Novartis Details Pure-Play Innovative Growth Strategy

Novartis CEO Vas Narasimhan recently outlined the company’s strategy of being a “pure-play” innovator drug company focused on five core therapeutic areas with eight potential multi-billion drugs in play.

CEO

Novartis

Emphasis on Innovative Medicines business

Novartis’ strategy is focused on growing its core Innovative Medicines business, a goal emphasized by a recent organizational change announced in April (April 2022) and the decision to spin off Sandoz, its generics and biosimilar’s business, into a stand-alone company, a move announced in late August (August 2022).

“Novartis is transforming into a ‘pure-play’ Innovative Medicines company,” said Vas Narasimhan, CEO of Novartis, in a September 22, 2022 statement, as the CEO outlined the company’s strategy and progress in meeting its financial goals. “Our strategy is focused on five core attractive therapeutic areas, key technology platforms, and the US market, with the aim to increase value per new molecular entity from our deep pipeline.” The company is targeting sales growth at a +4% compound annual growth rate through 2027 and a core operating income margin of approximately 40%+ in the mid to long term.

One key component for the strategy of Novartis is to implement a new organizational structure and operating model with the aim of achieving cost savings of $1 billion in selling, general and administrative expenses by 2024 (see Figure 1). Novartis had first announced the new operating structure in April (April 2022). The company is integrating its Pharmaceuticals and Oncology business units into an Innovative Medicines business to create two separate commercial organizations—Innovative Medicines US and Innovative Medicines International. The two units have full profit and loss responsibility across all therapeutic areas and ownership of customer experience, marketing and sales, and market access for their respective markets. The new model will support the company’s core therapeutic areas in cardiovascular, hematology, solid tumors, immunology and neuroscience.

The second key move by Novartis is spinning off Sandoz, its generics and biosmilars business, into a new publicly traded stand-alone company, a move announced by the company in late August (August 2022). The decision follows its previous announcement in October 2021, in which Novartis announced a strategic review of Sandoz. The stand-alone Sandoz would be headquartered in Switzerland and be listed on the SIX Swiss Exchange, with an American Depositary Receipt program in the US. The Sandoz spin-off transaction is expected to be completed in the second half of 2023.

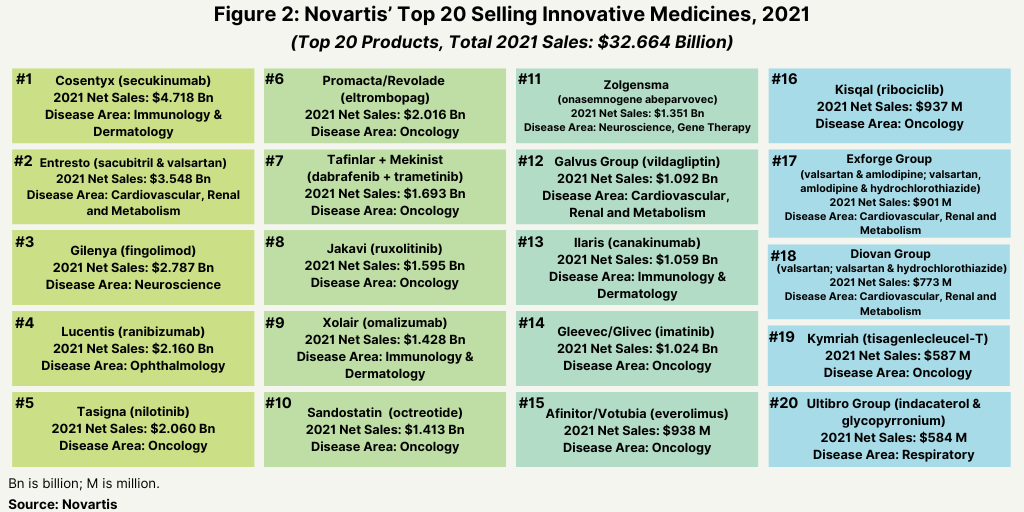

Therapeutic focus and eight potential multi-billion peak-sale products

In implementing its growth strategy for its Innovative Medicines business, Novartis is focused on five therapeutic areas: cardiovascular, immunology, neuroscience, solid tumors and hematology. The company is targeting eight current in-market brands for multi-billion peak sales potential: Cosentyx (secukinumab), Entresto (sacubitril/valsartan), Zolgensma (onasemnogene abeparvovec), Kisqali (ribociclib), Kesimpta (ofatumumab), Leqvio (inclisiran), Pluvicto (lutetium Lu 177 vipivotide tetraxetan), and Scemblix (asciminib). Three of those drugs—Cosentyx (secukinumab), Entresto (sacubitril/valsartan) and Zolgensma (onasemnogene abeparvovec)—had already achieved blockbuster status (defined as drugs with sales of $1 billion) or more. Figure 2 outlines Novartis’ top-selling products in 2021.

The company sees further peak-sales potential for these three drugs. Cosentyx (secukinumab), a biologic to treat psoriasis, ankylosing spondylitis, and psoriatic arthritis, has forecasted peak sales through 2026 of more than $7.0 billion, according to information from Novartis released in December 2021. Entresto (sacubitril/valsartan), a small-molecule drug to treat heart failure, has forecasted peak sales through 2026 of more than $5.0 billion. Zolgensma (onasemnogene abeparvovec), a gene therapy to treat a rare neuromuscular disease, spinal muscular atrophy, has forecasted peak sales through 2026 in the multi-billion range.

Other multi-billion peak sales drugs identified by Novartis include: Kesimpta (ofatumumab), a biologic for treating relapsing forms of multiple sclerosis; Kisqali (ribociclib), a small-molecule drug used to treat certain types of breast cancer and which sales of $937 million in 2021; and Leqvio (inclisiran), a chemically synthesized siRNA therapy to reduce low-density lipoprotein cholesterol. Novartis gained inclisiran in its $9.7-billion acquisition of The Medicines Company in 2020.

Two recent approvals are also slated for multi-billion peak sales potential. Pluvicto (lutetium Lu 177 vipivotide tetraxetan), a prostate cancer drug, was approved by the US Food and Drug Administration earlier this year (May 2022). It was specifically approved for treating adult patients with prostate-specific membrane antigen positive metastatic castration-resistant prostate cancer who have been treated with androgen receptor (AR) pathway inhibition and taxane-based chemotherapy. The FDA also approved Locametz (gallium Ga 68 gozetotide), a radioactive diagnostic agent, to detect this type of prostate cancer. Novartis gained the drug from its $3.9-billion acquisition of Advanced Accelerator Applications in 2018.

Scemblix (asciminib), a drug for treating chronic myeloid leukemia, was approved by the FDA in October 2021. It was specifically approved for treating Philadelphia chromosome-positive chronic myeloid leukemia in chronic phase, previously treated with two or more tyrosine kinase inhibitors, and approved asciminib for adult patients with Philadelphia chromosome-positive chronic myeloid leukemia in chronic phase with the T315I mutation.

Focus on the US market

These eight products are underpinning growth across all key geographies, and also supports Novartis’ goal of organically building its US business to become a top-five player in the US by 2027. The company is focusing on what it calls a “US-first” mindset by increasing share of US patients in clinical trials, building capability and talent, and through other actions, to enable it to achieve this objective. Novartis says it is also aims to be a top-three player in China, a key growth market identified by the company for the next decade, while maintaining leading positions in Germany and Japan.

Technology and modality focus

In addition to two established platforms in chemistry and biotherapeutics, three newer platforms—gene & cell therapies, radioligand therapies, and “xRNA” —are being prioritized by Novartis for continued investment into new R&D capabilities and manufacturing scale. The company has over 50 projects in exploratory to early clinical development in these new platforms.