Top Biomanufacturing Trends for 2022

What are key trends impacting biomanufacturing for 2022? COVID supply-chain challenges, unpredictable growth capacity, and China are major concerns.

By Joel Ranck, Market Analyst, BioPlan Associates

What to look for in 2022

Since the onset of the pandemic the biopharma industry has received global attention. Pundits, politicians, and the public commonly throw about terms such as supply chain, emergency use authorization, and patent protections to describe the industry response to COVID-19. Decision-makers in the industry, however, are living with these challenges in real-time. According to BioPlan’s 18th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, released in 2021, COVID-19 is affecting virtually all aspects of the industry as demand for consumables create challenges even to those areas entirely uninvolved in vaccine production.

Note: BioPlan is currently fielding its survey for its 19th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, which will be released in May (May 2022) and is interested in the input of biopharmaceutical companies, CDMOs, and other suppliers. Click here to take the survey.

Well before the pandemic, the biopharmaceutical industry was experiencing steady, rapid growth, including internationally. As the industry now adapts to recovery from the pandemic, we see significant additional expansion in bioprocessing activities worldwide. Suppliers that pre-pandemic could not have imagined such rapid growth are now being thrust into global supplier status. With sales at record levels, many are unprepared for this new position. This growth, however, brings uncertainty, inefficiency, and risks of future disruptions to the industry, including the inability to manage such growth and the likelihood that many will be unable to manage their recent successes.

A critical issue to many in 2022 will be how to plan for the future. Current planning efforts are thwarted by hiring challenges, growth management, over-extension/expansion, inventory issues with a global supply chain in chaos, and other issues. In the BioPlan study, most decision-makers have indicated that planning for the next 12–24 months has become a major challenge as they try to adapt to the recent disruptions.

Market Analyst

BioPlan Associates

COVID-19 accelerating many trends

The primary focus of the industry is, of course, on COVID-19: how to deal with it and what changes from the pandemic will be enduring versus transient. The operational aspects of the biopharmaceutical industry and its bioprocessing sector have rapidly pivoted and adapted to the COVID-19 pandemic. The biopharmaceutical industry and its manufacturing (bioprocessing) sector have, in most respects, already adapted, with most expected major changes already implemented and working well.

There is now generally more biopharmaceutical R&D and manufacturing being started or planned at many bioprocessing facilities/companies due to the pandemic. This includes unprecedented rapid worldwide expansions of R&D and bioprocessing capacity at a good number of facilities, mostly for the manufacture of pandemic and biodefense vaccines and therapeutics. These activities, involving expanded pandemic R&D or manufacturing, are pushing work “downstream” and displacing some bioprocessing to other facilities or contract development and manufacturing organizations (CDMOs). The pandemic response is adding R&D and manufacturing to facilities that were already near capacity pre-pandemic. Generally, however, the pre-pandemic projects were not being postponed or halted. Although many could be given lower priority, pipeline projects have continued. For example, even smaller contract manufacturing organizations (CMOs) that are not involved in pandemic-related R&D or manufacturing have seen increased new projects. This has created current and future demand for capacity as non-pandemic projects are shifted from developers to CDMOs or from one CDMO to another.

While this has been a boon for many CDMOs, especially the smaller companies that would have otherwise experienced much less dynamic growth, the future of the CDMO segment of the industry remains uncertain. Similar expansions have been seen in other segments as well, including single-use manufacturing device and other areas of consumables.

Long-term impact of the pandemic

According to respondents to the BioPlan survey, the key to success in the aftermath of the pandemic will be planning and coordination to manage what could become a post-pandemic glut. In addition, those able to secure a consistent supply chain and to focus on long-term solutions will be better positioned for the coming years. Near-term challenges involve many factors: logistics; inventory (including cross-border inventory and warehousing); on-shoring of manufacturing; second-source suppliers; strategies to avoid shortages of raw materials; and staff shortages. Post-pandemic changes will emphasize the successful strategies while identifying potential future stresses and failures in the system.

The industry will need to have a serious discussion about how well it responded to the pandemic and whether it managed the tens of billions of dollars in funding for the pandemic reasonably. Some questions to consider are: what waste occurred as billions of doses of vaccines were produced and were there outsourcing options that could have reduced logistical or warehousing failures? Looking forward, the industry will also need to identify what the long-term effects will be.

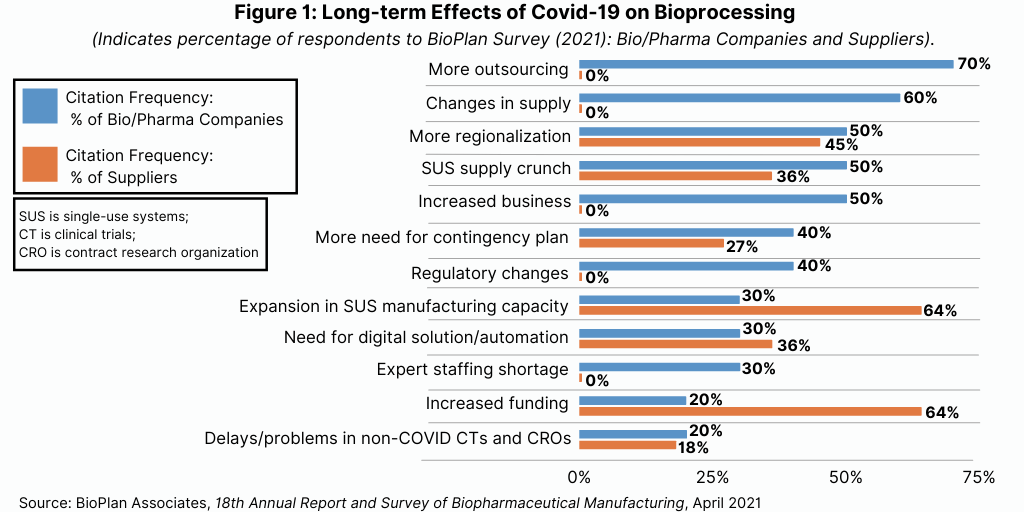

According to industry executives in the BioPlan survey, the top long-term effects that the industry can expect are more outsourcing, changes in supply chains (including concerns with suppliers’ abilities and securing second sources of supply), more regionalization, and a shortage of single-use systems (see Figure 1).

The main driver in bioprocessing today remains COVID-19. Suppliers giving priority to pandemic-related supplies or services are already positioned for the new post-pandemic reality. Nearly all bioprocessing equipment and services suppliers, including CMOs, have already implemented policies giving higher priority to projects that are pandemic response-related. More outsourcing can definitely be expected. While this was an ongoing pre-pandemic trend, the industry now, more than ever, recognizes the integral nature of contract manufacturing.

With 70% of the BioPlan study respondents noting that even more outsourcing will be done, it is clear that this industry segment will experience long-term expansion opportunities. In addition, regionalization is also likely to expand. This indicates that there is likely to be more regionally based facilities and suppliers. Multinational suppliers and manufacturers will continue to dominate, but the pandemic has already opened up opportunities for local and regional suppliers in Asia and Latin America, where manufacturing of vaccines can provide the fundamental boost necessary for creating regional biopharma activity.

Platform and product priorities

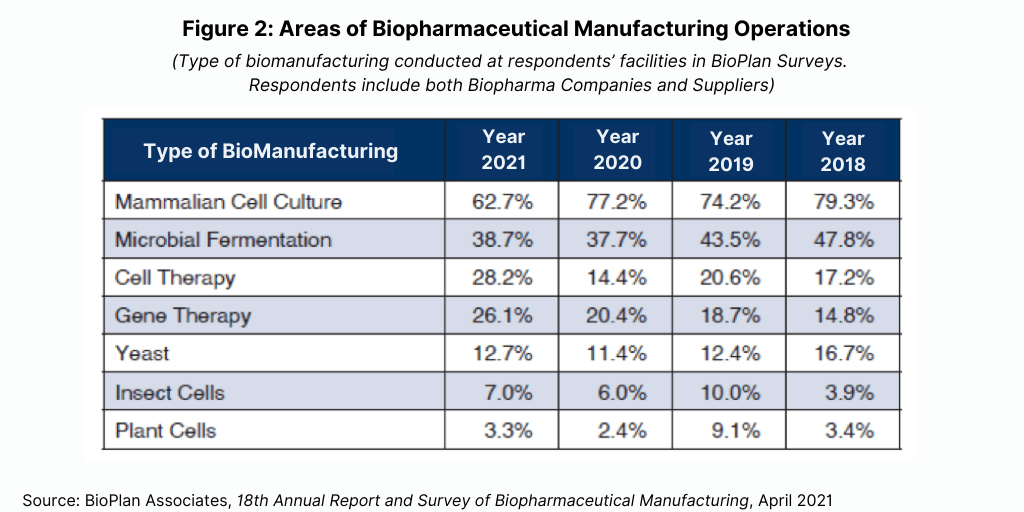

Mammalian cell culture still dominates biopharmaceutical development and manufacturing as it has for the past several decades. However, this year, the BioPlan survey results showed a decrease in the percentage of facilities using mammalian cell-culture platforms: 62.7%, down from 77.2% in 2020 (see Figure 2). This may be due to an increase in smaller facilities that are involved in cell or gene therapy or other advanced platforms. Microbial fermentation systems remained nearly the same at around 38%.

Mammalian expression systems (cell lines, vectors, and associated genetic engineering) continue to be preferred over other options (e.g., microbial and plant-based systems, particularly for recombinant proteins and monoclonal antibody production). Preferences for standardizing and minimizing the number of platforms used within a facility or company can be rather strong. This even includes mammalian manufacture of products at early stages for which later-stage development and commercial manufacturing will involve switching to microbial or other non-mammalian bioprocessing.

Respondents to the BioPlan survey clearly expect platforms for cellular/gene therapies to advance in the next five years, with this expected to significantly reduce manufacturing bottlenecks and other issues. Better process control/automation, hiring more staff with cell/gene therapy manufacturing expertise, viral vectors/gene therapies, and scaling-up using larger bioreactors and chromatography systems are the most important priorities.

Meanwhile, biosimilars and biogenerics are in the spotlight as blockbusters begin to sunset. The many follow-on products—biosimilars, biogenerics, and biobetters—in development and entering world markets confirm the maturation of the biopharmaceutical industry as its current major blockbuster products and established platform technologies start to go off patent. Follow-on biopharmaceuticals are a rapidly growing field. Many products are in the development pipeline, with this expected to change biopharmaceutical manufacturing and marketing.

Capacity grows globally

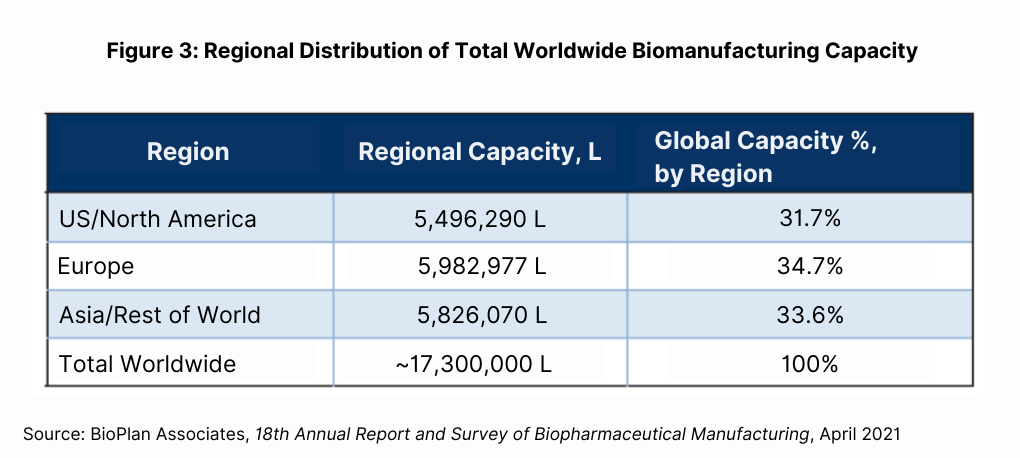

BioPlan’s Top 1000 Global Biopharmaceuticals Facilities Index (subscription database at www.Top1000Bio.com) reports 17.34 million liters of production worldwide, 70% of which is mammalian-based (see Figure 3). The US, with its greater emphasis on innovation, R&D, process development, and clinical manufacturing, numerically has the most bioprocessing facilities while Europe has greater bioprocessing capacity, with European facilities larger on average. Asian facilities are approaching the US in terms of number of facilities while their average capacity remains lower. In terms of CMOs, Asia/rest of world has the most capacity, but this is much more highly concentrated, including a few super-sized facilities such as those of Celltrion and Samsung Biologics in South Korea. The US has the largest number of CMOs, including a sizable number of new cellular/gene-therapy CMOs coming on line. Much as with overall capacity, the US CMO facilities are on average lower capacity than the other regions.

The majority of bioprocessing capacity worldwide continues to be held by a relatively small number of the largest facilities. The 100 largest facilities have around two-thirds of worldwide capacity. It must be kept in mind that most of the massive capacity held by the top leaders involves legacy ≥ 10,000-L bioreactor-anchored stainless-steel facilities. Relatively few such facilities are now being constructed in the US and Western Europe, with manufacturing in major market countries increasingly using single-use systems.

Those single-use systems continue to make advances into biopharmaceutical manufacturing and are becoming increasingly common in most areas. This is particularly true at pre-commercial scales (e.g., clinical and preclinical), where single-use systems dominate stainless- steel systems, especially upstream. BioPlan estimates that ≥ 85% of pre-commercial (R&D and clinical) product manufacturing now involves considerable, if not near total, single-use systems-based manufacturing.

It is now widely accepted that single-use system-based bioprocessing can reduce facility costs and size and provide faster changeovers and reduced times in bioprocessing. With the industry ramping up manufacture of COVID-19 and other pandemic products, expectations are for greater adoption of single-use systems for commercial manufacturing.

China CMOs: a major new biopharma participant

COVID-19 vaccines production has supported the domestic industry in China as it has globally. BioPlan recently published an extensive study and directory of CMOs in China (Growth of CMOs in China, June 2020). China is experiencing rapid growth of its domestic biopharmaceutical industry and its bioprocessing activities. This growth includes production to meet growing demand from its huge domestic population, particularly expansion of the manufacture of biogeneric monoclonal antibodies for domestic consumption, with this increasing in parallel with growth in innovative biopharmaceutical R&D and manufacturing and rapid expansion of CMO capacity in China. The increase in investigational new drug (IND) applications filed by China-based developers to conduct clinical trials in the US (and presumably Europe and other major markets) is increasing at an accelerating rate. The products involved are likely mostly innovative products while some will be seeking formal biosimilar approvals.

Regulatory wins and woes

The US Food and Drug Administration’s (FDA) increasing efficiency in product approvals comes at a critical time in the industry’s development. FDA (and nearly all other major market regulatory agencies) has matured along with the biopharmaceutical industry, and in many respects, the agency remains the industry’s primary gatekeeper by determining which companies and what products get to enter the largest (the US) market. FDA biopharmaceutical approvals have been steadily increasing. Now, over 10 years after implementation of biosimilars approvals, these and mainstream biologics approvals and related FDA actions are in general running smoothly, including becoming more predictable.

High costs of biopharmaceutical products, and related government-imposed price controls, continue to be a threat to the industry. Product costs at the patient level are often considered exorbitant. As a result, potential price controls are particularly important in the US, by far the largest single source and market for biopharmaceuticals. Substantive changes in how US developers set prices and changes in US government-imposed price controls will likely have global implications.

Major threats include political imposition of price controls, whether nationally by Congress or by individual states. Products could also not be sufficiently covered by insurers due to high costs, with patients essentially forced to use cheaper alternatives or even forego treatments. The past year was noisier in the US than in recent prior years in terms of protests over exceedingly high pharmaceutical prices, including pharmaceutical costs being a minor issue in the US 2020 elections. The arrival of biosimilars in the US and other major markets may take some pressure off calls for increased government cost-containment and price controls in the US and other major markets.

Globally, there is a trend for the imposition of pharmaceutical price controls by governments. This includes one of the largest and rapidly growing markets, mainland Chi which is increasingly imposing lower prices on bio/pharmaceuticals as a condition for government health insurance coverage for the products. China’s Volume-based Procurement initiatives are being implemented and studied. Some analyses have drawn clear conclusions that such price controls inhibit R&D innovation and do not necessarily move a region away from “me-too” type generic-drug strategies.

As industry groups point out, any new price controls, particularly if imposed in the US (still the source for the most pharmaceutical R&D and pharmaceutical sales/revenue and where most companies are based), will likely have adverse effects, including inhibiting investment in product R&D, clinical trials, manufacturing, and marketing.

Optimistic future for bioprocessing

The biopharmaceutical industry has continued to grow, evolve, and diversify over the past 40 years. This has demanded new and improved bioprocessing technologies to meet product demand, reduce costs, increase efficiencies, and comply with safety and regulatory requirements. This has led to improvements in productivity as the industry’s processing and development pipelines have matured. The current situation in the biopharmaceutical industry is exciting, with new technologies and markets, such as COVID 19 and other pandemic and biodefense, biosimilars, cellular and gene therapies, and many other new opportunities in both established and emerging markets.

Based upon what industry leaders and decision makers said in BioPlan’s 18th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, BioPlan projects an optimistic future vision for bioprocessing.

BioPlan is currently fielding its survey for its 19th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, which will be released in May (May 2022)) and is interested in the input of biopharmaceutical companies, CDMOs, and other suppliers. Click here to take the survey.

About the Author

Joel Ranck, Market Analyst at BioPlan Associates, is a market strategist with extensive experience in science, medicine, public health, healthcare, research, and higher education. His expertise includes primary and secondary research and market analysis of biopharma segments. His work has spanned the globe from Central Europe, South America, and the US. jranck@bioplanassociates.com, +1 301-921-5979, www.bioplanassociates.com.