Off the Charts: Pfizer Sets Industry Record for Revenues

Led by its COVID-19 vaccine, Pfizer reported record-breaking 2021 revenues, both on an industry and company level. What were its revenue gains, and how did its other products fare?

A record year for Pfizer and the industry

Pfizer reported its full-year 2021 revenues this week (February 8, 2022) and it made history by recording the largest revenue in its history and the largest revenue by a bio/pharmaceutical company in the industry’s history. Led by Comirnaty, its COVID-19 vaccine developed with BioNTech, Pfizer reported full-year 2021 revenues of $81.3 billion, a 95% increase over its 2020 revenues of $41.65 billion. Comirnaty was the lead contributor to this revenue gain. The COVID-19 vaccine generated 2021 global revenues of $36.78 billion, making it the largest revenue-generator for a single product for a given year in the history of the bio/pharmaceutical industry.

“In the early days of the COVID-19 pandemic, we committed to use all of the resources and expertise we had at our disposal to help protect populations globally against this deadly virus, as well as to offer treatments to help avoid the worst outcomes when infections do occur,” said Pfizer Chairman and CEO Albert Bourla, in a February 8, 2021 statement. “We put billions of dollars of capital on the line in pursuit of those goals, not knowing whether those investments would ever pay off. Now, less than two years since we made that commitment, we are proud to say that we have delivered both the first FDA-authorized vaccine against COVID-19 (with our partner, BioNTech) and the first FDA-authorized oral treatment for COVID-19.”

He added that: “These successes have not only made a positive difference in the world, but I believe they have fundamentally changed Pfizer and its culture forever. Everywhere I look in the company, I see colleagues who are inspired by what we have achieved to date and filled with determination to be part of the next breakthrough that could change the world for patients in need. As we enter a new year, I look forward to all we will accomplish together.”

In announcing the company’s 2021 results, Frank D’Amelio, Chief Financial Officer and Executive Vice President of Pfizer also issued the company’s 2022 financial guidance, which if achieved, would represent the highest level of annual revenues and adjusted diluted earnings per share (EPS) in Pfizer’s history. Its 2022 guidance estimates revenues of $98.0 to $102.0 billion and adjusted diluted EPS of $6.35 to $6.55.

For 2022, Pfizer is projecting revenues for its COVID-19 vaccine of $32 billion, slightly down from the vaccine’s 2021 reported revenues of $36.78 billion, which includes doses expected to be delivered in fiscal 2022 under contracts signed as of late-January 2022. The company, however, is projecting large gains for its other COVID-19 product, Paxlovid (nirmatrelvir tablets and ritonavir tablets, co-packaged for oral use), an oral antiviral COVID-19 treatment. The company’s 2022 guidance projects revenues of $22 billion, which reflects treatment courses expected to be delivered primarily under supply contracts signed or committed as of late January 2022.

Paxlovid was authorized for emergency by the US Food and Drug Administration in late December 2021 for for the treatment of mild-to-moderate coronavirus disease (COVID-19) in adults and pediatric patients (12 years of age and older weighing at least 40 kilograms or about 88 pounds) with positive results of direct SARS-CoV-2 testing, and who are at high risk for progression to severe COVID-19, including hospitalization or death. Paxlovid consists of nirmatrelvir, which inhibits a SARS-CoV-2 protein to stop the virus from replicating, and ritonavir, which slows down nirmatrelvir’s breakdown to help it remain in the body for a longer period at higher concentrations. Paxlovid is administered as three tablets (two tablets of nirmatrelvir and one tablet of ritonavir) taken together orally twice daily for five days, for a total of 30 tablets. Paxlovid is not authorized for use for longer than five consecutive days.

The combined projected revenues for Pfizer’s COVID-19 products for 2022—its COVID-19 vaccine, Comirnaty, and its oral antiviral drug, Paxlovid, if achieved , would be $54 billion, equaling or surpassing the total revenues of any other bio/pharmaceutical company (using bio/pharmaceutical product revenues as a comparative indicator using 2020 sales as a measure).

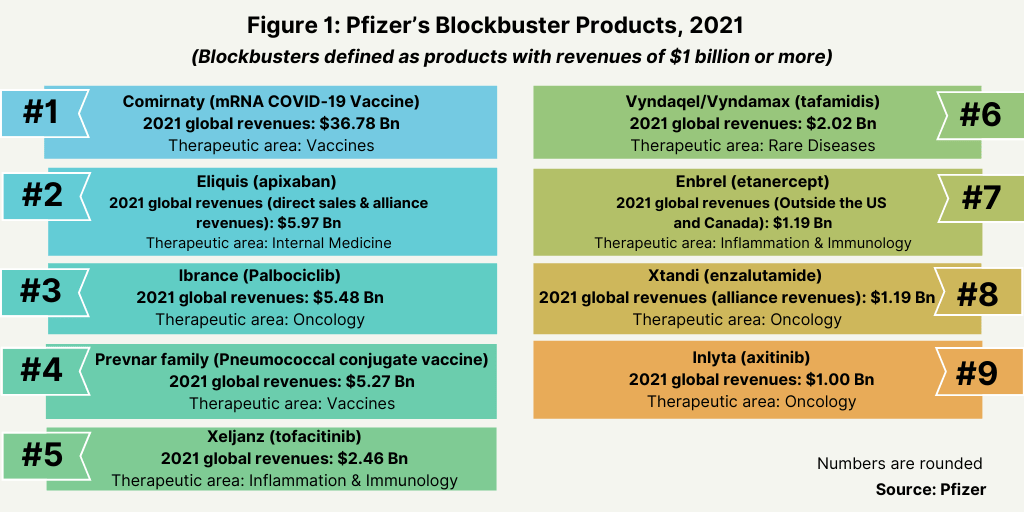

Other Pfizer’s blockbusters

In all for 2021, Pfizer had nine blockbuster products (defined as products with sales of $1 billion) (see Figure 1). Its COVID-19 vaccine was the largest revenue-generating product, representing roughly six times the revenues of its next two best-selling products: Eliquis (apixaban), an anticoagulant developed with Bristol-Myers Squibb with 2021 global revenues of $5.97 billion and the anti-cancer drug, Ibrance (palbociclib) with 2021 global revenues: $5.48 billion (see Figure 1).