European Parliament Takes Next Step in Reforming EU Pharma Legislation

The European Parliament adopted its positions on proposals to revamp the EU‘s pharmaceutical legislation, which includes measures impacting drug development, commercialization, manufacturing & the supply chain. European innovator & generic-drug companies weigh in.

EU policymakers move on pharmaceutical reforms

Policymakers in the European Union (EU) took a major step forward in the process for revising the EU’s pharmaceutical legislation, the largest reform in more than 20 years, with the European Parliament earlier this month (April 2024) adopting its position on the European Commission’s proposal to revise the EU’s legislation. Last April (April 2023), the European Commission put forward a “pharmaceutical package” to revise the EU’s pharmaceutical legislation. It included proposals for a new directive and a new regulation, which aim to make medicines more available, accessible, and affordable while supporting the competitiveness and attractiveness of the EU pharmaceutical industry, which includes higher environmental standards. Now, having adopted its position on that proposal, the European Parliament will later vote on its adoption in early June (June 2024) following the elections of the European Parliament.

This is the latest step in what has become a multi-year process for EU pharmaceutical reform. The European Commission began the process for the proposed reforms in November 2020 by issuing its Pharmaceutical Strategy for Europe. The strategy kick-started a revision of the current pharmaceutical legislation that sought to respond to current challenges faced in the EU’s pharmaceutical sector. The proposed reforms seek to achieve the following main objectives:

Security of supply. Enhance availability and ensure medicines can always be supplied to patients, regardless of where they live in the EU;

Increase access to medicines. Create a single market for medicines ensuring that all patients across the EU have timely and equitable access to safe, effective, and affordable medicines;

Facilitate innovation. Continue to offer an attractive and innovation-friendly framework for research, development, and production of medicines in Europe;

Improve the regulatory process. Reduce drastically the administrative burden by speeding up procedures significantly and reduce authorization times for medicines, so they reach patients faster;

Address antimicrobial resistance. Address antimicrobial resistance and the presence of pharmaceuticals in the environment through a One Health approach; and

Environmental standards for medicines. Make medicines more environmentally sustainable.

The legislative package endorsed by the European Parliament

Although the broader goals of the European Commission’s proposal to foster innovation and enhance the security of supply, accessibility, and affordability of medicines in the EU were not questioned, the specifics of how such goals would be realized has been the subject of much debate by policymakers, the bio/pharma industry, and other stakeholders.

The European Parliament outlined its position on those reforms in early April, with a voite for adoption scheduled for later in early June (June 2024) following the elections of the European Parliament. The key measures in that position are outlined below.

Incentives for innovation

Members of the European Parliament (MEPs) want to introduce a minimum regulatory data protection period (during which other companies cannot access product data) of seven and a half years, in addition to two years of market protection (during which generic, hybrid or biosimilar products cannot be sold), following a marketing authorization.

Pharmaceutical companies would be eligible for additional periods of data protection if their particular product addresses an unmet medical need (+12 months), if comparative clinical trials are being conducted on the product (+6 months), and if a significant share of the product’s research and development takes place in the EU and at least partly in collaboration with EU research entities (+6 months). MEPs also want a cap on the combined data protection period of eight and half years.

A one-time extension (+12 months) of the two-year market protection period could be granted if the company obtains marketing authorization for an additional therapeutic indication that provides significant clinical benefits in comparison with existing therapies.

Orphan drugs (medicines developed to treat rare diseases) would benefit from up to 11 years of market exclusivity if they address a “high unmet medical need.”

Combatting antimicrobial resistance (AMR)

To boost research and the development of novel antimicrobials, MEPs want to introduce market-entry rewards and milestone-payment reward schemes (e.g. early-stage financial support when certain R&D objectives are achieved prior to market approval). These would be complemented by a subscription model scheme through voluntary joint procurement agreements to encourage investment in antimicrobials.

They support the introduction of a “transferable data exclusivity voucher” for priority antimicrobials, providing for a maximum of 12 additional months of data protection for an authorized product. The voucher could not be used for a product that has already benefited from maximum regulatory data protection and would be transferable only once to another marketing authorization holder.

Among the new measures to promote the prudent use of antimicrobials, MEPs want stricter requirements, such as restricting the prescriptions and dispensation to the amount required for the treatment and limiting the duration for which they are prescribed.

Strengthened requirements for environmental risk assessment

The position taken by the European Parliament also includes new rules that would require companies to submit an environmental risk assessment (ERA) when requesting a marketing authorization. To ensure adequate evaluation of ERAs, MEPs want the creation, within the European Medicines Agency, of a new ad-hoc environmental risk assessment working party. MEPs say that the risk-mitigation measures (taken to avoid and limit emissions to air, water and soil) should address the entire life cycle of medicines.

Increased independence for EU health emergency body

To effectively address public health challenges and boost European research, MEPs want the European Health Emergency Preparedness and Response Authority (HERA, currently a department of the European Commission) to become a separate structure under the European Center for Disease Prevention and Control (ECDC). MEPs say that HERA should primarily focus on the fight against the most urgent health threats, including antimicrobial resistance and medicine shortages.

Industry responds

Both innovator drug companies and generic and biosimilar companies, through their respective trade associations in Europe, responded to the European Parliament’s position on EU pharmaceutical reform.

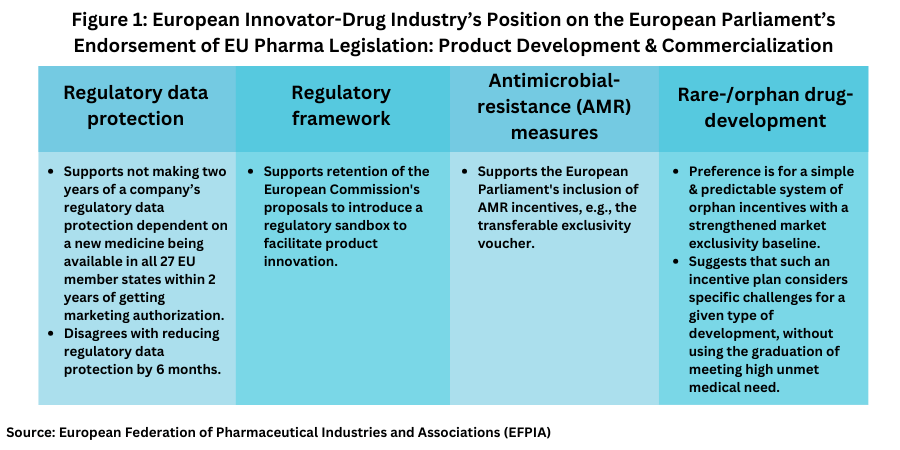

The European Federation of Pharmaceutical Industries and Associations (EFPIA), which represents innovator-drug companies and national pharmaceutical associations in the EU, issued a detailed statement on the position taken by the European Parliament (see Figures 1 and 2).

Nathalie Moll, EFPIA Director General, said: “This is a significant moment for the research based pharmaceutical industry. Today’s [April 10, 2024] vote sets out how Europe sees the future of health and life science research and innovation and patient care in the region. Ensuring patients have faster, more equitable access to new medicine—and how Europe can close the investment gap on other parts of the world—has been the subject of significant debate in the past months.”

EFPIA’s Moll said that certain amendments have enhanced the European Commission’s original proposals to develop a future-proof regulatory framework. EFPIA also agrees with certain proposals regarding regulatory data protection (see Figure 1) made by the European Parliament, namely not making two years of a company’s regulatory data protection dependent on a new medicine being available in all 27 EU member states within two years of getting marketing authorization. “They have recognized that the majority of factors determining whether a medicine is made available or not, are out of the control of an individual company,” said Moll in an April 10, 2024, statement. “Rather than waiting for legislation that is not designed to address medicines access in Member States, we are convinced that by getting around the table with patients, payers, providers and national policy makers, we can find workable solutions to improve access for patients today. “

However, Moll points out that “despite some improvement to the original European Commission proposals, the position adopted in the plenary reduces regulatory data protection by six months.” She said that “[i]t is difficult to understand how reducing incentives to research, develop and manufacture new medicines and vaccines could ever be in the best interest of Europe or European patients, particularly at a time when Europe recognizes that it needs to boost competitiveness to compete for global investment with ambitious nations like the US and China…This can only be achieved through the implementation of coherent and complimentary policies within the revision of the pharmaceutical legislation that will strengthen, not weaken the research-based pharmaceutical industry in all Member States.”

EFPIA was also supportive of the European Parliament’s inclusion of measures to foster product development for antimicrobial-resistance, through incentives, such as the transferable exclusivity voucher (see Figure 1). On orphan medicines, EFPIA disagrees with having incentives and measures tied specifically into meeting high unmet medical need (HUMN) (see Figure 1). “A simple and predictable system of orphan incentives with a strengthened market exclusivity baseline, and modulation that considers the specific challenges related to a given type of development, without using the graduation of HUMN, would have been the better choice for European Rare Disease patients,” she said. “We hope that Member States will consider these key ingredients and enable an improved ecosystem for research and development of solutions for rare disease patients.”

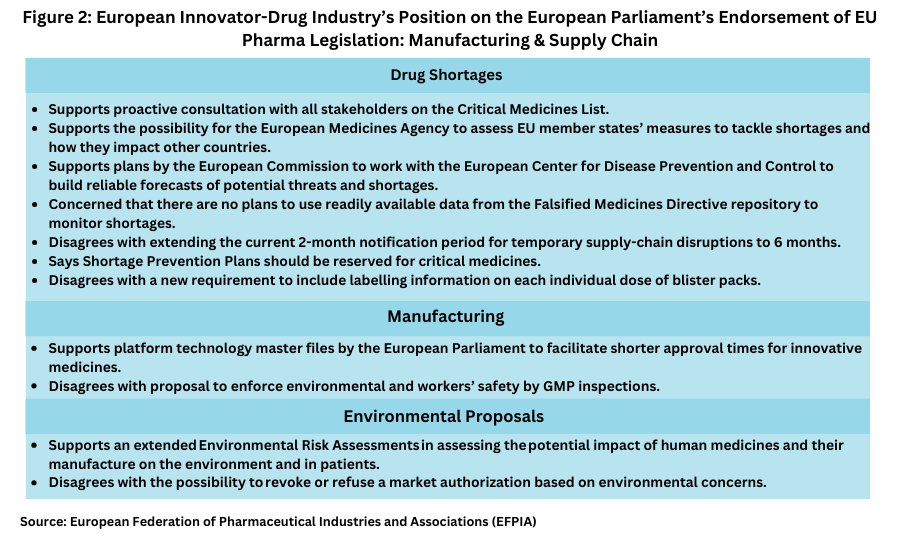

The EFPIA also provided its view on measures relating to addressing drug shortages and manufacturing (see Figure 2). “There are a number of positive elements within the text approved by the Parliament, including proactive consultation with all stakeholders on the Critical Medicines list, the possibility for the European Medicines Agency to assess Member States’ measures to tackle shortages and how they impact on other countries, as well as plans by the Commission [European Commission] to work with the ECDC [European Center for Disease Control and Prevention] to build reliable forecasts of potential threats and shortages.” Moll said.

“However, EFPIA continues to have concerns around a few proposals. There remain no plans to use readily available data from the Falsified Medicines Directive [i.e., the European Medicines Verification System (EMVS)] repository to monitor shortages; we believe this is a missed opportunity. Extending the current 2-month notification period for temporary supply-chain disruptions to 6 months will likely lead to unnecessary notifications, which could reduce visibility of actual shortages. Shortage Prevention Plans (SPPs) should be reserved for critical medicines. “

Generics industry weighs in

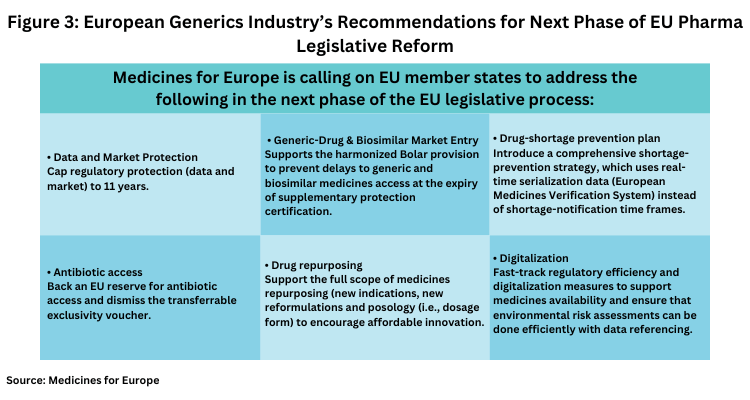

The generics and biosimilar industry, as represented by Medicines for Europe, also weighed in the European Parliament’s plenary vote that outlined the European Parliament’s position on the proposed pharmaceutical reforms. Medicines for Europe Director General Adrian van den Hoven said: “We are happy to see the Parliament advance this important legislation. While imperfect, there are many improvements to the legislation to increase access to medicines for all Europeans. Other elements in the deal, like unrealistic shortage requirements and the transferrable exclusivity voucher, will work against medicines availability and health system sustainability. We trust the Council [European Council] focus on the objectives of the review, access, availability and affordability in future work on this legislation.” Specific recommendations by Medicines for Europe for the next steps in the legislative process are outlined below (see Figure 3).

• Data and market protection. Cap regulatory protection (data and market) to 11 years which, Medicines for Europe says is the longest protection in the world and ensure that modulation criteria support better access in Central and Eastern Europe and smaller markets.

• Generic-drug and biosimilar market entry. Support the harmonized Bolar provision to prevent delays to generic and biosimilar medicines access at supplementary protection certification expiry.

• Drug-shortage prevention plan. Introduce a comprehensive shortage prevention strategy which uses real-time serialization data (EMVS), instead of shortage-notification time frames.

• Antibiotic access. Back an EU reserve for antibiotic access and dismiss the transferrable exclusivity voucher which rewards monopolies instead of public health.

• Drug repurposing. Support the full scope of medicines repurposing (new indications, new reformulations and posology) to encourage affordable innovation.

• Digitalization. Fast-track regulatory efficiency and digitalization measures to support medicines availability and ensure that environmental risk assessments can be done efficiently with data referencing.