Organon: What’s Next for the New Merck & Co. Spin-off?

Kevin Ali, the CEO of Organon, the new company formed from the spin-off of Merck & Co.’s women’s health, established brands, and biosimilars businesses, is leading the new, independent company that launched in June 2021. What’s the strategy and expectations for the new company and for Merck?

Formation of Organon: strategic rationale by Merck

Organon launched as an independent, standalone, publicly traded company on June 3, 2021 consisting of three businesses—women’s health, established brands, and biosimilars—spun off from Merck & Co. to form the company, Merck had announced its intention to spin off the company in February 2020 through a distribution of Organon’s publicly traded stock to company shareholders. In 2020, the products that will comprise Organon had total sales of $6.5 billion.

|

|

Kevin Ali |

In making the decision to spin off those three business (women’s health, established brands, and biosimilars), Merck stressed its commitment to what it deemed as its growth pillars in oncology, vaccines, hospital and specialty products, and animal health, which it expects will drive approximately 90% of Merck’s revenue growth post the spin-off. Merck explained at the time of the announced spin-off in February 2020 and again in an investor presentation in May (May 2021) that spin-off would reduce Merck’s human health manufacturing footprint by approximately 25% and the number of human health products it manufactures and markets by approximately 50% to allow for a more focused operating model in support of its growth products.

The name Organon has been a part of Merck since Merck’s acquisition of Schering-Plough in 2009. In 2007, Schering-Plough acquired Organon BioSciences from the Dutch chemical company, AkzoNobel. At the time of the 2007 acquisition, Organon Bioscienes comprised primarily of Organon, a human health business, and Intervet, an animal health business. It also included Nobilon, a human vaccine development unit, and Diosynth, a third-party manufacturing unit of Organon, which was subsequently sold to Fujifilm in 2011 to form Fujifilm Diosynth Biotechnologies.

Organon: the new company

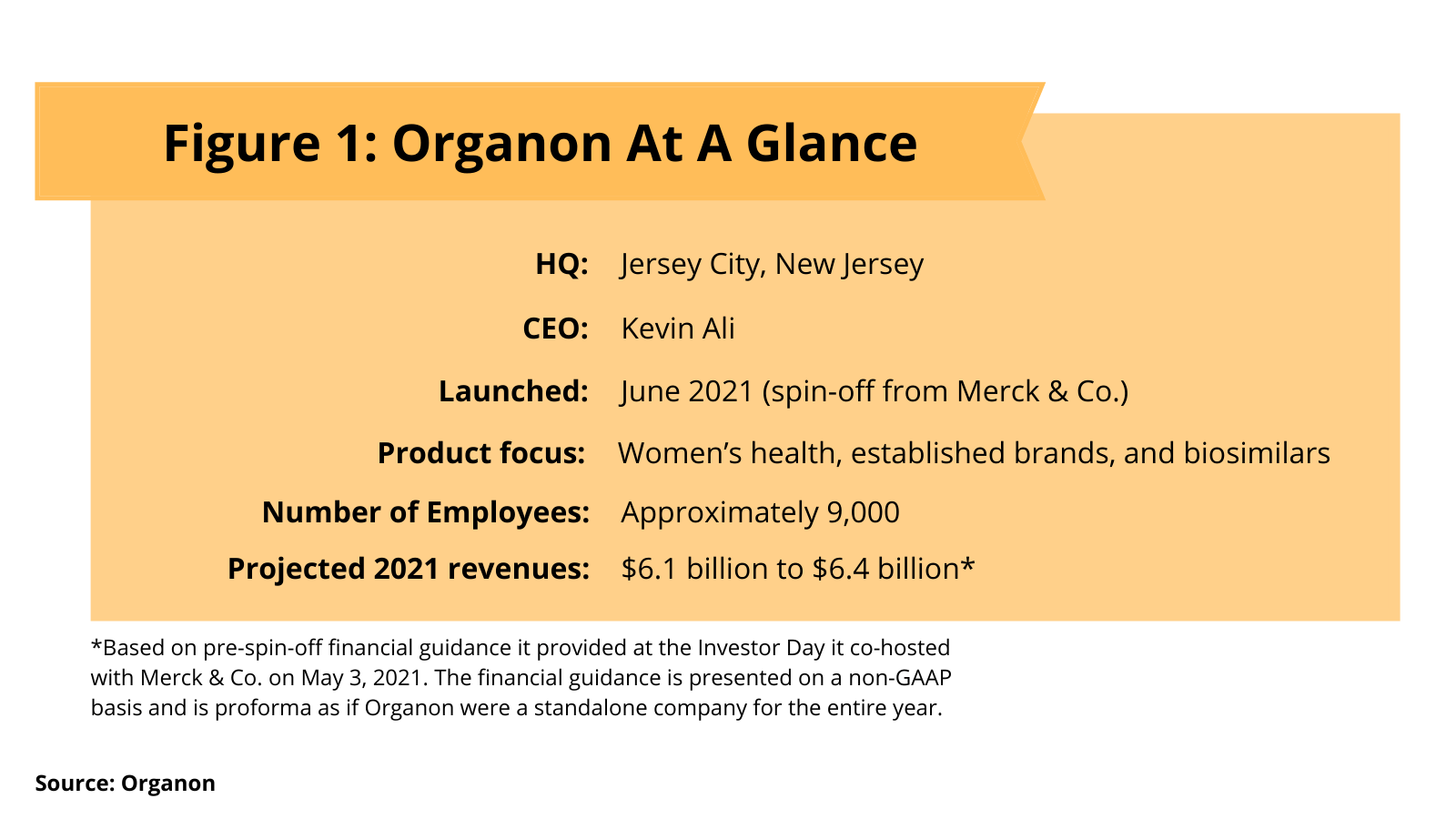

Organon is led by CEO Kevin Ali, who has three decades of pharmaceutical commercial experience within Merck, including as President, MSD International; President, Emerging Markets; Senior Vice President in charge of the Bone, Respiratory, Immunology and Dermatology Franchise; and Managing Director respectively of Germany and Turkey (see Figure 1). The new company consists of approximately 9,000 employees, which represented 12% of Merck’s global workforce as of December 31, 2020. In its second-quarter 2021 earnings released reported on August 3, 2021, Organon affirmed a pre-spin off financial guidance for 2021 revenues of between $6.1 billion and $6.4 billion (see Figure 1). Ali’s international commercial experience fits with Organon’s product portfolio with approximately 79% of revenue generated by the company outside the US.

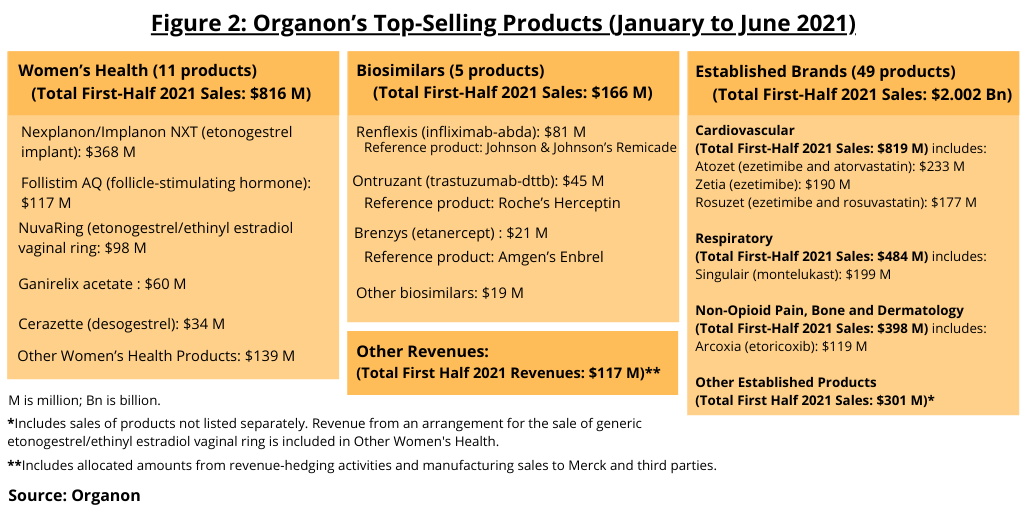

Overall, Organon has more than 60 products, with the largest number and revenue from its established brands business. Organon’s established brands business consists of 49 products across a range of therapeutic areas, including respiratory, cardiovascular, dermatology, and non-opioid pain (see Figure 1). This portfolio includes brands beyond their patent loss in most markets, with only modest remaining loss-of-exclusivity exposure beyond 2021, according to information from Merck as reported in May 2021. The products comprising Organon’s established brands business posted 2020 revenues of $4.5 billion, and in the first-half of 2021, the established brands business posted sales of approximately $2.0 billion (see Figure 2).

Women’s health is the next largest business of Organon and now consists of contractive and fertility products (see Figure 2). The portfolio consists of 11 products and posted first-half 2021 sales of $816 million. Its lead product is Nexplanon/Implanon (etonogestrel implant), which posted global 2020 sales of $680 million and first-half 2021 sales of $368 million. The company is targeting potential blockbuster status (annual sales of $1 billion+) for the product over the near term with the product holding US market exclusivity through 2027. Organon is looking to expand the focus of its women’s health business beyond contraception and fertility to address conditions that are unique to women as well as health issues that disproportionately affect women to position itself in market which the company estimates of more than $60 billion by 2026.

Organon has made two moves to add to its women’s health portfolio since the launch of the company in June. In late July (July 2021), it formed a licensing agreement with ObsEva, a Geneva-based bio/pharmaceutical company, for the global development, manufacturing, and commercial rights to ebopiprant, an investigational, orally active, selective prostaglandin F2α (PGF2α) receptor antagonist being evaluated as a potential treatment for preterm labor by reducing inflammation and uterine contractions. Under the agreement, Organon will gain exclusive worldwide rights to develop and commercialize ebopiprant. ObsEva is entitled to receive tiered double-digit royalties on commercial sales as well as up to $500 million in upfront and milestone payments including $25 million to be paid at signing, up to $90 million in development and regulatory milestones, and up to $385 million in sales-based milestones.

In June (June 2021), Organon completed the acquisition of Alydia Health, a commercial-stage medical-device company focused on preventing maternal morbidity and mortality caused by postpartum hemorrhage or abnormal postpartum uterine bleeding. Total consideration was $240 million, including a $215-million cash payment ($50 million of which was paid by Merck, upon signing in March 2021, and $165 million paid by Organon at close) plus a $25-million contingent milestone payment. Alydia’s device, the Jada System, is designed to encourage normal contraction of the uterus to stop excessive bleeding after childbirth. Alydia received 510(k) clearance (marketing authorization) from the US Food and Drug Administration for the Jada® System in August 2020.

Biosimilars is the third business area of Organon and currently consists of five biosimilar products (see Figure 2) and formed from its collaboration with Samsung Bioepis, a joint venture between Samsung Biologics and Biogen. First-half 2021 sales for the biosimilar business were $166 million. Key growth drivers identified by the company include: Renflexis (infliximab-abda) in the US, a biosimilar of Johnson & Johnson’s Remicade; the launch of Aybintio (bevacizumab) in the European Union, a biosimilar of Roche’s Avastin; and the launch of Hadlima (adalimumab-bwwd) in Canada, a biosimilar of AbbVie’s Humira, as well as the anticipated launch of Hadlima in the US in 2023.