From DCAT Week: Pharma Industry Outlook and Executive Insights in Supply Management, Sustainability

A roundup of some key highlights from the education programs at DCAT Week: market insights on the performance of the global bio/pharmaceutical industry, perspectives on approaches in supply management, including supplier risk assessment and mitigation, an energy and chemicals outlook, and a CPO view of sustainability and how it factors into supplier selection and evaluation.

The education programs at DCAT Week 2023 provided market insights on the performance of the global bio/pharmaceutical industry as well as perspectives on approaches in supply management. Detailed editorial coverage of the programs will follow in upcoming issues of DCAT Value Chain Insights, but below is a snapshot view of the topics and experts featured in the programs.

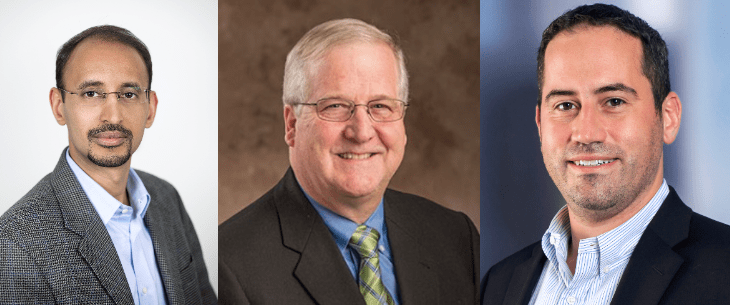

Vice President, Global Pharma Strategy,

IQVIA

Market outlook for Pharma in 2023-2030

Big strategic issues are facing Pharma as governments, healthcare systems, and customers play a larger role in influencing innovation as they seek more cost-effective and simpler solutions beyond the molecule itself. As Graham Lewis, Vice President, Global Pharma Strategy, IQVIA, put it at the Pharma Industry Outlook program: “Pharma is in the cart, but is not the horse.” Key choices for bio/pharma companies are to decide on the optimal scope of their geographic and therapeutic footprints and whether to “stick to the knitting” or embrace a wider role in healthcare. Three issues loom large: acceptable returns on R&D investment, a generics squeeze, and mounting financial pressure on biotechs

EY Americas Health Sciences and Wellness Industry Markets Leader,

Ernst & Young (EY)

Small bio/pharmaceutical companies play an increasingly important role in product innovation for the industry, and Arda Ural, PhD, EY Americas Health Sciences and Wellness Industry Markets Leader, Ernst & Young (EY), further examined the key trends in industry deal-making and capital flow into Emerging Pharma, a vital customer base for CDMOs/CMOs and partner for bio/pharma companies.

Evolving issues in supply management

Without question, dealing with recent market volatility has been the number one issue facing the industry. These conditions have resulted in escalating raw materials costs, actual and potential supply risks, and pricing pressures.

In an engaging panel discussion at the program, Executive Insights: Weathering the Storm – The Path Forward in Optimizing Supply Practices, senior executives from Bristol-Myers Squibb, Catalent, and BASF addressed the all-important question facing the industry: how has supply management evolved in the light of recent volatility (inflationary pressures, supply-chain issues, and geopolitical uncertainty). A key emphasis discussed was the collaboration in the customer-supplier interface for greater supply-chain visibility. Other topics examined were best practices and approaches in contracting; evaluating how supplier evaluation and selection has evolved; and key considerations in supplier risk assessment and mitigation.

Greater supply-chain resiliency is a common goal across all industries, and in the DCAT Week education program, The Disruption Busters: New Approaches in Supplier Risk Assessment & Mitigation, leading experts shared cross-industry learnings to better identify, respond to, and manage supplier risks. Vishal Bhandari & Mike Piccarreta, both Partners in the Healthcare & Life Sciences Practice of the management-consulting firm, Kearney, and co-founders of the firm’s Center for Supplier Risk Management, gave examples from the automotive, high-tech and pharma industries, where best practices show that supplier risk management needs to be managed end-to-end from risk sensing to execution and can deploy tools such as digitally enabled value-chain mapping. And Dr. David Closs, Ph.D., the John H. McConnell Chair Emeritus, Michigan State University (MSU), shared several ways on how other industries are mitigating risk, including SKU reduction, applying AI/other digital tools, and using news tactics in second and localized sourcing.

DCAT presented this program in partnership with the Axia Institute, a research and innovation center within MSU. DCAT is also partnered with MSU’s top-ranked Supply Management Program at MSU’s Broad College of Business.

Senior Vice President, Global Procurement, and Chief Procurement Officer,

GlaxoSmithKline

Two hot-button issues: sustainability and raw materials costs

Sustainability has become an all-important issue in bio/pharma companies’ selection and evaluation of their suppliers as companies seek to reduce their carbon footprint in line with international climate goals. Companies’ emphasis on sustainability and ESG (environmental, social and governance) goals was a major theme across several DCAT Week education programs, and in the program, Industry Radar: Energy, Raw Materials, and Sustainability, Lisa Martin, Senior Vice President, Global Procurement, and Chief Procurement Officer, GSK, outlined the company’s recently launched Sustainable Procurement Program for Suppliers and how GSK is working with its suppliers to support the company’s sustainability goals and how sustainability factors into supplier selection and evaluation.

The program also addressed another important issue for the bio/pharma industry: rising raw materials costs. Eric Bober, Vice President, NexantECA, provided an energy and chemicals outlook to examine the pressure points impacting energy supply–demand fundamentals, including natural gas, particularly in Europe, and the impact on chemical production—both commodity chemicals and downstream chemicals used in bio/pharma production.