Small-Molecule Drugs: The Innovation Battle

Small molecules again dominated new drug approvals by the FDA in 2021, but which companies had approvals? Is innovation coming from the large or small companies?

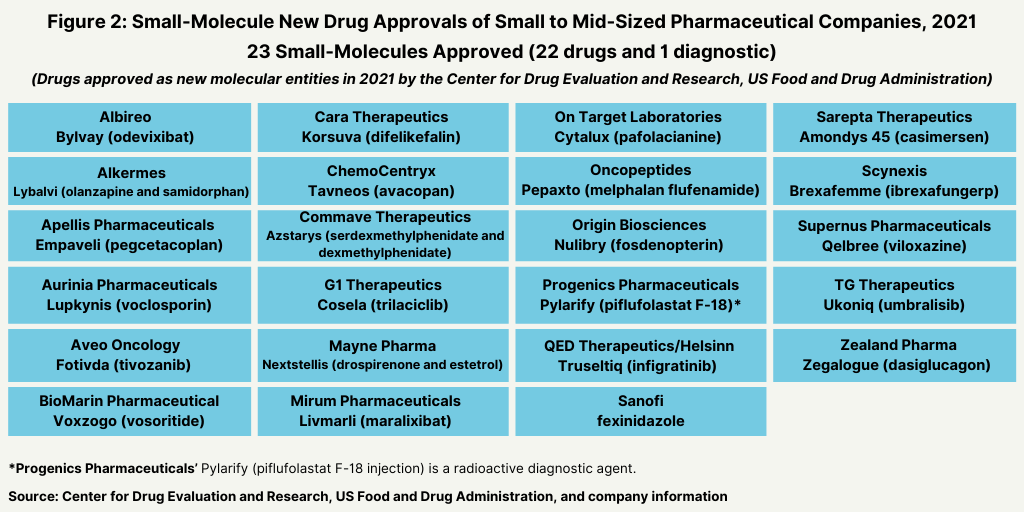

Product mix of new drug approvals in 2021

In terms of product mix, small-molecule drugs dominated approvals of new molecular entities (NMEs) by the US Food and Drug Administration’s Center for Drug Evaluation and Research in 2021. Of the 50 NMEs approved in 2021, 36, or 72%, were small molecules, and 14, or 28%, were biologics. This continues a recent trend of having approximately three-fourths of NME approvals be small molecules. In 2020, 75% or 40 of the 53 NMEs were small molecules. In 2019, 79% of NME approvals were small molecules; in 2018, it was 71% and 74% in 2017.

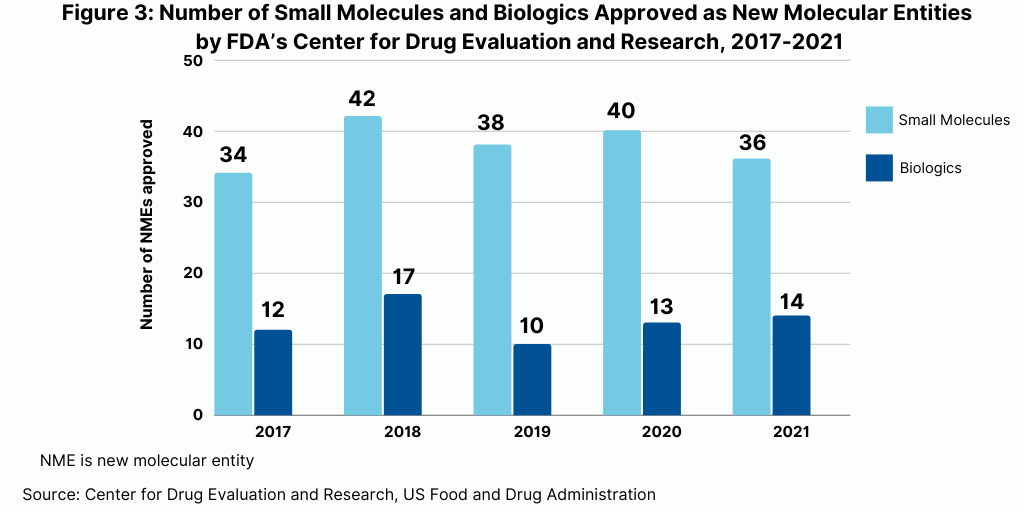

Big Pharma and small-molecule drug approvals

Of the 36 small molecules approved as NMEs in 2021, the large pharmaceutical companies accounted for 13, or 36%, of the NME small-molecule approvals in 2021 (see Figure 1).

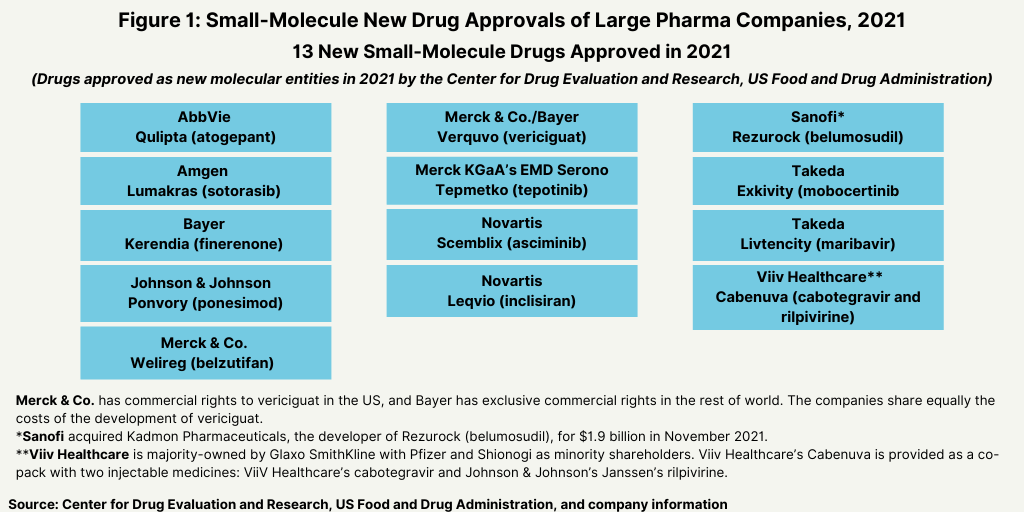

Smaller companies and new small-molecule approvals

Meanwhile, small companies accounted for 23, or 64% of the small-molecule NME approvals in 2021 (see Figure 2).

Small-molecule NME approvals: keeping with historical trends

The dominance of small-molecule new drug approvals in 2021 was consistent with historical levels over the past five years, which has seen relatively stable levels of the number of small-molecules and biologics approved (see Figure 3).