Lonza Updates Plan for New Mammalian Biomanufacturing Facility in China

|

|

David Maier |

Lonza is proceeding with plans for a new mammalian biologics development and manufacturing facility in Guangzhou, China. David Maier, Head of China Strategic Growth Projects, Mammalian & Microbial Development & Manufacturing, Lonza, outlined the details of the expansion and how it fits into the company’s overall biomanufacturing network at the DCAT Member Company Announcement Forum—Virtual Edition, a special online forum of the major news announcements from DCAT member companies originally to be made March 23, 2020 at DCAT Week ’20 in New York.

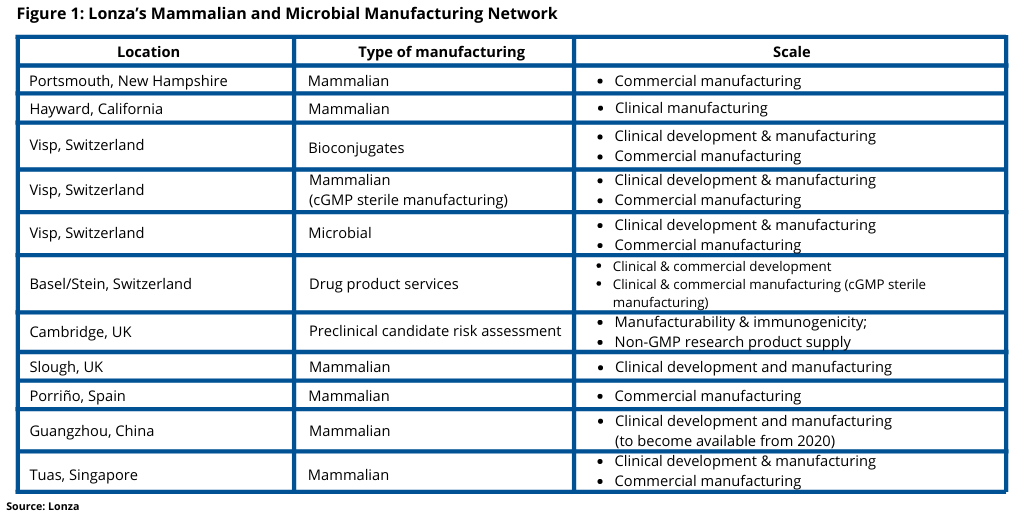

The new 17,000-square-meter mammalian biologics development and manufacturing facility is in Sino-Singapore Guangzhou Knowledge City, an industrial park in Guangzhou, China. The facility is the product of a three-way agreement between Lonza, GE Healthcare (now Cytiva following the completion of the $21.4-billion acquisition by Danaher of GE Healthcare Life Sciences in March 2020), and the Guangzhou Development District (GDD), which was signed in 2018, and under which Cytiva and the GDD built and Lonza bought and will operate the facility. Lonza expects to begin operational qualification activities of the plant later in 2020 and to begin laboratory and manufacturing operations for new CDMO projects in early 2021. The Guangzhou site is the company’s seventh mammalian site in the company’s mammalian and microbial biomanufacturing network (see Figure 1), which includes mammalian development and manufacturing sites in the US, Switzerland, Spain, the UK, and Singapore.

Lonza will offer CDMO services from this facility that will include Cytiva’s KUBio cGMP modular manufacturing platform offering single-use biologics manufacturing at 1,000-liter and 2,000-liter scales as well as laboratories and facilities for cell-line construction, cell banking, process development, technical transfers, analytics and testing, and quality control. The facility consists of 6,500 square meters of lab space and one KUBio modular biomanufacturing unit.

The Phase 1 part of the facility includes the addition of development labs, and pilot-, clinical-, and commercial-scale manufacturing capabilities, and offices. The facility will focus on mammalian biologics manufacturing for active pharmaceutical ingredients, primarily CHO (Chinese hamster ovary)-based monoclonal antibodies although the facility will be capable of other production modalities.

In addition, Lonza has secured contiguous, adjacent land to the facility for Phase 2 expansion opportunities, which the company says potentially could include drug-product fill–finish facilities, additional small-scale single-use biomanufacturing assets, and/or large-scale stainless-steel assets.

The biomanufacturing site adds to Lonza’s already existing manufacturing capabilities in China of chemicals, small-molecule drug-substance and dosage-form manufacturing.

Lonza’s Maier explained that the company’s expansion in China is due to increasing growth in biologics and for CDMO biologics services in the country. To underscore the growth of biologics in China, Maier offered industry estimates that analyzed the number of antibody products in China. In 2020, the estimated number of antibody products (marketed and in development) in China is 504, up from 67 in 2015. In Europe, there are an estimated 667 antibody products (marketed and in development) in 2020, up from 559 in 2015. In the US, there are an estimated 834 antibody products (marketed and in development) in 2020, up from 602 in 2015 (1). From a CDMO perspective, biologics CMDO growth is outpacing overall pharmaceutical industry growth and biologics growth, particularly in China. The compound annual growth rate (CAGR) between 2019 and 2025 of the biologics market in China is projected at 18% compared to 8% in the US. For the biologics CDMO market, the CAGR in China is projected at 28% compared to 7% in the US (2).

References

- Citeline, March 2020.

- Frost & Sullivan, 2019; Roots analysis, 2017.