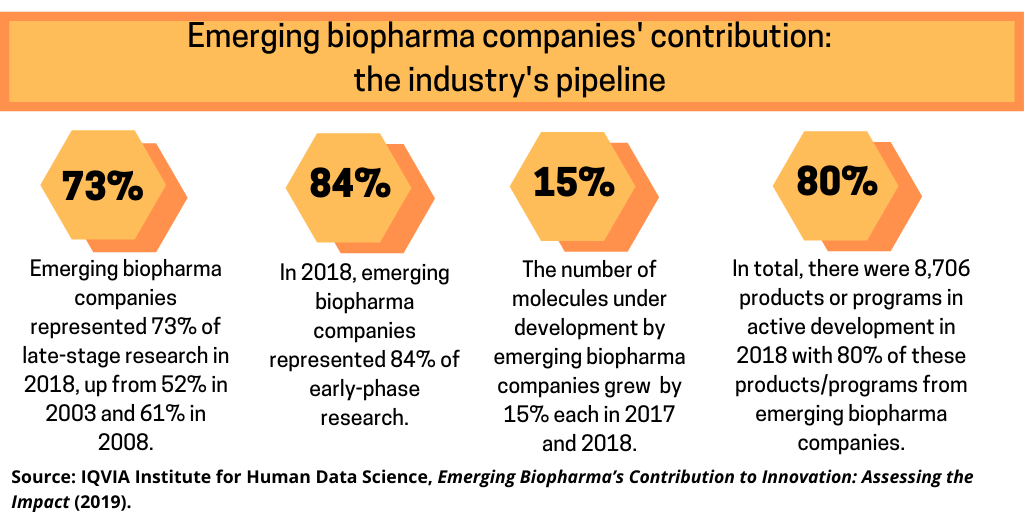

- Emerging biopharma companies represented 73% of late-stage research in 2018, up from 52% in 2003 and 61% in 2008.

- The number of molecules under development by emerging biopharma companies grew by 15% each in 2017 and 2018.

- In 2018, emerging biopharma companies represented 84% of early-phase research.

- In total, there were 8,706 products or programs in active development in 2018, ranging from discovery to registration, with 80% of these products/programs from emerging biopharma companies.

- Emerging biopharma companies conducted 65% of all clinical trials in 2018 and are now running more trials than larger companies across all phases.

- Oncology products developed by emerging biopharma companies have increased 74% since 2013.

- Emerging biopharma companies are developing more than 90% of next-generation biotherapeutics, which include cell and gene therapies and RNAi technologies.

- Emerging biopharma companies were the original patentees for 29 of the current top 100 drugs, which accounted for 40% of sales in the United States in 2018.

- For drugs launched in 2018, emerging biopharma companies originated and launched 42% of the new drugs, a higher percentage than in past years and up from 26% in 2017.

- Emerging biopharma companies have a greater focus on orphan drugs than other companies, with over half the drugs launched by emerging biopharma companies in 2018 receiving orphan-drug designation and almost a quarter approved based on a single-arm trial.

Inside emerging biopharma companies

In terms of business models, the IQVIA report points out that the top 30 emerging biopharma companies use three main business models in their development and commercialization strategies: (1) US-based standalone companies, which largely develop assets to license to other companies; (2) hub-and-spoke companies with centralized corporate functions and separate subsidiaries to optimize operations and develop assets across a wide range of therapy areas; and (3) ex-US companies that are typically regionally focused companies working on biobetter and/or biosimilars or that in-license assets for marketing in emerging markets.

There are currently 3,212 emerging biopharma companies collectively investigating 6,965 assets. Of these, 47% are investigating a single asset while another 40% are investigating 2–10 assets each, according to the IQVIA analysis. The top 30 emerging biopharma companies by number of compounds/programs in any stage of R&D account for 703 products, or 8.1% of all products under investigation.

Emerging biopharma companies and larger companies

The increased importance of emerging biopharma companies can be seen based on their contributions to the industry’s pipeline and product launches comparative to larger pharmaceutical companies (see Table I). Emerging biopharma companies accounted for 73% of the total late-stage R&D pipeline in 2018, compared with 61% in 2008. Large pharma companies, defined as with annual global prescription sales exceeding $10 billion, have seen their share drop from 27% to 19% from 2017 to 2018. At the same time, the share of mid-sized pharma companies, defined as those companies with annual global prescription sales between $5 billion and $10 billion, and small pharma companies, defined as companies with annual global prescription sales between $500 million to $5 billion, developing novel products has remained steady since 2003, with small pharma developing approximately 5–6% of products and mid-sized pharma developing from 2–5%, according to the IQVIA analysis.

| Table I: Global Medicine Sales and Number of R&D Pipeline Drugs per Company in 2018 by Segment | |||

| Company type | Number of companies in analysis | Combined revenues | Combined number of pipeline products |

| Large Pharma | 25 companies | $637 Billion | 1,845 products |

| Mid-sized Pharma | 9 companies | $50 Billion | 181 products |

| Small Pharma Companies | 74 companies | $159 Billion | 446 products |

| Emerging Biopharma Companies | 3,212 companies | $139 Billion | 8,572 products |

Large companies are those with global prescription sales exceeding $10 billion in the calendar year.

Mid-sized companies have global prescription sales between $5 billion and $10 billion in the calendar year.

Small companies have global prescription sales between $500 million to $5 billion in the calendar year.

Emerging biopharma companies are defined as those with either R&D spend < $200 million or prescription sales up to $500 million.

Source: IQVIA Pipeline Intelligence, Jan 2019; IQVIA MIDAS, Dec 2018.

The IQVIA analysis notes that emerging biopharma companies are increasing their pipeline share because they are the most active in the fastest-growing areas of oncology and orphan drugs and because they increasingly can develop their innovations without the need to partner or be acquired. In the past, the majority of emerging biopharma assets were sold or licensed before launch. However, in 2018, emerging biopharma companies themselves launched 47% of novel therapies. Looking ahead, the IQVIA analysis notes that since 2013, the absolute number of active R&D compounds has increased 37%, and this will likely support a continued increase in the number of emerging biopharma company-launched drugs over the next five years.

Over the last 15 years, emerging biopharma companies have seen steady growth in their share of the overall R&D product pipeline. They reached an 80% share of the total pipeline in 2018, up from 65% in 2003. This share increase is seen through all phases of development. Emerging biopharma companies have a growing impact on early-stage development (i.e., from discovery through Phase I) with their share of pipeline products increasing from 68% in 2003 to 84% in 2018. Emerging biopharma companies have also increased their share in late-stage development (i.e., from Phase II to registration) from 52% in 2003 to 73% in 2018, according to the IQVIA analysis. This increase mirrors an increase in the number of emerging biopharma companies launching novel products, which grew from 33% in 2010 to 47% in 2018.

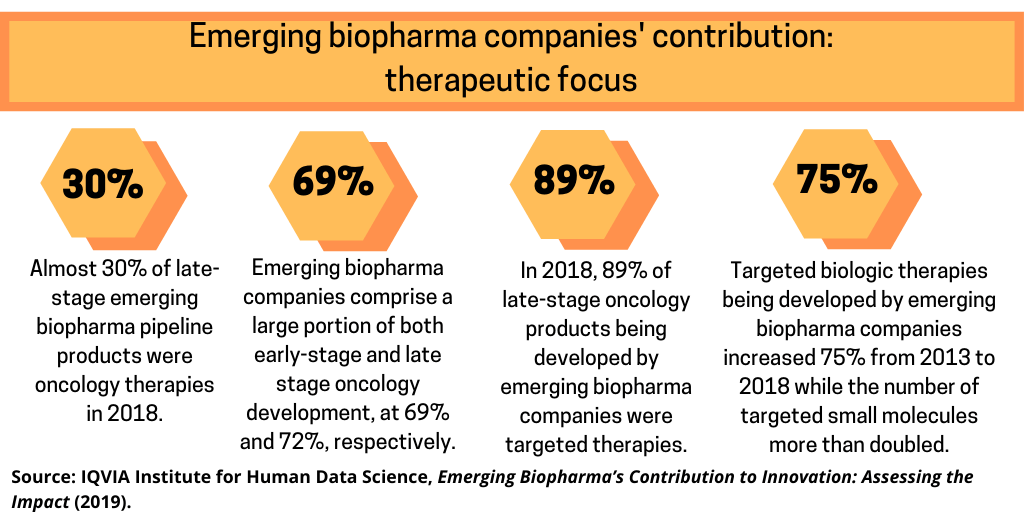

Emerging biopharma companies and therapeutic focus

To further illustrate emerging biopharma companies’ role in drug development, the number of molecules in development by emerging biopharma companies in Phase II or later increased by 15.3% in 2018 to a total of 2,120 molecules, and by 57.5% from 2013–2018, at a compound annual growth rate (CAGR) of approximately 9.5% over the same period, according to the IQVIA analysis. Almost 30% of late-stage emerging biopharma pipeline products were oncology therapies in 2018. Oncology products developed by emerging pharma companies have grown by 20% since 2017 and 74% since 2013, according to the IQVIA analysis. Emerging biopharma companies comprise a large portion of both early-stage and late-stage oncology development, at 69% and 72%, respectively. The number of late-stage pipeline oncology therapies developed by emerging biopharma companies grew from 351 in 2013 to 610 in 2018, an expansion of 74%, due in large part to the growing number of targeted therapies in the pipeline. In 2018, 89% of late-stage oncology products being developed by emerging biopharma companies were targeted therapies. Targeted biologic therapies increased 75% from 2013 to 2018 while the number of targeted small molecules more than doubled, according to the IQVIA analysis. Other therapies, including radiotherapies and hormonal, have increased more modestly by 10% over the past five years.

Outside of oncology, the next largest areas of pipeline development include pain, other central nervous system therapeutics, dermatologics, immunosuppressants and gastrointestinal (GI) products. Emerging biopharma companies’ shares for the early- and late-stage pipeline in these areas are on average 70%, according to the IQVIA analysis.

Next-generation biotherapeutics, defined as cell, gene and nucleotide therapies, make up less than 10% of the total late-stage R&D pipeline, but have more than doubled in number over the past three years, according to the IQVIA analysis. The total number of next-generation biotherapeutics in the late-stage pipeline reached 269 by the end of 2018, up from 182 in 2017, as a number of products moved from Phase I to Phase II. Emerging biopharma companies accounted for 92% of the late-stage pipeline in this area.

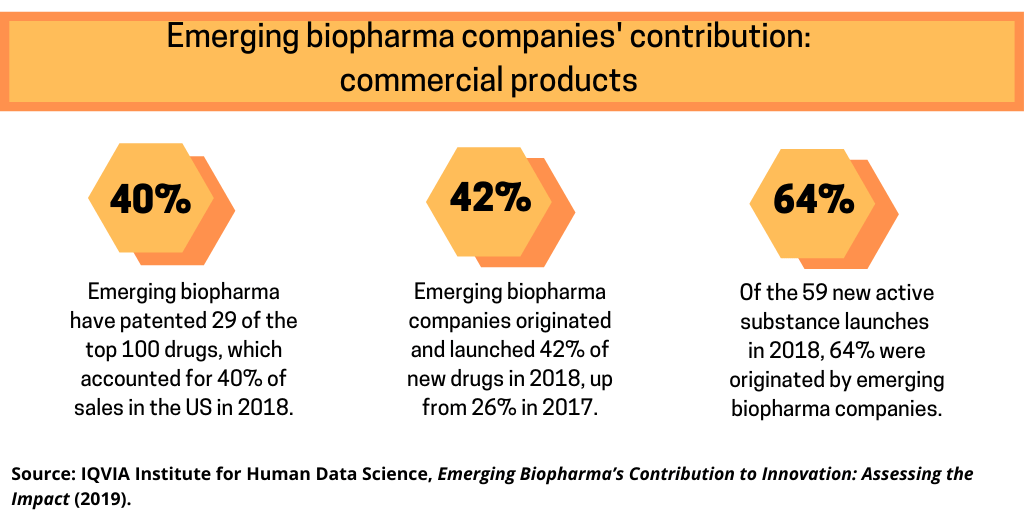

Emerging biopharma companies and commercial products

The IQVIA analysis also examines the role of emerging biopharma companies in commercial products. Emerging biopharma companies have patented 29 of the top 100 drugs, which accounted for 40% of sales in the United States in 2018. Emerging biopharma companies originated and launched 42% of new drugs in 2018, a higher percentage than in past years, and up from 26% in 2017. Of the 59 new active substance launches in 2018, 64% were originated by emerging biopharma companies. Over half of emerging biopharma company-launched drugs had orphan designation and almost a quarter were approved based on a single-arm trial. Moreover, an increasing number of product launches were originated by emerging biopharma companies with emerging biopharma companies accounting for 50% or 110 of the 219 launches in the past five years compared to 43% of the 158 in the prior five years, according to the IQVIA analysis.

While contributing more to new product launches, development times were more favorable for larger companies. The median time for emerging biopharma companies to launch new drugs was 16.6 years in 2018, more than 30% slower than other company segments, according to the IQVIA analysis. The IQVIA analysis points out that emerging biopharma company-originated products generally reach the market faster if they were acquired. This is particularly so for assets that were initially owned by an emerging biopharma company but submitted and subsequently launched by a large pharma company; these types of products spent less time in development compared to those owned, developed and launched by an emerging biopharma company. In addition, emerging biopharma companies generally achieve lower average sales when launching new active substances than other companies. The average quarterly sales uptake at one year after launch is 2.6 times higher for larger companies launching emerging biopharma-originated products than for emerging biopharma companies who develop and launch their own assets, widening to 6.5 times higher 18 months later, according to the IQVIA analysis.

Additional information may be found in the report by the IQVIA Institute for Human Data Science, Emerging Biopharma’s Contribution to Innovation: Assessing the Impact.