What’s Next for the New GSK After Consumer Healthcare Spin-off?

GlaxoSmithKline has completed the spin-off of its consumer healthcare business to form a separate stand-alone $11-billion company, Haleon. The move is part of a larger strategic plan by GSK’s CEO Emma Walmsley to drive growth in its core bio/pharmaceuticals business. What is next for the New GSK?

Haleon launches as a stand-alone company

This week (July 18, 2022), GlaxoSmithKline completed the spin-off its consumer healthcare business to form a separate stand-alone, publicly traded company. GSK had first announced plans for the spin-off in June 2021.

GSK’s Consumer Healthcare business was a joint venture between GSK and Pfizer. It was formed from the combination of the legacy GSK consumer healthcare business with the Novartis consumer healthcare business in 2015, and the subsequent combination of that resulting business with Pfizer’s consumer healthcare business in 2019. GSK hed a majority controlling interest in the joint venture of 68% and Pfizer 32%. Under the de-merger, Pfizer holds a 32% stake in Haleon while GSK holds a 13.5% stake. The remaining stake in Haleon is held by the shareholders of GSK. All the shareholders of GSK received one share of Haleon for each GSK share held on Jul 15, 2022. Pfizer announced plans to sell its overall stake in Haleon last month (June 2022).

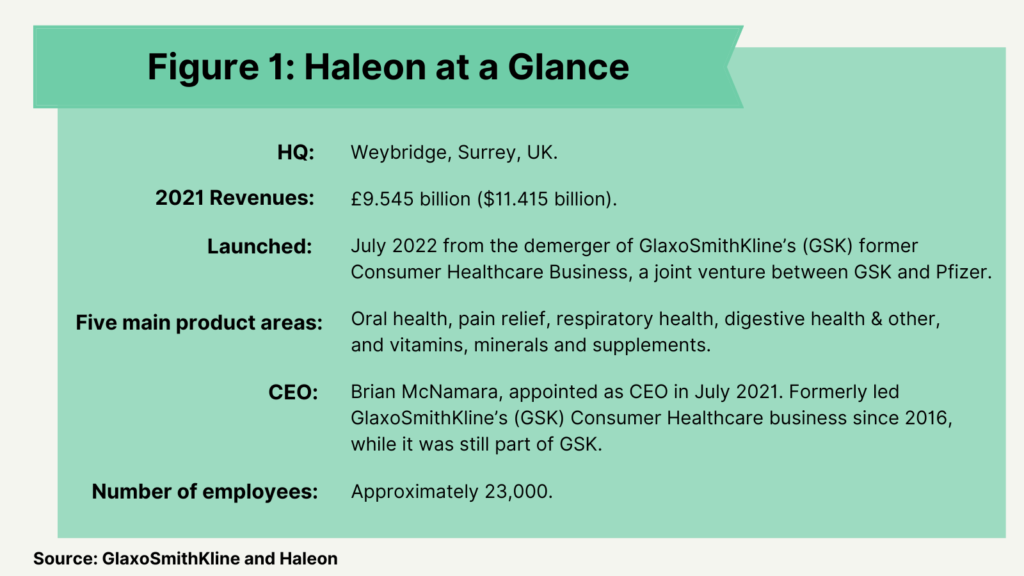

The business posted 2021 revenues of £9.5 billion ($11.4 billion), and the new company, Haleon, is headed by CEO Brian McNamara, who was appointed as CEO in July 2021 and formerly led GSK’s consumer healthcare business since 2016, while it was still part of GSK (see Figure 1). The new company, operates across five product segments: (1) oral health, which represented 29% of the business’ FY 2021 revenues of £9.5 billion ($11.4 billion); (2) pain relief, 23%; (3) digestive health and other, 20%; (4) vitamins, minerals, and supplements, 16%; and (5) respiratory health, 12%. The new company operates a supply chain that combines a network of 24 in-house dedicated consumer healthcare manufacturing facilities globally and approximately 180 third-party contract manufacturing organizations (CMOs), according to Haleon’s prospectus filing. Haleon is headquartered in Weybridge, UK, and a new Weybridge campus is expected to open at the end of 2024. In addition to being the new company’s corporate headquarters, it will also be a center of R&D and innovation and home to a new Shopper Science Lab.

The New GSK

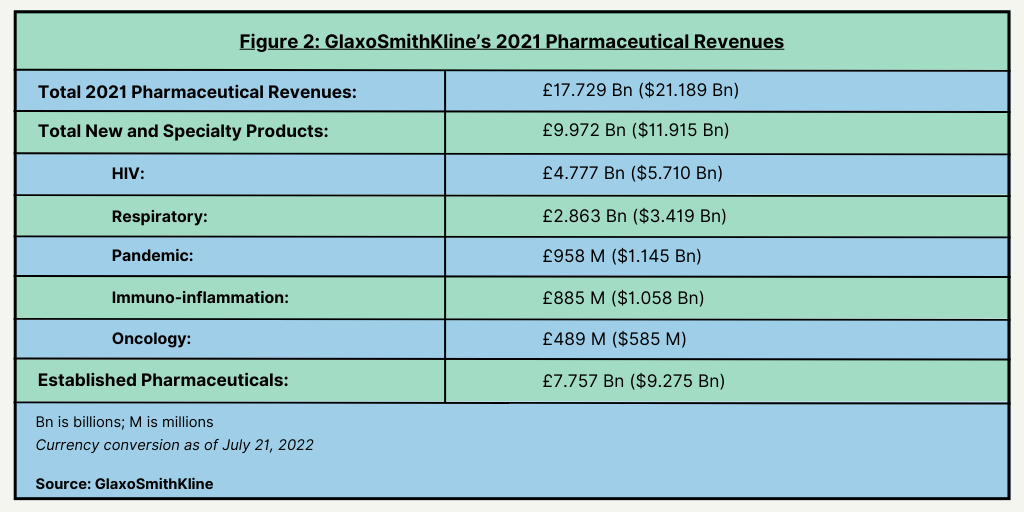

The move to spin off its consumer healthcare business is part of a larger strategic plan by GSK’s CEO Emma Walmsley to drive growth in the company’s core bio/pharmaceuticals business and vaccines business. In 2021, GSK posted 2021 revenues in its bio/pharmaceutical business of £17.7 billion ($21.2 billion) (see Figure 2). New and specialty pharmaceuticals accounted for 56% of its total pharmaceutical revenues and established products 44%. Its largest therapeutic sector for its new and specialty products is HIV, accounting for 48% of its revenues in its new and specialty products, followed by respiratory products (29%), pandemic products (9.6%), immuno-inflammation (8.9%), and oncology (4.9%) (see Figure 2). Its vaccines business posted 2021 revenues of approximately £6.8 billion ($8.1 billion).

In its first-quarter 2022 results, the company set a new growth outlook for annual organic revenue growth of 4-6% and sustainable moderate expansion of adjusted operating margin over the medium term at constant exchange rates.

Thus far in 2022, the company has also made several acquisitions to help drive growth. To bolster its oncology business, earlier this month (July 2022), GSK completed its $1.9-billion acquisition of Sierra Oncology, a San Mateo, California-based late-stage bio/pharmaceutical company focused on rare forms of cancer. GSK had announced the acquisition in April (April 2022). Sierra Oncology’s lead asset is momelotinib, in Phase III trials for treating myelofibrosis, a cancer of the bone marrow impacting the normal production of blood cells, resulting in anemia. If approved, anticipates launch of the product in the US in 2023. Momelotinib will increase GSK’s hematology portfolio, which includes Blenrep (belantamab mafodotin) for treating a certain type of multiple myeloma.

To drive growth in its vaccine business, in May (May 2022), GSK agreed to acquire Affinivax, a Cambridge, Massachusetts-based bio/pharmaceutical company developing vaccines, in a $3.3-billion deal ($2.1 billion upfront and up to $1.2 billion in potential development milestones). The deal is expected to close in the third quarter of 2022.

Affinivax’s most advanced vaccines are pneumococcal vaccines for which it applies its proprietary vaccine technology platform, Multiple Antigen Presenting System (MAPS). MAPS supports higher valency than conventional conjugation technologies to enable broader coverage against prevalent pneumococcal serotypes and potentially creating higher immunogenicity than current vaccines. Pneumococcal disease includes pneumonia, meningitis, bloodstream infections, and milder diseases such as sinusitis and otitis media. There are many different pneumococcal serotypes. The number of serotypes in current vaccines is limited due to the degree of immunological interference observed when using existing conjugation technologies, according to information from the companies.

Affinivax’s most advanced vaccine candidate, AFX3772, is in Phase II development and includes 24 pneumococcal polysaccharides plus two conserved pneumococcal proteins (compared to up to 20 serotypes in currently approved vaccines). The US Food and Drug Administration (FDA) granted breakthrough therapy designation for AFX3772 to prevent Streptococcus pneumoniae invasive disease and pneumonia in adults 50 years old and above. Phase III trials are expected to start in the short term (as reported on May 31, 2022). Phase I/II clinical trials for pediatric use are planned to begin later this year (2022). A 30-plus valent pneumococcal vaccine candidate is also in preclinical development.