What’s Trending: Generic Drugs by the Numbers & Key Market Developments

Generic-drug approvals in the US reached a recent high in 2023 although the number of first-generic approvals were down comparative to recent years. DCAT Value Chain Insights takes a look inside the numbers and the key market moves from the leading generic-drug companies.

Generic-drug approvals in the US

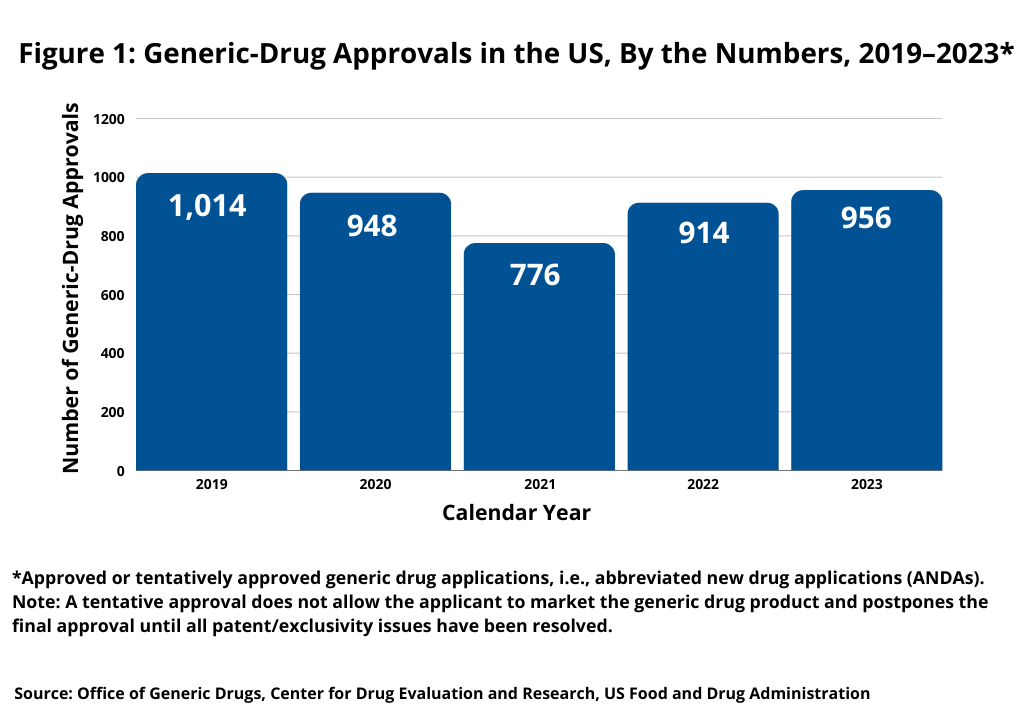

In looking at the numbers, how are generic-drug approvals in the US trending? In 2023, the Center for Drug Evaluation and Research (CDER) of the US Food and Drug Administration (FDA) approved or tentatively approved 956 generic-drug applications, i.e., abbreviated new drug applications (ANDAs) (see Figure 1). For definition, a tentative approval does not allow the applicant to market the generic-drug product and postpones the final approval until all patent/exclusivity issues have been resolved. This level is slightly up from recent prior years. In 2022, FDA’s CDER approved 914 generic drugs and only 776 in 2021, which was a recent low.

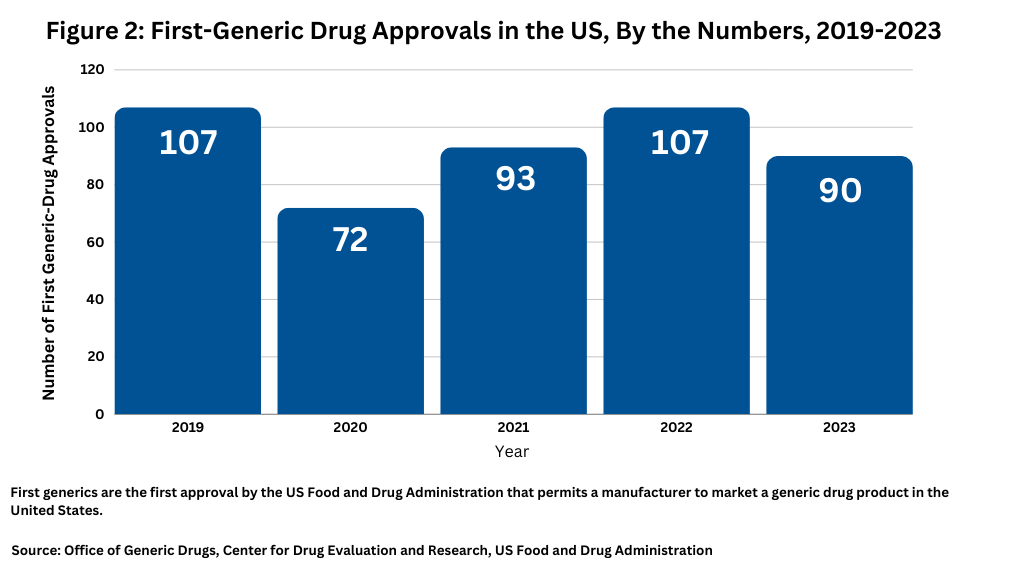

Among generic-drug approvals, it is important to look at “first-generic” approvals, which as the name implies, are the first approval by the US Food and Drug Administration that permits a manufacturer to market a generic drug product in the United States. In 2023, FDA’s CDER approved 90 first generics, slightly down from 2022, when FDA approved 107 first generics, but on par with 2021 levels, when the agency approved 93 first generics (see Figure 2).

Key market developments

But the numbers alone do not tell the full story of the generics market. Always marked by a highly cost-competitive market, several of the leading generic-drug companies are continuing a strategy to improve margins, particularly in the US market, through restructuring initiatives and diversification of product portfolios to more value-added products. On a geographic basis, North America represents a shrinking share of the global generics market value due to rising competition and downward pricing pressures. Although the US generics market has begun to stabilize since 2019, strong pricing pressures remain.

Teva is continuing its “Pivot-to-Growth,” strategy, which the company announced last May (May 2023) and which is being led by Richard Francis, who became Teva’s President and CEO in January 2023. He succeeded Kåre Schultz, formerly Teva’s CEO, who retired, effective December 31, 2022.

Schultz had been Teva’s CEO since 2017 and came on board to lead a major restructuring plan, which was announced in late 2017. The plan addressed declining revenue from the company’s generics business, large debt caused by its $40.5-billion acquisition of Allergan’s generics business in 2016, and declining revenue from its number one specialty innovator product at the time, Copaxone (glatiramer acetate) for treating multiple sclerosis, which faced its own generic-drug competition). Schultz was hired to turn the company around. He oversaw the company’s restructuring and developed the ensuing strategy of further diversifying in innovator drugs and optimizing the company’s generics portfolio by rationalizing the company’s generics product portfolio and moving it away from less profitable areas to more value-added products, such as complex generics, biosimilars, and other products with a higher barrier to market entry.

Francis is now leading the company and is charged with continuing the company’s turnaround, which he plans to do so through its “Pivot to Growth Strategy,” which consists of four main growth areas: innovative drugs, biosimilars, the company’s core generics business, and capital allocation to further reduce debt.

With respect to its generics business, in 2023, Teva reported revenues of $8.7 billion, which represented 55% of the company’s 2023 overall revenues of $15.8 billion. In North America, the company reported 2023 revenues in its generics business of $3.475 billion (a 2% decline year-over-year), $3.664 billion in Europe (a 6% gain year-over-year), and $1.594 billion in international markets (a 1% gain year-over-year). As part of its generics strategy, Teva is seeking to focus on complex, differentiated products, such as drug–device combinations and long-acting injectables.

For its part, Viatris reported 2023 total revenues of $15.43 billion, compared to $16.26 billion for the comparable prior-year period, representing a decrease of $835.8 million, or 5%. The decline was principally due to a decline of net sales from developed markets, which decreased by $517.0 million or 5%, and from net sales from Japan, Australia and New Zealand, which collectively decreased by $207.9 million or 13%.

Viatris also substantially completed in 2023 a significant restructuring program that was initiated during 2020. As part of the restructuring, the company optimized its commercial capabilities and enabling functions and closed, downsized, or divested certain manufacturing facilities globally that were deemed to be no longer viable either due to surplus capacity, challenging market dynamics, or a shift in its product portfolio toward more complex products.

Sandoz, the former generics and biosimilars business of Novartis, which was spin off by Novartis in October 2023, completed its first year as a stand-alone company in 2023. The company reported full-year 2023 net sales of $9.6 billion, up 7% in constant currencies (up 6% in US dollars). Its generics business reported 2023 revenues of $7.4 billion, up 4% in US dollars and 5% in constant currency. Its biosimilars business reported 2023 revenues of $2.2 billion, a 15% gain in both US dollars and constant currencies. This strong double-digit biosimilar growth reflects the launch of Hyrimoz, a high-concentration formulation of adalimumab (reference product AbbVie’s Humira) indicated for the treatment of various inflammatory conditions as well as ongoing strong demand for the company’s first-ever biosimilar, Omnitrope (somatropin), a human growth hormone product.