2020 Vision: China and Pharma

China is the second largest national pharmaceutical market in the global pharma industry and a large supplier of pharma ingredients globally. In the wake of COVID-19 and related economic and supply impacts, will that role change, and if so, how?

Sourcing from China in the wake of the COVID-19 pandemic

One of the major issues facing pharmaceutical companies, CDMOs/CMOs, and suppliers arising from the COVID-19 pandemic is what steps, if any, need to be taken to reduce supply-chain vulnerabilities. Although this issue applies across global manufacturing and supply networks, sourcing from China, both chemicals and pharmaceutical ingredients, has come to the fore with a series of policy proposals in the US and the European Union (EU) as well as calls from pharmaceutical industry groups, such as the Association of Accessible Medicines, which represents generic-drug and biosimilar manufacturers in the US, and Medicines for Europe, which represents generic-drug and biosimilar manufacturers in Europe, to move forward with plans to re-shore certain aspects of drug manufacturing respectively to the US and EU.

Even before the COVID-19 pandemic, however, evaluation of pharmaceutical supply chains and dependence on offshore sources in pharmaceutical production was occurring in the US. Last fall (October 2019), Janet Woodcock, Director of the Center for Evaluation and Research (CDER) at the US Food and Drug Administration (FDA), testified before the Subcommittee on Health, Committee on Energy and Commerce, US House of Representatives, to provide information on the US position in global pharmaceutical supply chains.

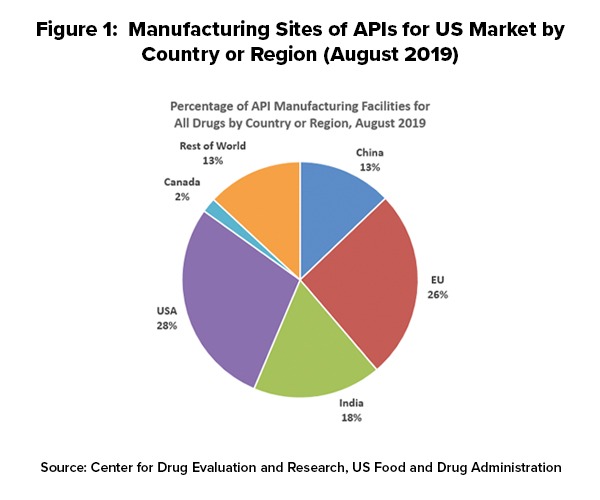

As of August 2019, 28% of the manufacturing facilities making APIs for US markets were based in the US. The remaining 72% of the API manufacturers supplying the US market were outside the US, which includes 13% in China (see Figure 1). The analysis applies to all FDA-regulated products, which includes prescription drugs (branded and generic), over-the-counter (OTC) drugs, and compounded medications.

Outside the US, the European Union (EU) represents the largest source of APIs manufactured for US-marketed drugs at 26%, representing the historical and current position of EU-based fine chemical and API manufacturers as well as offshore facilities of pharmaceutical manufacturers. India follows at 18% of APIs supplied to the US and then China at 13% (see Figure 1).

In explaining geographic shifts in API production for US-marketed drugs over the past decade, Woodcock pointed to a variety of factors, including lower-cost labor costs, as a major contributing factor. She cited a 2009 paper by the World Bank, “Exploratory Study on Active Pharmaceutical Ingredient Manufacturing for Essential Medicines,” which specified if a typical Western API company has an average wage index of 100, this index is as low as 8 for a Chinese company and 10 for an Indian company (note: this analysis, published in 2009, does not reflect subsequent cost adjustments or cost equalization since 2009). She also pointed to lower energy costs (electricity and coal) and lower water costs in China as well as a network of raw materials and intermediary suppliers that can provide lower shipping and transaction costs for raw materials.

The generic-drug industry is particularly reliant on China as a source for APIs and other materials, including products such as antibiotics. Earlier this year, the Association for Accessible Medicines (AAM), released a report, A Blueprint for Enhancing the Security of the US Pharmaceutical Supply Chain, a six-element framework that lays out actions that the federal government could take to ensure a consistent supply of critical pharmaceuticals. The blueprint builds upon the existing generic pharmaceutical supply chain in the US, which produces more than 61 billion doses annually in nearly 150 manufacturing facilities across the US, according to information from the AAM.

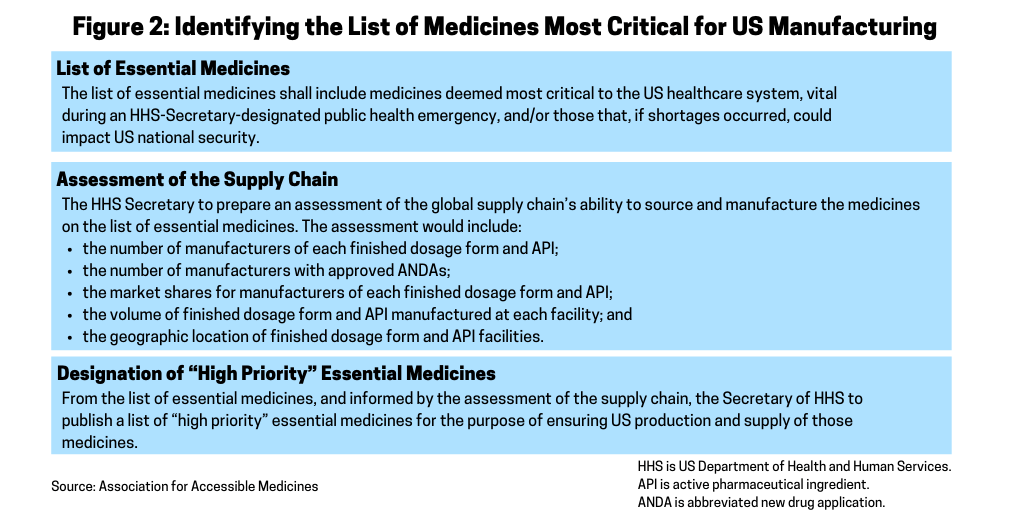

A key part of the AAM’s blueprint for securing the US pharmaceutical supply chain is to provide the Secretary of the Department of Health and Human Services (HHS) the authority to establish a list of essential medicines for the US (see Figure 2). The AAM recommends that within 180 days of the enactment of the blueprint, the HHS Secretary would establish a list of essential medicines for the US. Essential medicines are defined as the active pharmaceutical ingredient (API) and finished dosage form. The list of essential medicines includes medicines deemed most critical to the US healthcare system during an HHS Secretary-designated public health emergency and/or those that, if shortages occurred, could impact US national security. In developing the list, the AAM suggests that the HHS Secretary consult with the FDA, the Centers for Disease Control and Prevention (CDC), the National Institutes of Health (NIH) and other public-health agencies as well as the Secretary of Defense and Secretary of State. The list of essential medicines would be subject to a 60-day public comment period.

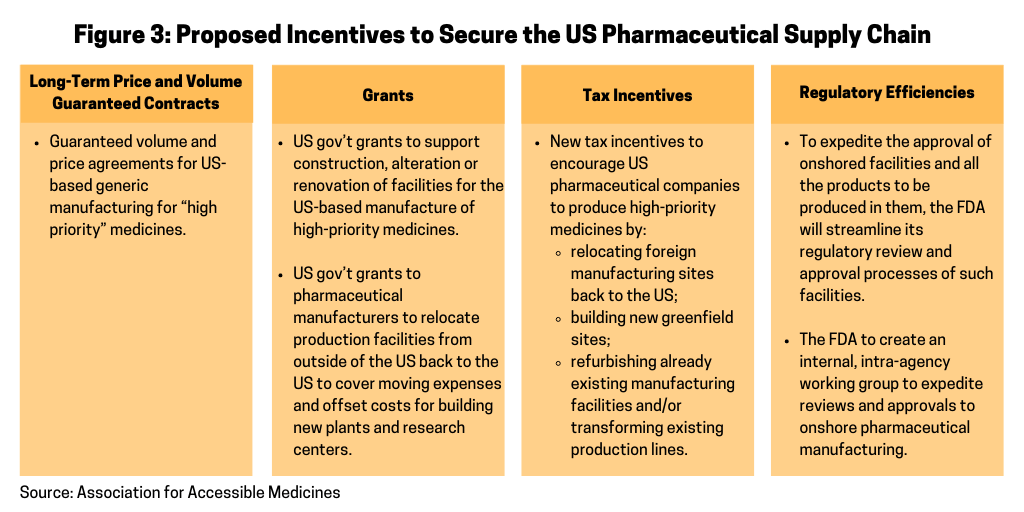

In its blueprint, the AAM outlines several incentives as a means to encourage pharmaceutical manufacturers to repatriate pharmaceutical manufacturing to the US and ways to offset the costs for doing so (see Figure 3). The AAM’s proposal specifies that within six months of the completion of the list of “high priority” medicines, the HHS, acting through the Office of the Assistant Secretary for Preparedness and Response under the HHS, would seek new and specific proposals from pharmaceutical manufacturers to determine how individual companies can help secure the US pharmaceutical manufacturing base for priority medicines. Proposals would include the list of specific finished dosage forms and APIs the company proposes manufacturing in the US and the specific type of incentives necessary to make the facilities economically viable. The HHS would be authorized to make such incentives available as described in Figure 3.

The outbreak of COVID-19 in Europe also has sparked a renewed debate about strengthening medicines supply chains and manufacturing in Europe. “The first step should be to support existing manufacturing capacity and be innovative to support its expansion,” said Medicines for Europe in a July 9, 2020 statement. “This includes a mix of smart policy making in the following key areas: investment, competitiveness, market-based incentives and a modernized regulatory framework.” The group made those comments in offering its view of the European Commission’s proposed Pharmaceutical Strategy for Europe. The European Commission had put on its agenda for 2020 a work program to develop a pharmaceutical strategy for the EU, and EU health ministers met earlier this year (May 2020) to discuss the strategy and to begin to develop a five-year plan, for which certain key goals, such as providing access to medicines at affordable prices and ensuring the supply of medicines, has taken on greater importance in the wake of issues arising from the COVID-19 pandemic. A public consultation period is open through mid-September (September 2020) and the European Commission is seeking to adopt a final strategy by the end of this year (2020).

Reshoring drug manufacturing is also among a series of legislative proposals introduced in the US Congress this year (2020) in response to the COVID-19 pandemic as well as last year (2019) that call for an assessment of US-based drug manufacturing and measures to ensure US-based production of critical or essential drugs. The most recent was in late June (June 2020) by US Senators Marco Rubio (R-FL) and Elizabeth Warren (D-MA), who introduced bipartisan legislation to direct the Federal Trade Commission (FTC) and the Secretary of the Treasury—acting through the Committee on Foreign Investment in the United States (CFIUS)—to conduct a study on the US reliance on foreign countries and the impact of foreign direct investment on the US pharmaceutical industry and DNA analysis industries. In March (March 2020), Senator Rubio introduced another piece of bipartisan legislation that directs the Department of Defense to determine the extent of its dependency on foreign entities for drugs, active pharmaceutical ingredients (APIs), and pharmaceutical components.

Certain bills specifically identify sourcing practices from China. In March (March 2020), Senator Tom Cotton (R-AR) introduced Protecting Our Pharmaceutical Supply Chain from China Act of 2020 (S. 3537) to require that the Secretary of Health and Human Services maintain a list of the country of origin of all drugs marketed in the US and to ban the use of federal funds for the purchase of drugs manufactured in China.

A reduction of reliance on offshore drug manufacturing is also on the policy table in the EU. As part of the European Commission’s Pharmaceutical Strategy for Europe, which the European Commission hopes to finalize by the end of 2020, the plan calls for ways to reduce the EU’s dependency on imports of APIs, other ingredients, and pharmaceuticals from third-countries, meaning countries not part of the EU or territories of EU member states. The EC points to the EU’s dependence on APIs necessary for the production of some generic medicines, including antibiotics, oncologic medicines and basic medicines, such as paracetamol /acetaminophen, a common over-the-counter analgesic, from China and India.

In offering comments on the European Commission’s roadmap for its pharmaceutical strategy, the European Fine Chemicals Group (EFCG), which represents fine-chemical producers in Europe and a sector group of the European Industry Chemical Council (CEFIC), which represents European chemical manufacturers, underscored the need to repatriate pharmaceutical manufacturing back to the EU to reduce vulnerabilities in the pharmaceutical manufacturing value chain in the EU, particularly for generic drugs, and for starting materials and process chemicals for both innovator and generic drugs. It is proposing a selective reshoring of key building blocks of the pharma supply chain that leverages existing EU manufacturing capabilities.

The COVID-19 pandemic has created momentum for these and other proposals, such as requiring country-of-origin labeling in drug packaging suggested by some industry groups, that would require and/or create financial incentives for drug manufacturers to re-evaluate their supply chains and to re-shore part of their supply chains. How, and to what extent, these proposals take root and come to fruition will be an important issue for the pharmaceutical industry in the near and long term.