The European Chemical Industry Seeks More Action To Combat the Energy Crisis and Mfg Risk in Europe

The European Chemical Industry Council (Cefic) is calling for more action to address Europe’s energy crisis. For the first time ever, the EU is importing more chemicals than it exports, and Cefic is proposing specific measures to address the energy crisis and the adverse impact on chemical production.

Rising energy prices and impact on European chemical production

Facing high energy prices and the resulting financial pressures on chemical production in Europe, the European Chemical Industry Council (Cefic), which represents European chemical manufacturers, is calling for more action by the European Commission and European Union (EU) member states to address the energy crisis in Europe. Cefic has put forth a detailed proposal for EU authorities to take to address rising energy prices in an effort to mitigate declining chemical production in Europe and the negative financial impact on chemical manufacturers in Europe.

Director General

Cefic

“We are approaching the point of no-return: if no emergency solution to the energy prices is provided to our sector, we are not far off the breaking point,” said Marco Mensink, Cefic Director General, in an October 14, 2022 statement. “Hundreds of businesses in the chemical sector are already in survival mode, and we have started seeing the first closures. We need action now.”

The adverse impact on rising energy prices in Europe is evidenced by a first-time chemicals trade deficit in Europe. For the first time ever, the EU imports more chemicals than it exports, both in volume and value, resulting in a trade deficit of EUR 5.6 billion ($5.6 billion) for the first half of 2022.

The chemical industry is the fourth largest manufacturing industry in the EU and supplies all other value chains, including pharmaceuticals, and is one of the most energy-intensive industries in Europe. In 2019, the fuel and power consumption of the chemical industry including pharmaceuticals, in the 27 member states of the EU, amounted to 50.8 million metric tons of oil equivalent (about 591 TWh), according to information from Cefic and Eurostat, the statistical office of the EU. EU-27 gas and electricity account for nearly two thirds of total energy consumption (respectively 211 TWh and 166 TWh) in the EU. Gas consumption in the EU chemical industry accounts for about 10% of total EU gas consumption.

“Skyrocketing gas and electricity prices vis-à-vis competing economies, the potential risk of gas supply shortages and mandates of electricity consumption reduction are putting hundreds of chemical plants at risk throughout Europe,” said Cefic’s position paper on the energy crisis issued October 14, 2022.

The EU has taken action, but has it been enough?

EU authorities have taken a series of action to mitigate rising energy prices, which have largely resulted from the war in Ukraine and the decline in natural gas supplies from Russia. Russian energy supplies have dropped significantly in the EU, reflected in the decline in EU natural gas imports from Russia: from 45% in 2021, to just 14% in September 2022, according to information from the European Commission. To address lower energy supplies and resulting escalating energy prices, EU authorities have put into measures on both the demand and supply side. It put into place new minimum gas storage obligations requiring EU underground gas storage to be filled to 80% of capacity by November 1, 2022, and to 90% thereafter. Gas storage in the EU is now at more than 90%; it was 30% in February 2022. EU authorities also adopted the European Gas Demand Reduction Plan that set a target for EU member states to reduce gas demand by 15%, beginning August 1, 2022 through March 31, 2023, and authorized a triggering mechanism that could be applied when there is substantial risk of a severe gas shortage or exceptionally high gas demand to impose mandatory gas demand reduction in all EU member states. In September 2022, new measures were adopted to reduce electricity demand that set a target for EU member states to reduce overall electricity demand by 10% and an obligation of EU member states to reduce electricity demand during peak price hours by 5%. The European Commission estimates that reducing electricity demand by 5% at peak times would reduce gas use for power by around 4% over the winter and reduce pressure on prices. Earlier this month (October 18, 2022), the European Commission proposed new measures on joint gas purchasing, price-limiting mechanisms, and transparent infrastructure use, as well as on gaining further solidarity from EU member states on demand management.

But are those measures enough to mitigate rising energy prices and the adverse impact on chemical manufacturers in Europe? “We welcome the intent of the European institutions and Member States to address the impact of this crisis and strongly support the EU continuing to do its utmost to act to attract sufficient volumes of natural gas at cost-competitive prices,” Cefic said in its position paper issued October 14, 2022. “We encourage the European institutions to assess the unintended consequences of any policy option, in particular negative implications for the liquidity of wholesale markets and cross-border energy flows, as well as the impact on gas demand. Unfortunately, this is not enough,” said Cefic. “The impact of this prolonged energy crisis and diverging energy costs in Europe compared to the rest of the world is far-reaching, affecting the survival of entire industrial value chains in Europe. Moreover, we see the risk that an uncoordinated implementation of different measures will not only lead to a fragmentation of the internal energy market, but even to its regression. This would further harm European industry. National measures in place of EU-wide measures will harm the level playing field in the chemical and other European industries despite this being an important pillar of the EU internal market.”

The European chemical industry’s proposal for energy price relief

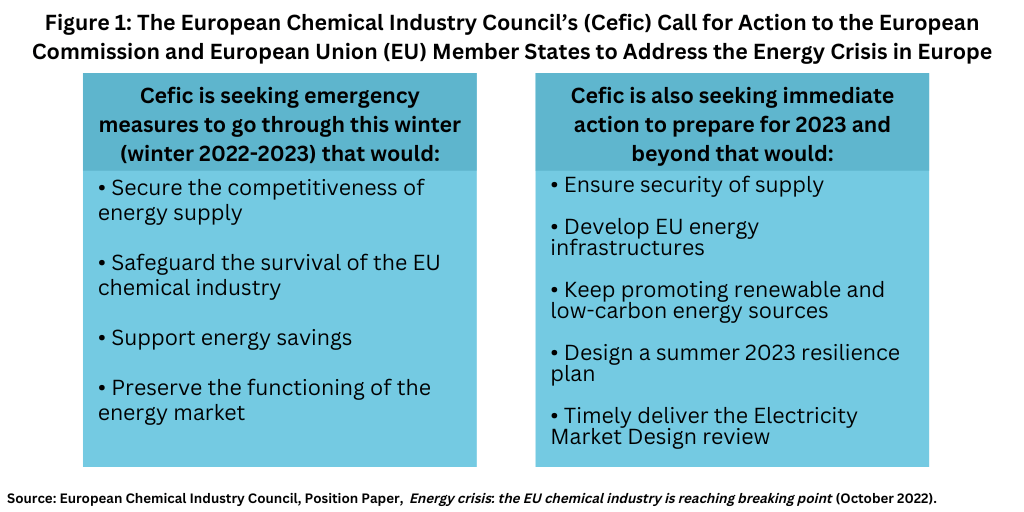

Cefic is calling on the European Commission and EU member states to immediately design and implement closely coordinated pan-European measures to limit the impact of energy prices vis-à-vis competing economies, increase energy supply, and incentivize reductions in energy consumption, which target the upcoming winter and prepare for 2023 and beyond. Figure 1 outlines the key elements that Cefic is proposing.

Emergency measures to get through the upcoming winter

To implement emergency measures to get through the upcoming winter, Cefic is proposing specific measures to secure the competitiveness of energy supply, safeguard the survival of EU industry, support energy savings, and preserve the functioning of the energy market. These measures are further outlined below.

Secure the competitiveness of energy supply. Cefic outlined several ways to secure the competitiveness of energy supply in the EU. It is calling for more international solidarity from EU allies (e.g., Norway and the US) to deliver their gas to Europe at cost-competitive prices. It is calling on EU authorities to remove obstacles to allow all available (idle and backup) power plants in Europe to increase the production of low-cost electricity, for all electricity-generation assets to minimize the use of natural gas in electricity, and to have the deployment of floating regasification units take place at the highest possible speed and without unnecessary administrative delays. It also wants to ensure that emergency measures target escalating energy prices, in particular for gas and electricity.

Cefic also is calling on EU authorities to reinforce RePower EU, a set of measures to reduce the EU’s dependence on Russian fossil fuels, in particular, the planned monetization of the Market Stability Reserve, which is designed to provide stability for the EU emissions trading system, as a means to lower power prices in the short term. It says these measures with other proposals by the European Commission would preserve the integrity of the carbon markets in the long term while contributing to a positive impact on the cost of electricity. It is also calling on EU authorities to design and implement measures to remove permitting bottlenecks hampering both short-term fuel-mix change and expansion of renewable energy and other low-carbon energy supply for both existing fuel installations and for new ones.

Safeguard the survival of EU industry. Cefic is also proposing several measures to support industry during the energy crisis. Overall, it is calling on EU authorities to alleviate the impact of energy-related costs for industries without causing an unintended increase in energy consumption and to ensure all energy-intensive industries are eligible for support. In addition, it is asking EU authorities to monitor and assess sanctions on trade flows from Russia, China, the US, and Turkey and the impact on EU manufacturing and to provide further supportive actions as appropriate.

It is also seeking access to financing mechanisms for industry, especially small-to-medium-sized enterprises, to prevent the further erosion of industrial value chains in Europe. It is also seeking other support measures for industry, including: measures for temporary technical unemployment; increases in temporary EU member state aid overall and for more sectors to be included; and tax policy that ensures that national energy tax levels do not exceed the minimum levels set in the EU Energy Tax Directive.

It is also seeking support for the design of reporting structures compliant with EU competition law to give short-term feedback on capacity reduction and closures and for such information to be available in much shorter lead times than the current ex-post statistics can provide. It is also calling for an expansion and fast tracking of the spending of the EU emissions trading system innovation fund so that crucial projects for future decarbonization continue to be pursued as well as to provide tax incentives to support industry.

Support energy savings. Cefic is also proposing several ways to support energy savings, including: giving direct support (grants and loans) to large companies and small-to medium sized enterprises for voluntary measures that reduce energy demand now; provide project funding by national governments under the EU State Aid frameworks; and incentivize voluntary measures by providing easy access and remunerating fuel.

Preserve the functioning of the energy market. In addition, Cefic is urging EU authorities to take actions to preserve the functioning of the energy market. It emphasizes the value in learning from the different proposals given by EU member states and related emergency measures while ensuring that they do not cause a risk to the security of supply and are considered as exceptional and strictly temporary. It also says these measures should be designed in such a way that they do not change the power merit order or result in an undue increase in gas consumption, which would endanger the security of gas supply.

Further actions to prepare for 2023 and beyond

Cefic is also seeking action now to further prepare for 2023 and beyond with several key goals as outlined below.

Ensure security of supply. Secure additional gas supplies for spring 2023 onwards to reassure the market, but also include all other energy carriers as securing energy supply is not only a gas issue.

Develop EU energy infrastructures. Define the planning of the necessary EU energy infrastructure to allow for much faster and competitive electrification and hydrogen transport in Europe, including for industries located in disadvantaged areas. Plan the necessary resources to be made available, especially for overcoming cross-border issues both within the EU and with other jurisdictions.

Keep promoting renewable and low-carbon energies. Accelerate the approval of pending authorization procedures for the deployment of renewable and low-carbon energies and energy infrastructures. Find a solution to shorten the permitting of renewable and low-carbon projects in Europe as soon as possible.

Design a resilience plan for summer 2023. Implement stress tests to determine electricity adequacy for the summer of 2023. Include both the gas and the power sector and the largest industrial energy consumers in the EU in the stress testing to avoid energy problems next winter.

Delivery on a timely basis the Electricity Market Design review: Create the enabling conditions to unlock the potential of electrification as a climate solution.