Cambrex CEO Outlines Company’s Growth Strategy

|

|

Steven Klosk |

Cambrex is moving forward with a growth plan following the recent sale of the company for $2.4 billion to an affiliate of the investment firm, Permira Funds, a series of expansions, and two large-scale acquisitions to build its capabilities as an end-to-end provider of drug substances and drug products. Steven Klosk, CEO of Cambrex, detailed the company’s growth plan at the DCAT Member Company Announcement Forum—Virtual Edition, a special online forum of the major news announcements from DCAT member companies originally to be made March 23, 2020 at DCAT Week ’20 in New York.

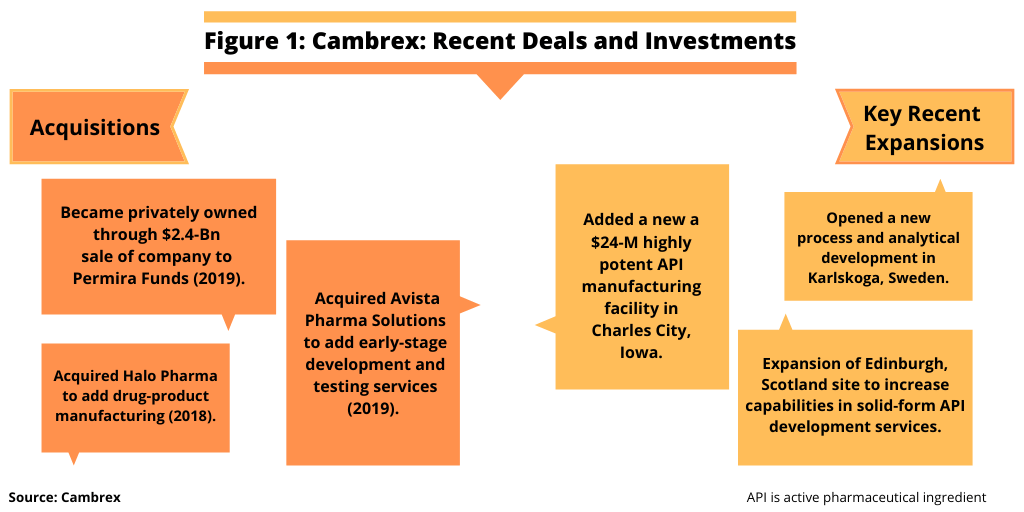

Klosk explained that the company’s strategy is based on being a full-service provider of small-molecule development and manufacturing services for both drug substances and drug products. Cambrex, already positioned in small-molecule active pharmaceutical ingredient (API) development and manufacturing services, added drug-product capabilities through its $425-million acquisition of Halo Pharma in 2018 and early-stage development and testing services through its $252-million acquisition of Avista Pharma Solutions in 2019 (see Figure 1).

Following the integration of those businesses, Cambrex is now organized into three business units: drug substance, drug product, and early-stage development and testing. The drug-substance business incorporates its clinical development and commercial manufacturing of APIs, as well as specialist capabilities, such as the handling of controlled and highly potent substances, continuous flow chemistry, biocatalysis, and solid-state science.

The drug-product business has expertise in the formulation and development of conventional and specialist dosage forms, including oral solids, semi-solids, and liquids, as well as fixed-dose combination products, pediatric formulations and dosage forms, bi-layer tablets, stick packs, topical products, and sterile and non-sterile ointments.

The early-stage discovery and testing business offers early clinical-phase support for projects requiring smaller quantities of drug-substance and drug-product supply in addition to offering stand-alone analytical services, such as microbiology testing and cleanroom validation, and compendial and drug-release testing.

Klosk explained that the company’s focus on small molecules remains the same and its strategy is to provide an integrated offering for small molecules from preclinical development through to commercial launch. This strategy, he said, is supported by the number of FDA approvals for small molecules, which remains high, and by a healthy clinical development pipeline. Sixty-five percent of the current clinical pipeline projects are sponsored by small pharma companies, which, Klosk says for Cambrex, presents the opportunity to approach different potential customers with a choice of outsourcing models: drug substance, drug product, or analytical testing services, or an end-to-end partner.

In all, the addition of Halo Pharma and Avista Pharma Solutions added more than 800 employees and six new facilities to Cambrex, and the company’s workforce now numbers more than 2,000 employees at 12 manufacturing locations across North America and Europe: For drug substances, the company has facilities in five site locations: Charles City, Iowa; Karlskoga, Sweden; Paullo, Italy; Tallinn, Estonia; and Wiesbaden, Germany. For drug products, the company has facilities in two site locations: Mirabel, Quebec, Canada and Whippany, New Jersey. Finally, the company has five facility locations for early-stage development and testing: High Point, North Carolina; Durham, North Carolina; Agawam, Massachusetts; Longmont, Colorado; and Edinburgh, Scotland.

In addition to acquisitions, Cambrex is growing organically through a series of expansions, of which Klosk highlighted three projects completed or announced in 2019 to boost capacity and capabilities (see Figure 1). In Charles City, Iowa, a $24-million highly potent API facility was completed to enable manufacturing campaigns of batch sizes up to 300 kg; a new Process and Analytical Development R&D Center was opened in Karlskoga, Sweden; and an expansion at the company’s Edinburgh, Scotland site will increase the company’s capabilities in solid-form API development services.

Cambrex’s growth strategy going forward will now occur as a privately owned company. In December 2019, Cambrex, formerly a publicly traded company, announced the $2.4-billion acquisition of the company by an affiliate of Permira Funds, an investment firm. “The Permira Funds’ investment supports the ongoing growth of Cambrex by enhancing the company’s ability to service its global customer base and broadening its capabilities to provide additional world-class services to support the analysis, development and manufacturing of drug substances and drug products,” said Klosk.